Investment Thesis

Diploma is a decentralised global distributor, providing value-added solutions for industrial and life sciences markets. The company has EBIT margins >20%, low capital intensity and high free cash flow (FCF) generation which enables them to effectively redeploy capital within its large, fragmented markets. Since 2019, Diploma’s refreshed management team has accelerated growth via £1.2b of acquisition spend, and built resilience through broader diversification across geographies and end-markets. Diploma is well positioned to sustain double-digit earnings growth over the long-term, see below.

1. The business has multiple drivers to lift organic revenue sustainably >5% per annum. The group has strategically positioned itself within higher quality businesses supported by structurally growing end markets (data centres and industrial automation). While management are focused on the multiple levers to grow share including product cross-sell, new market expansion and targeted reinvestment to enable scale.

2. Diploma operates in fragmented markets with single-digit market shares, providing runway to sustain >5% revenue growth from acquisitions at high returns on capital. Diploma has small market shares of <3% in Controls, <2% in Seals and <1% in Life Sciences, which highlights the latent opportunity to grow within existing segments. Management are also proven, high-quality capital allocators, with a significant pipeline of 2,000+ targets at a market value of >£1b to selectively grow into.

3. Operating margins of 20%+ are sustainable given organic growth, accretive M&A and high barriers to entry. Diploma has seen operating margins rise from 17.8% in FY19 to 20.6% in FY24, largely driven by accretive acquisitions/ divestments which accounted for 67% of earnings growth at operating margins of 24%. Core margins have increased more modestly to 19%, while a large portion of leverage has been reinvested to enable future scale. This reinvestment along with a value proposition that lowers the total cost of ownership delivers high retention, pricing power and sustainable margins.

View – Accumulate, Diploma is highly resilient with broad diversification across geographies, end-markets and segments. The business has a high-quality management team, who are importantly focused on the right things – the customer, the culture and the long-term. My estimates have revenue compounding at a 3-year, 13.5% constant annual growth rate (CAGR) and EPS at a 15% CAGR. Using a blended 50:50 discounted FCF (10% discount rate) and EV/EBIT multiple valuation, returns a target price £51. Would be accumulating the stock around £46, representing a 10% discount to target price. The stock is on a reasonable P/E multiple of 25x and can deliver returns via earnings growth of 15% and a 1% dividend yield, without any multiple expansion.

Market and Variant view

Factset estimates have 3-year revenue CAGR of 7% and EPS of 8%, reflecting a more modest outlook for organic and M&A growth. The sell-side is broadly positive with 75% of analyst buy ratings and 25% hold. The company is also not widely covered with 12 listed analysts. My FY27 EPS estimates are 22% above consensus. The variant perception is around increased organic growth, primarily in Seals and the ability to continue deploying capital at reasonable returns of 18% return on adjusted trading capital employed (ROATCE).

Company Overview

Diploma is a highly diversified, value-added distributor of essential products that are critical components within niche markets. The company has three segments; Controls, Seals and Life Sciences and 15 business units, operating in a highly decentralised structure that enables agile decision-making to drive the best customer outcomes.

Diploma targets market segments where the product cost is low, forms part of operating expenses and remains essential to customer operations. The company provides a combination of technical expertise, superior customer service, breadth of stock and value-added customisations to lower the customer’s total cost of ownership. This in turn drives loyalty and a high willingness to pay, enabling the business to pass on inflationary cost pressures and maintain industry leading EBIT margins of 20%.

Free cash flow to adjusted net profit (∼100%), low capex requirements (<2% capex) and a fragmented marketplace has enabled Diploma to enhance growth via acquisitions. Since 2021, Diploma has accelerated this strategy with the new management team opportunistically deploying £1.2b across strategic and bolt-on acquisitions. These transactions have improved the overall quality of the group by building scale within key regions such as the US and entering adjacent product categories. The below highlights the geographic shift and changes in segment exposure since 2019.

The group’s three operating segments are:

1. Controls (47% of revenue) – sell connector-type products for demanding environments such as aerospace, motorsport, and defence. The acquisition of Windy City Wire (WCW) broadened the portfolio into low-voltage wires and cables for smart buildings and data centres. Products include interconnects, fasteners (nuts and bolts), wires and cables, adhesives, and industrial automation. The value-add comes through long-term supply contracts, customer service, technical support, cut-to-length tubing, kitting, and customised assembly solutions. Diploma focuses on repair, refurbishment, and upgrade programs, where stock availability, responsiveness and customer uptime are critical to success. Retention is solid, with an example being TIE (a business unit) where customer retention is >96%.

2. Seals (36%) – provide seals, O-rings, gaskets, and other parts that are used at the interface of components to prevent leaks and contamination. The company targets the construction, mining, and agriculture industries, where the use of low-quality or incorrectly fitted seals can lead to equipment failures and costly downtime. Diploma adds value through its extensive inventory of over >60k stock-keeping units (SKUs), next-day delivery, responsive customer service, labelled and packaged kits, part enhancement services, and technical expertise. This extensive support enables repair shops to deliver urgent repairs and assists original equipment manufacturers (OEMs), who are not seal specialists, to select and design the optimal sealing solutions. Revenue is repeatable in Aftermarket given the need for broad stock availability and speed, and in OEM due to the knowledge, relationships and technical expertise delivered in the process. Two thirds of the segment is related to customer opex.

3. Life & Sciences (16%) – sell diagnostic, medtech, and scientific products to surgeons, clinicians or researchers in smaller, dispersed markets and where funding for public health care is high. Markets include Canada, Australia, Ireland, and Scandinavia. The company has exclusive long-term contracts (ranging from 3 to 10 years) with small-mid sized suppliers, as well as customers including hospitals, clinical and research labs. These relationships are stable and durable, with value added through a consultant-like approach, exclusive supply agreements, and comprehensive technical support that includes aftermarket support. End customers benefit from time savings, expertise and access to a diverse range of global products. Notably, >70% of revenue is derived from highly recurring consumables and services.

1. Are Diploma’s competitive advantages sustainable?

We explore the extent and durability of Diploma’s competitive advantages using Hamilton Helmer’s 7 powers:

1. Scale economies – yes, generally a market leader within niche segments. Diploma builds leadership by delivering a superior value proposition and accelerating growth through M&A. Increased scale has led to lower per-unit costs, which is reinvested back to enable further growth. In addition, Diploma has a comprehensive supply base with >10k suppliers and >60k SKUs in Seals and Controls, with scale providing better buying terms and stock availability.

2. Counter positioning – no, often seen as the incumbent. High barriers to entry exist due to long-term exclusive relationships, scale, speed and expertise that lowers the total cost of ownership.

3. Process Power – moderate, most of its businesses have limited process power. Although they offer light manufacturing or customisations which are patented. For example, WSW uses patented technology in its Rack Packs and transporters, enabled by a vertically integrated model that saves contractors around 20% to 30% in labour time.

4. Switching costs – high. Products are a small fraction of the total cost of ownership. Coupled with a broad supply network developed over decades, deep technical expertise, long-term supply agreements, and value-added products, the switching costs for customers are high. The businesses are therefore highly recurring with inherent pricing power. Many hospitals customers have been with the group for decades.

5. Brand – moderate. Strong customer focus and value-added proposition has contributed to a broadly positive portfolio of brands. The group's top brands are WSW and Hercules.

6. Cornered Resource – yes, the corporate culture, management team and strategy are highly attractive for founders looking to sell. Diploma provides ongoing reinvestment, a long-term strategy and DNA preservation, which stands in stark contrast to the cost-cutting approach often associated with private equity firms. This has enabled Diploma to acquire businesses at lower multiples or uncompetitive processes.

7. Network economies – not really, while they do operate marketplace-like businesses such as Hercules in Seals, overall network effects are not material to the group.

Diploma has clear competitive advantages around scale economies, switching costs and cornered resource. These factors increase the barriers to entry and enable pricing power.

2. Why are 20%+ operating margins sustainable?

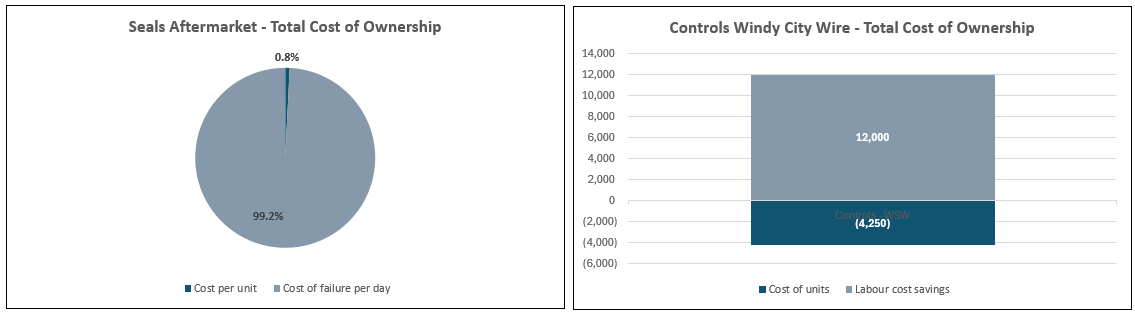

On average, volume-based distributors operate with single-digit margins, while value-added distributors have average margins in the mid-teens. In contrast, Diploma boasts group operating margins of 20%, a byproduct of the significant value proposition that lowers the total cost of ownership. See below.

In the above examples, actual product costs remain a fraction of the total savings. For Seals, Diploma’s extensive stock availability, customisation options, and next-day shipping allow repair shops to quickly acquire seals at around 0.8% of the potential losses incurred from daily site downtime. For WSW, its vertically integrated model, combined with patented Rack Pack boxes and transporters, saves approximately 20% on labour costs—three times the cost of the wire itself.

As described above, a combination of scale and high switching costs along with an inherent focus on the customer strengthens these barriers to entry. For Seals, the highly technical nature and >60k SKU stock availability dating back 50 years makes it unattractive for wholesale distributors to enter. For Life Sciences, Diploma’s superior access within 95% of Canadian hospitals, exclusive supply agreements, in-market technical expertise and existing relationships makes it difficult for other distributors to gain a foothold. Diploma can therefore raise prices and pass on inflationary costs to maintain margins.

From FY19 to FY24, operating margins increased from 17.8% to 20.5%. Approximately 67% of incremental operating profits were from accretive M&A and divestments, contributing an average margin of 24%. Core margins increased more modestly to 19%. This implies a shift in the business mix rather than pure organic expansion.

Organic growth has averaged 5% pre-COVID and 6% over the past five years. The company has multiple levers to continue this:

1. Mix-shift to higher-growth end markets: increased exposure (20% in 2018 to 35% in 2023) to higher growth sectors such as industrial automation, aerospace, data centres and US infrastructure.

2. Product cross-sell opportunities: can bring existing products to newly acquired businesses and vice versa.

3. Market share gains: competitive advantages and runway are significant, with share in the low-single digits across segments, while competition is fragmented and lack scale.

4. Rise in specialised, quality businesses: acquired higher margin, faster growing businesses and divested lower growers (Hawco).

5. Pricing power: ability to offset inflationary pressures, primarily from copper price rises.

6. Scale enables sustainable reinvestment: increased revenue has enabled greater reinvestment in people and infrastructure to sustain future growth i.e. new Louisville facility for Seals expanding next-day delivery nationwide.

7. Decentralised business units: fast, customer focused decision making and innovation.

My 5-year estimates have organic growth of 6% and modest operating margin improvements, which are likely conservative. A combination of increased synergies, scale, barriers to entry and organic growth enables margins to sustainably grow.

3. Can the business sustain >5% revenue growth from acquisitions?

A key driver of Diploma’s growth is its ability to deploy capital at high returns. Since 2021, the company has accelerated this strategy, investing £1.2b – 5x the amount spent in the previous decade. New management has demonstrated a willingness to increase the frequency, transaction size and multiples paid for acquisitions as seen below. Note, the multiple used is based on the pro-forma earnings under the first year of ownership.

While this approach may appear to involve greater risk, it has improved business resilience via geographic and end-market diversification. Focus and discipline have been a priority with the group reducing business units from 20 to 15, while targeting high quality businesses rather than turnarounds. Head of Corporate Development Steve Sargeant notes “The core characteristics we look for are the same as ever. What's the value-add proposition? Does the business have organic growth potential and does it have a great management team we can back?”. The track record speaks for itself: as illustrated below, 6 out of the 7 largest acquisitions to date have yielded positive outcomes.

While ROATCE has decreased from 24% to 18%, this decline is largely a result of the significant capital deployed at higher multiples. The valuations paid have been justified by accelerated organic growth, strategic expansion, and enhanced diversification. Notably, management was disciplined during the elevated valuation period of 2021 and 2022 with minimal activity, while also divesting its Russian business Kentek, before the geopolitical issues occurred. As capital deployment slows and organic growth accelerates, incremental ROATCE should average 30% over the next 3 years.

The pipeline remains strong, with >£1 billion across >2,000 target opportunities, while scale economies has opened doors to previously unattainable prospects. Notably, penetration across all segments remains low (Controls <3%, Seals <1%, and Life Sciences <0.5%) while the markets themselves are highly fragmented. This presents a runway for continued growth, reinforced by the below graph.

Management and Positioning

The key shareholders are long-term funds including Capital Group 13%, Mawer Investment Management 5%, Royal London 5% and Mondrian 3%. The management team and people are critical to success, making the incentive structure important. 80% of remuneration is weighted to variable pay with targets around adjusted EPS, ROATCE, total shareholder return (TSR) and free cash flow. To retain high-calibre talent, fixed pay has increased by 9% and 13% for the CEO and CFO respectively while the group share plan has expanded to general managers. Management stock ownership and tenure is shown below – the CEOs equity ownership is reasonable. The management team is disciplined, focused, passionate and committed to long-term success. It is not often you get a team member commenting on mood and culture for long-term success, “Organisational mood is forged through constant communication, strong connection with our managers and this allows us to feel the individual and the collective momentum and adjust, focus, adjust pace and ensure positive energy. All of that combination drives momentum and execution.”

Valuation

My estimates have Diploma trading on a forward P/E of 25x and EV/EBIT of 19x, reflecting a 5% premium over its ten-year historical averages. The company’s valuation is 49% higher than other UK distributors, such as Bunzl and RS Group, a premium that is justified by a superior margin and growth profile. The most relevant peer group comprise of other serial acquirers, seen below.

The company trades favourably in terms of valuation multiples, earnings growth, dividend yield, capex to sales, and its margin profile. Although ROIC is slightly below average, it is a byproduct of the significant capital deployed in recent times. Overall, the valuation seems reasonable, and the premium is appropriate.

Risks to view

The counter view centres on Diploma’s premium valuation and for organic growth to slow due to the cycle. The key risks are:

· Poor capital allocation – future capital deployment could be more challenging as Diploma needs to invest larger amounts due to scale. Valuations could also remain elevated like 2021, limiting the ability to acquire or lowering returns if they misallocate. The business has reduced this risk by developing a more robust corporate development structure while ensuring the right people are in place to make these decisions.

· Management team and people – the management team is critical to the success of the business, and high turnover could pose a significant risk across the organisation. General managers within business units are also important given the decentralised nature of the organisation. Diploma's strong culture, aligned incentives, and focus on mood and engagement helps mitigate this risk.

· Supplier risk – risk a supplier chooses to sell directly or shift to alternate distributors. Another risk posed is the inability to bring new suppliers across its platform. Long-term supply agreements and a strong value proposition reduces this risk, while the business now works with over 10k suppliers, which has decreased concentration.

· Competition – we could see new or existing players try to replicate Diploma’s model. We have highlighted the high barriers to entry around cost and time as well as the recurring nature of business. Although if a new player is willing to invest significantly, Diploma’s organic growth and margins could be impacted.

Disclaimer: All posts on “cosmiccapital” are for informational purposes only. This is NOT a recommendation to buy or sell securities discussed. Please do your own work before investing your money.