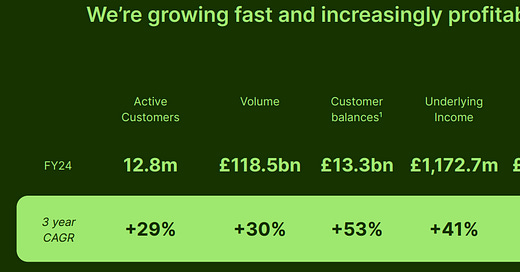

FY24 was a great year for Wise. Active customers rose 29% to 12.8m, underlying income increased 31% to £1.2b and underlying profit before tax (PBT) lifted 226% to £242m. Market expectations were clearly upbeat. However, at its full year results management highlighted the benefits from scale and a more efficient cost base would be returned to customers in the form of lower prices and investments into marketing, product development and operations.

The result was a disappointing outlook with medium-term guidance of underlying income growth 15-20% (from >20%) and underlying PBT margins of 13-16% (vs 20.6% in FY24). The market response was understandably negative reflected in an initial 20% stock price fall while analysts questioned the competitive intensity and runway for growth.

However, if we take a step back and connect the dots, nothing has really changed. The strategy has remained consistent and clear; a mission to lower costs, increase speeds and develop products that are convenient and transparent. This was explained all the way back in 2017 by CEO Kristo Käärmann“When we started TransferWise, we were clear about what we wanted to do: build a better way of sending money internationally. From personal experience, we knew it was a big, broken and greedy system — one that could be better and fairer in every way… We’ve done this because it’s the right thing to do — because we can, and because if we don’t take a stand in lowering the cost of sending money internationally, no one else will. You can see all the new prices at the end of this post.”

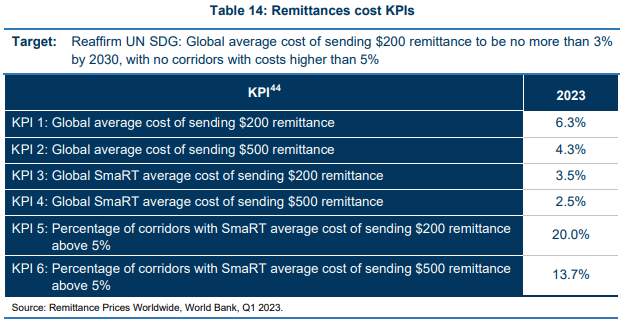

The company’s average cross-currency take-rate is 0.64%, and even lower in more developed currency routes. As seen below, Wise is already 4-10x cheaper than the average cost of sending <$500 abroad in 2023 and well below the UN’s 3% target by 2030.

So this is not a reaction to anything, rather business as usual as Wise attempts to lower the barriers for cross-border payments. These actions reflect a strong corporate culture prioritising the customer-first, and consistently seeking to improve its competitive advantage through innovation and reinvestment. And why not? The opportunity is vast. Although Wise is the digital leader, they make up <5% of Consumer cross-border payments and <1% of Business.

The 1Q25 results have already shown early signs of progress with a slight uplift in operating metrics across active customer and volume growth. While there will be ups and downs along the way, the longer-term picture is clear with Wise well positioned to win in cross-border payments as the market leader, with a product-led and customer-first culture underpinned by consistent reinvestment.

The below reflects a portfolio of 85+ partners using Wise’s infrastructure to power International payments.