Mastercard - Investment Thesis

Mastercard is a high-quality compounder with market share gains and margin upside

Investment Thesis

Mastercard is the number two player digitising consumer payments. Its network across 3b+ cards, 100m+ acquiring merchants and $7b of payment volumes has scale and comparable attributes to the market leader, Visa. Mastercard is the preferred payments exposure due to the below.

1. Mastercard has counter-positioning and is taking share from Visa. The company is seen as an innovative strategic partner with a services led approach, strong international presence, and higher reinvestment profile. Visa would need to adopt greater reinvestment and cultural change, which is unlikely given forecasts for margin expansion. Mastercard has recently won notable flips including Varo Bank, Webster Bank and Citizens. The company’s share of global payment volumes among the top 5 vendors has grown from 30% in 2017 to 34% in 2023, while Visa’s share has declined marginally from 58% to 57%.

2. Higher exposure to International and value-added services (VAS) enables faster and more durable growth. International regions such as Latin America, parts of Europe and Asia Pacific have low levels of digital payments adoption while personal consumption expenditure (PCE) growth potential is higher. Mastercard is skewed to these regions providing durable and diversified growth, while Visa is heavily weighted to North America (53% of payment volumes). Mastercard also has a higher mix of VAS, which has delivered 65% of its annualised net revenue growth since 2019.

3. Scale efficiencies across payments and VAS delivers greater margin upside. Mastercard’s cost base is 91% of Visa’s despite having 60% of the payment volumes. Although scale delivers operating leverage to both, there is greater upside for Mastercard given its lower volume and margin profile. Further scale in VAS also benefits margins. Mastercard currently has net operating margins of 58% compared to Visa’s 68%.

Mastercard is a high-quality business with a solid management team and conservative balance sheet. The business is capital light with net margins of 46% and operates the better business in an Oligopoly market structure. Mastercard has deployed capital well reflected in ROIC of 54%.

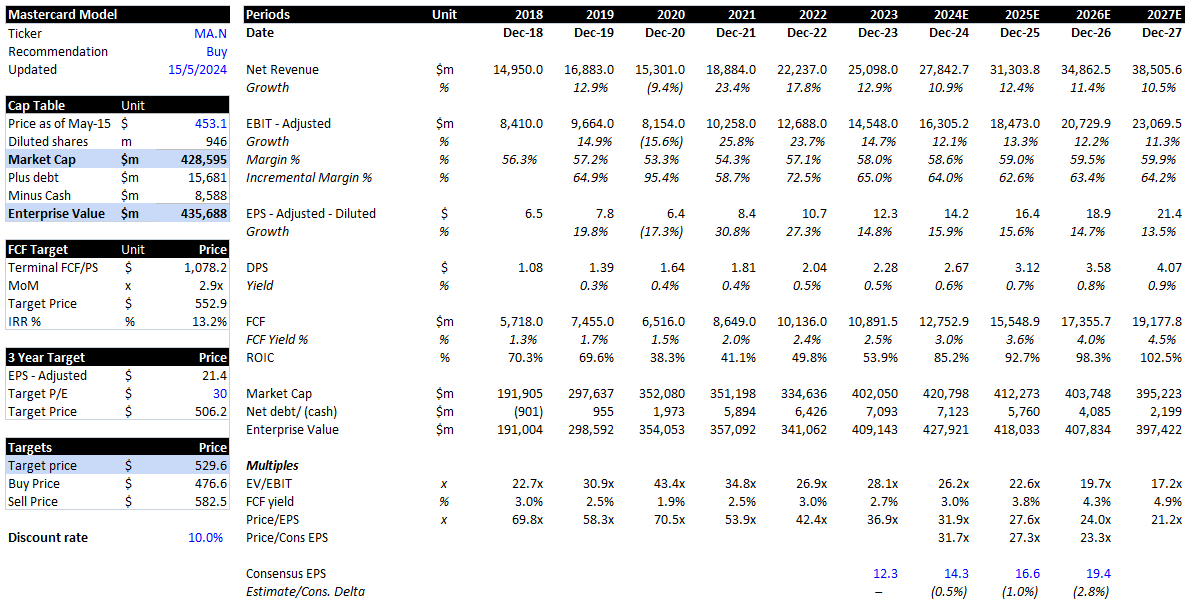

Recommendation – Buy, durable competitive advantages, strong industry dynamics and consistent operating leverage drives mid double-digit earnings growth. Forward P/E of 30x is at 10-year long-term averages and is a reasonable entry point. Using a 50/50 discounted FCF and P/E multiple valuation returns a target price of $529.6. Would be buying Mastercard at current levels, up to $477 implying a 10% margin of safety and IRR of 15%.

Market and Variant view

Factset estimates have 3-year revenue CAGR of 12% and EPS of 16.5%, in-line with my forecasts. The sell-side is positive with 22/24 analysts either a strong buy or a buy. The variant perception is small but lies in the market underappreciating the runway and ability for Mastercard to durably compound earnings at double-digits. This is reflected in a higher discounted FCF valuation capturing long-term cash flows and terminal growth.

Company and Industry Overview

Consumer payments primarily consists of two players; Visa and Mastercard who have around 57% and 34% of global payment volumes among the top 5 vendors. Other players include Amex, Discover and JCB who hold the remaining 9% share. Note this analysis does not include China’s Union Pay or any other government owned networks. Market share dynamics have remained broadly consistent due to high switching costs and a relatively stable industry structure.

Visa has a strong position in the US with 61% share and has grown slightly faster than Mastercard. Mastercard is more prominent in International markets and has taken share here, with European payment volumes now on par with Visa. These networks are moving beyond consumer payments into new flows such as B2B, B2C and P2P. They remain in the early stages of adoption with the market estimated to be worth $200t, which compares to the $51t TAM for consumer payments.

1. How Durable is Mastercard’s Competitive Position?

Scale and network effects have created significant barriers to entry. Disruptive FinTech’s have chosen to instead partner to bring instant scale and accelerate revenue growth. We explore Mastercard’s competitive advantages using Hamilton Helmer’s 7 powers:

1. Scale economies – yes, the network has global scale with 3b cards, 100m+ acquiring merchants and $7b in payment volumes. The company is the strong number two player with 34% share of payment volumes and has leading positions in countries across Europe, APAC and LATAM. While Visa has more scale, the networks are comparable from a merchant acquirer (terminal) and credential (card) perspective. Mastercard has EBIT margins of 58% and incremental margins above 60%.

2. Counter positioning – yes, Mastercard is positioned as a Services led organisation, with greater innovation, a strong International presence and higher reinvestment profile. Issuers who switch get a strategic partner and more targeted value proposition, which Visa would find difficult to replicate due to its higher margin profile and less nimble culture. Mastercard has 33.4k employees vs Visa’s 28.8k.

3. Switching costs – high, especially for credit cards issuers. Switching requires the transition of millions of cards, a new rewards program, and services for these cards. The issuer faces the risk of disruption and churn of its user base, which makes contracts very sticky. While Mastercard has been able to win new deals, they are relatively infrequent.

4. Network economies – a large card network attracts more merchants, which increases payment volumes and brings more issuers to the platform. This flywheel has been in effect for decades and has accelerated over the past 5 years as COVID has increased the acceptance points and propensity for consumers to travel anywhere with a card.

5. Brand – well-known brand, although they have not leveraged pricing due to the regulatory backdrop.

6. Process Power – own the infrastructure known as BankNet and the leading value-added services portfolio, with the latter often the differentiating factor for wins against Visa. VAS represents 38% of net revenue.

7. Cornered Resource – less evident, would be the management team who are well tenured and proven to be at the forefront of innovation.

2. Can Mastercard sustain double digit revenue growth

Since 2019, Mastercard has delivered gross revenue CAGR of 12.7% from:

· Core payments revenue ∼ 10.4%

· Value-added services ∼ 22.5%

The core driver for payments revenue growth are purchase volumes, which have increased at an 11% CAGR. My expectations are for purchase volumes to continue compounding at 9-11% over the cycle driven by:

· Real personal consumption expenditures (PCE) ∼ 2-3%

· Inflation ∼ 2%

· Winning share ∼ 0.5%

· Displacing cash/cheque and new transactions ∼ 1-2%

· New flows ∼ 2-3%

· Maestro Conversion ∼ 1%

The growth from PCE, inflation and share gains is expected to continue over the cycle. While the opportunity to displace cash and cheque remains significant with Mastercard’s higher skew to International markets implying a longer runway for growth. The total cash & cheque opportunity in Latin America, Asia Pacific and Central Europe, Middle East and Africa is around 51%, 48% and 76% respectively. Digital payments adoption is evidently more nascent, with a proven approach to drive adoption by increasing credential and acceptance points.

New flows is a $200t opportunity as the networks leverage existing infrastructure to digitise new use cases. New flows currently represents 13% of Mastercard’s revenue. While partnerships with FinTechs, governments and enterprises have contributed to growth, the segment remains underpenetrated as the majority of payments continue to be done via cash & cheque or other less efficient methods. Segment growth can compound at 20% and becomes more material as it grows in size.

VAS has been the major contributor to net revenue growth, contributing 6.5% of the 10.4% net revenue CAGR since 2019. The segment has a low correlation to incentives, which has been a headwind for network revenues. VAS also remains underpenetrated especially across customers such as processors, merchants and governments, while acquisitions continue to expand its offering. My estimates have VAS compounding at 14% over 4-years, faster than the core and enabling double-digit revenue growth.

3. What happens to domestic take-rates and net yields

For every $100 domestic transaction, Mastercard generates a gross total of 21c which consists of 13c from payment volumes and 8c from transaction fees. Since 2019, take-rates from purchase volumes have declined by 2.2% per annum and transactions by 3.4%. Regulatory pressures, lower value new flows and the increasing buying power of merchants has led to this pricing pressure.

Merchants have become increasingly dissatisfied with the level of fees charged. These larger merchants are using their buying power and have joined up to pass the credit-card routing bill in the US. Amazon in the U.K. is also an example of the disruption merchants are causing. Mastercard needs to manage pricing and offer value with any increases. My estimates have pricing continuing to decline modestly.

Despite this pricing pressure, net yields (net revenue divided by purchase volumes) should grow and return to 2018 levels driven by a mix shift towards cross-border payments (where take-rates are 1.8%) and value-added services. See appendix.

Management and Positioning

The key shareholders are index and large mutual funds including Mastercard Foundation Asset, Vanguard, Blackrock, and T. Rowe Price. Management is well tenured and have executed strongly since IPO. The group culture is strong and performance driven underpinned by the incentive structure – CEO salary is 95% variable-based with targets around EPS and net revenue growth targets. Internal ownership is solid. See below.

Valuation

Mastercard trades on 30x forward P/E which is at its 10-year historical average. The company is at a premium to Visa at 26x; due to its faster revenue growth, greater margin upside, market share gains and broader diversification. Mastercard is also at a premium to competitors such as Amex and Discover, who operate closed-loop networks and have bank like models. The credit risk and weaker competitive moat warrants this discount, while MA/V operate a dominant duopoly. Mastercard is more expensive than the NASDAQ index average of 24x, which is reasonable given the stable market dynamics, durable growth and competitive advantages. Overall, the valuation is reasonable.

Risks to view

The counter view is that Mastercard is entering a more mature lifecycle, with slower growth expected following a ramp in revenue after COVID. The business will need to reinvent itself into the new flows category which is lower margin. Also, we could be heading into a weaker consumer environment. In addition, government regulation and disruptive technology remain lingering risks.

· Regulation – governments are increasingly seeking to disintermediate the duopoly position. Reg-II, the credit card competition act and reduced debit card swipe fees are near-term risks in the US which aim to improve competition and reduce fees charged. This has also been a phenomenon globally with the likes of Europe and Australia enforcing similar regulation. These networks have been resilient to fee changes as net take-rates of 7bps are only a fraction of the interchange fees ranging from 20-200bps. We have seen debit interchange caps in Europe of 20bps and 10bps in Australia, while card adoption rates are some of the highest globally.

· Market share losses – competitors start growing at faster rates by either winning deals or increasing partnerships with FinTechs. While Mastercard is well counter-positioned against Visa with greater reinvestment and a differentiated services portfolio, the risk is Visa uses pricing or reinvests more to improve its offering.

· Technology risk – competing technologies such as crypto, real-time payments and account-account providers such as Venmo and Cash App could take some share of flows. The advantage MA/Visa has is they already have global scale and often these new technologies require some form of card payment. In regions where digital card adoption is lower, the risk is higher for these flows to go to other payment networks. India’s government-owned UPI and Brazil’s Pix are examples of this, where these government schemes have taken considerable share by incentivising the relatively digitally nascent population.

· Capital One volumes –the recent acquisition of Discover by Capital One could see Mastercard volumes reduce as they use them are the primary network.

Appendix

Disclaimer: All posts on “cosmiccapital” are for informational purposes only. This is NOT a recommendation to buy or sell securities discussed. Please do your own work before investing your money.