Diploma 1H25 Results - Stock Analysis

A serial acquirer with a long runway to reinvest capital at high-teens returns

Diploma delivered a stronger than expected 1H25 result.

Revenue rose 14% to £728.5m

Adjusted net profit grew 23% to £107.5m

Operating (EBIT) margins expanded 190 basis points to 21.5%.

The beat came from organic revenue growth lifting from 7% in the 1Q to 9% for the half, implying 11% growth in the 2Q. Peerless was the key contributor and will be discussed later. M&A contributed 7% to growth while FX was a 2% drag.

Despite ongoing macro uncertainty, the strong first-half has given management the confidence to upgrade full-year guidance. Organic revenue growth is expected to be 8% (up from 6%) and operating margins at 22% (from 21%). The result extends Diploma’s impressive 15-year track record of consistent growth.

Controls

Controls drove the group result with strong growth as seen below.

The segment has become the key growth driver, increasing from 29% of revenue in FY20 to 54% in 1H25. This shift reflects the well timed and bold capital allocation decisions made to acquire higher-quality businesses at premium valuations - around 10x EBIT. The main ones being Windy City Wire (Oct 2020) and Peerless (May 2024) which have both delivered strong double-digit revenue growth and accretive margins well above the group average.

Peerless had an exceptional first year. Management noted 6-month revenue grew in the high 20% versus last disclosed figures and operating margins in the mid-40s. Excluding Peerless, organic revenue grew in line with the financial model at 5%.

Based on my estimates, this implies Controls ex Peerless grew organically at a high-single-digit rate, while Peerless contributed over 80% of segment revenue and earnings growth.

The growth has been underpinned by expansion across the US and European aerospace and defence markets. While long production backlogs in civil aerospace and favourable prices in the spot market has seen strong demand and elevated margins. Management expects this to normalise to revenue growth in the high single digits and operating margins closer to 30%. I’ve reflected gradual margin compression in my outer year forecasts.

For reference, Peerless reported $108m in revenue and $34m in EBIT at 31% margins in FY23.

Seals

Seals reported an underwhelming half, with performance weighed down by continued soft conditions in manufacturing and construction, primarily in Europe. Organic revenue growth was flat, while the divestments of Kubo and Pennine, combined with FX headwinds, led to a 6% decline in reported revenue.

There were pockets of strength. M Seals delivered double-digit revenue growth, and VSP gained share across the industrial and transportation end markets.

Management is not wasting a mini crisis. They’re scaling investment, restructuring underperforming businesses, and strengthening leadership teams, laying the foundation to capture growth when end markets recover. This reflects a proven playbook of reinvesting leverage to drive long-term performance.

After a challenging couple of years, Seals is well-positioned to benefit from a cyclical recovery. My estimates reflect a pickup in 2H25, with growth to rise above the company’s 5% target in FY26.

Life Sciences

Life Sciences had a solid performance, with organic revenue growth of 6% and reported growth of 1%. The gap between organic and reported growth reflects the prior year’s strategic product rationalisation in Europe, exiting lower-performing lines to improve portfolio quality.

Much like Seals right now, Life Sciences made changes during a challenging period and has now come out stronger - gaining share across Australasia and Canada. The outlook is positive with a robust pipeline of new products across both existing and emerging therapies expected to support growth.

Financials

Diploma’s financials are solid and have remained pretty consistent over the last five-years - underscoring the resilience and quality of the business model:

Revenue grew 14% to £728.5m

Adjusted net profit grew 23% to £107.5m

Share count stable

FCF rose 26% to £83.8m

FCF conversion of 78% vs 76% 1H24

Interim dividend up 5% to 18.2p

Net debt decreased from £424m to £374m (1.1x leverage)

Working capital increased from £245m to £318m due to inventory build

Tariffs

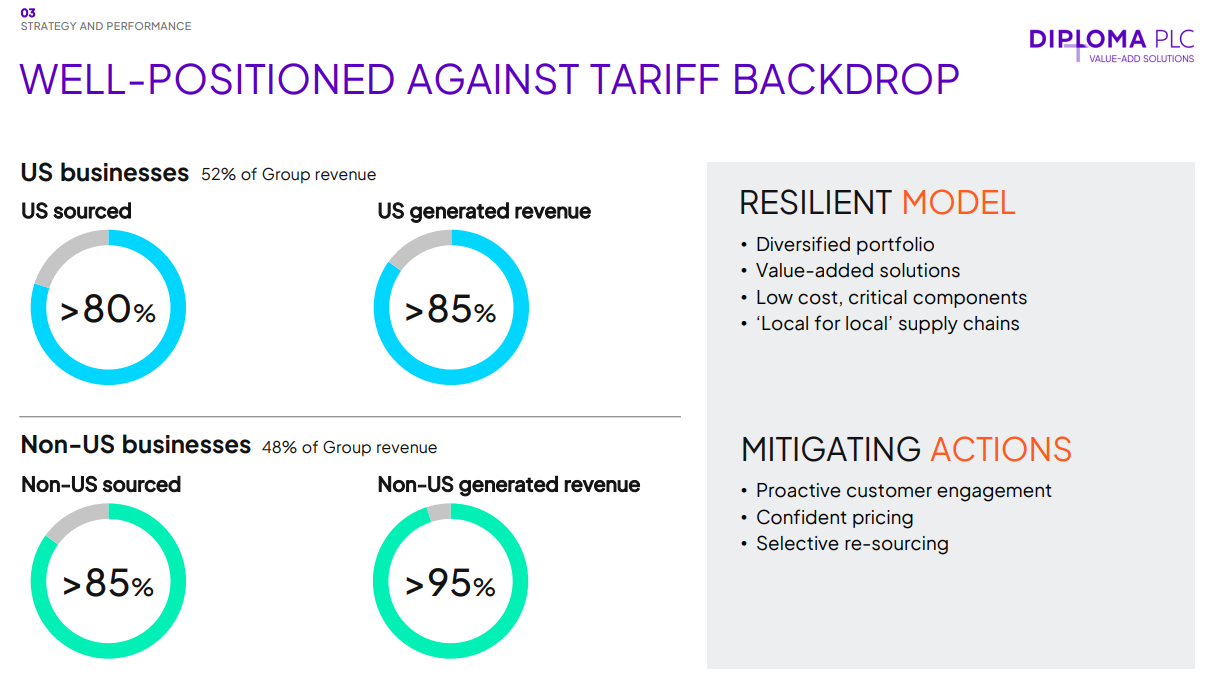

Diploma is well placed to navigate tariff impacts. Its value-added, low-cost solutions means it can effectively pass on prices to offset cost inflation. The decentralised model also enables fast, on the ground decision making.

The group has a highly localised supply chain with around 85% of purchases and sales occurring within the same country. Direct sourcing from China is also minimal. See below.

Diploma stands to benefit competitively as peers who are more reliant on emerging market supply chains face higher costs. This creates an opportunity to gain share and reinforce customer relationships in a more volatile global trade environment.

Capital Allocation

For serial acquirers like Diploma, the quality of people is integral. Management are not only operators but stewards of capital, and their decisions define the long-term trajectory of the business.

The success at Diploma today is a result of superior capital allocation done over many years. It's rare to find a management team with this calibre of judgement and long-term focus. Their approach is backed by sensible decision making:

Maintaining M&A discipline: The team refuses to pursue acquisitions that don't meet strict quality, strategic fit and valuation criteria.

Focusing the portfolio: Divestments of non-core assets impacts near-term revenue growth but improves focus and strategic alignment.

Investing in the core: Reinvestment in existing businesses drives sustainable organic revenue growth.

Clear returns framework: Apply a rigorous M&A hurdle of 20% ROATCE within three years.

Consistent Approach: Not returning excess capital during quieter M&A periods, reflecting the confidence in the reinvestment runway.

This half, Diploma only made one bolt-on acquisition and divested three non-core assets, reflecting this discipline and long-term focus. They have stayed patient and are confident in M&A growth above target over the cycle. CEO Johnny Thomson notes:

Finding the right businesses at the right price requires discipline and patience. It is never going to be a linear process. There are a number of exciting deals in discussion at the moment. Some of them will become Diploma businesses, some of them won’t. We set a high bar.

and

Discipline is always key to that because it's not just about quantum, it's about quality. And as a result of that, I've said many, many times, our acquisition flow won't always be linear. We're not going to force it to do any old acquisition to satisfy our model. It's about the quality. And if the quality isn't there in the market at any given period of time, that's okay, we've got great organic growth to see it as our priority anyway. So we're not going to force it and we're not going to make mistakes. The track record is based on really, really good discipline.

ROATCE in the high-teens has remained stable since 2020 and reflects the high returns generated from the £1.3b of capital deployed over the past 6 years.

Summary

Diploma delivered a solid result, primarily from Controls which continues to outperform. High quality businesses such as Windy City Wire and Peerless are key drivers. My organic growth forecasts have lifted.

The lower near-term activity in M&A has seen my forecasts fall here. Diploma operates in large, fragmented industries, giving management ample runway to deploy capital at attractive returns when the right assets become available.

This translates into double-digit revenue and earnings growth over the cycle. Diploma currently trades on a forward P/E of 26x, with an estimated IRR of 11%.

These are reasonable returns for a diversified and resilient business with limited tariff exposure. Diploma is a serial acquirer with strong organic growth, a long M&A runway and a leading management team. I am a holder here. The business is well placed as CEO Johnny Thomson explains:

Diploma has always had strong fundamentals, and over the last five or six years, we've built from that a bigger and better group. More ambition, more quality, more diversification, more resilience, more discipline, and as a result, a more dependable, long-term compounding outcomes.

The near-term risk lies in Peerless, where earnings could normalise faster than expected as elevated demand settles.

Stock is +12% since my initiation back in Oct 2024, link here.