Mastercard delivered a strong 3Q24 result with accelerating revenue growth across payment network +10%, value-added services +18% and net revenue +13%. Operating profits rose 14% to $4.4b at a margin of 59.3% vs 58.8% in the prior year. While the result exceeded expectations, the stock was down by 3%. The key takeaways are:

There will likely be tax headwinds from FY25 and beyond. Mastercard has benefited from tax incentives in Singapore which resulted in near zero taxes for Asia-Pacific revenues. From 2025, these tax benefits will likely be offset due to OECD Pillar 2 guidelines imposing a global minimum tax rate of 15%. The estimated tax rate headwind is 4%, which impacts future earnings by 4-5%. Mastercard’s 10K notes “we expect the Pillar 2 Rules will primarily offset the reduction to our effective income tax rate resulting from our incentive grant received from the Singapore Ministry of Finance. For the nine months ended September 30, 2024, this incentive grant reduced our effective income tax rate by approximately 4%.”

Visa faces the same tax headwind, although there was no mention on its call or financial statements which is possibly due to the lower exposure to APAC (15% vs Mastercard 25%). Visa’s 10K notes “Effective through September 30, 2028, the Company’s operating hub in the Asia Pacific region is subject to a tax incentive in Singapore which is conditional upon meeting certain requirements.” Visa has guided for a higher FY25 tax rate of 18-18.5% compared to 17.6% in FY24.

To note, these tax impacts were not identified in my analysis, and were largely unexpected from my end.

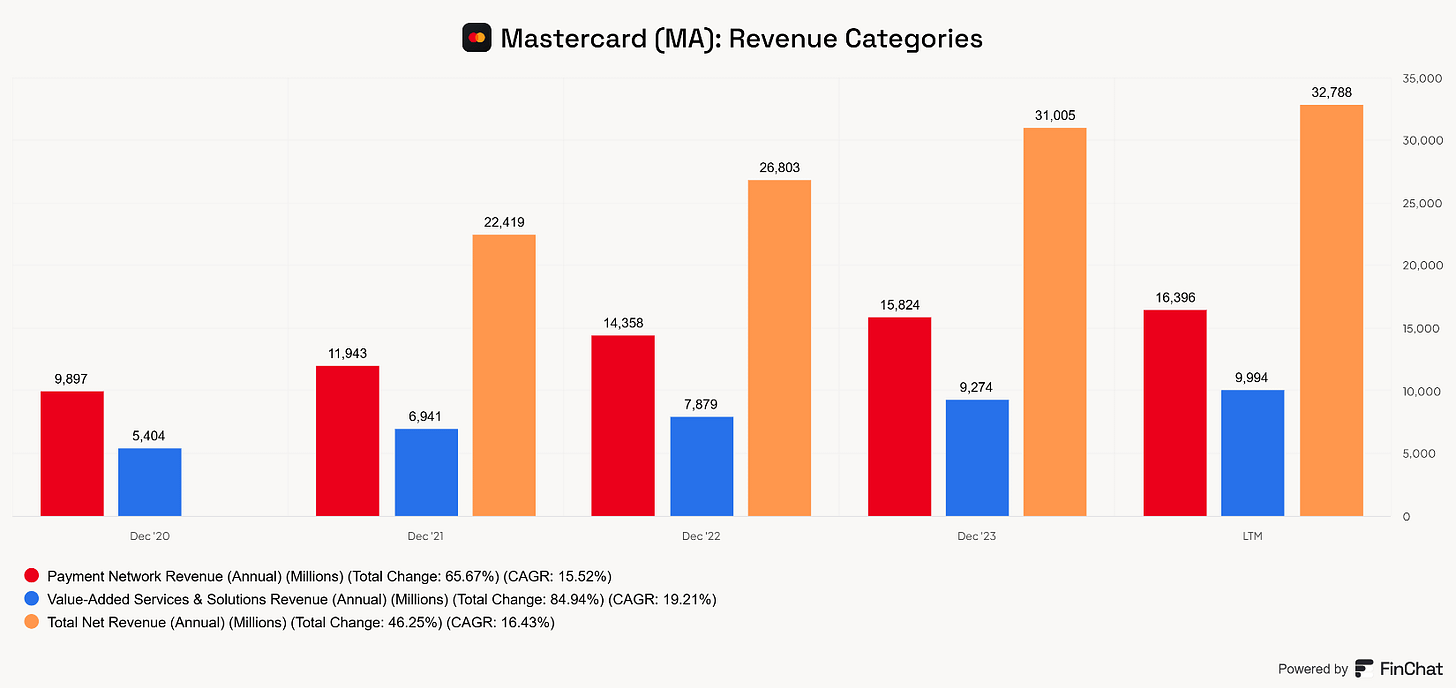

Mastercard is gaining share, which is reflected in the financials below.

In relation to share gains, CEO Michael Miebach explains, “We do this by understanding our customers' needs and by offering differentiated services that can help them and drive value and/or choice to the end customer.” To note, the word customer was mentioned 32 times on the call, compared to Visa’s 5 mentions. Not ringing any alarm bells, but found this interesting as it reflects a corporate culture that is innovation led and customer focused.

The primary risk to payment networks is regulation, with Mastercard more insulated given its diversified business model and proven track record of innovation. The Department of Justice’s anti-trust case against Visa and its US debit practices is a case in point and likely opens up the market for more competition. While Mastercard is not immune with the European Commission seeking documents in August 2024 targeting the company’s practices regarding network fees related to acquirers. With increasing regulation, Mastercard provides the better exposure given its geographically diverse revenue mix and greater skew to value-added services. We explained this further in our June investment note here.