Stablecoins: Trump's Bullish, Should You Be Too?

Potential impacts for Mastercard, Visa and Wise

There has been a lot of talk recently around stablecoins. First with the Circle IPO and then the US Senate passing stablecoin legislation which aims to establish a regulatory framework for its use.

Donald Trump is bullish.

Stablecoins have been sold to investors as a solution to the payment ecosystem. This has been heralded all too often, and there seems to always be something new. In saying that, let’s not turn a blind eye.

I understand the need. You have a card payments system which takes two days to settle funds and where merchants can be charged up to 3% per transaction. Merchants hate this given they already have low margins.

Large merchants have pushed back in the past. In 2022, Amazon stopped accepting Visa credit cards in the UK after the network decided to increase cross-border fees following Brexit. Although this was resolved pretty quickly with greater rebates, it was clear that Amazon was not happy with the power of networks and the overall fees.

Stablecoins

With that as a background, let’s talk about the impeding threat of stablecoins. It has been floated around as a viable alternative.

Stablecoins were first introduced in 2014 when Tether launched USDT. More tokens have since been issued such as Circle’s USDC, while the use case has expanded beyond just buying and selling other cypto assets.

How does it work?

The stablecoins we will be talking about are those such as USDC and EURC (issued by Circle, hence the C at the end) which are issued on blockchain networks and are digital currency tokens. They are more secure because they are backed on a 1:1 basis by highly liquid, price stable cash securities rather than crypto. For example, USDC is backed by the equivalent amount of USD fiat currency.

For a consumer to access a stablecoin, they will need to have a consumer application or digital wallet from the likes of Coinbase, Robinhood, Nubank and more.

To buy a stablecoin, consumers will then need to transfer the related currency to this wallet and purchase the coin.

Once the stablecoin is purchased they can use it at a vendor that accepts the stablecoin (not many at the moment).

The process is reflected below.

What is the value for merchants?

Stablecoins are a way for merchants to cut out swipe and interchange fees. A processor such as a Stripe is still needed so the respective fee for them will likely remain.

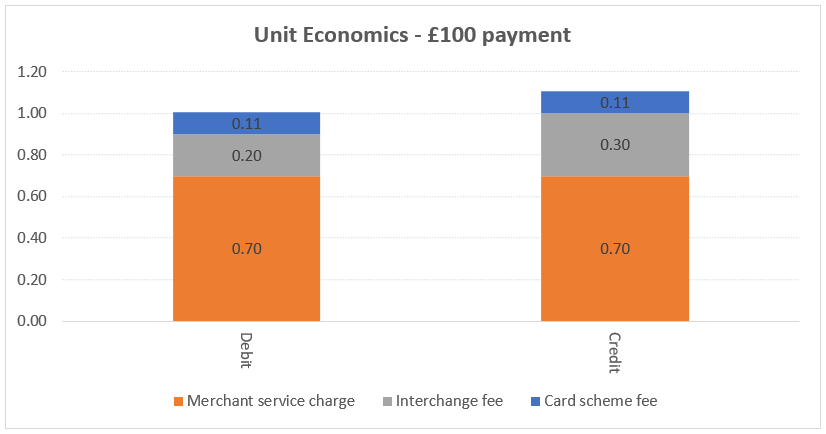

Stripe announced it would charge a 1.5% fee on stablecoin payments. It’s cheaper than credit card transactions in the US which can get up to 3% but not in Europe where interchange regulation has reduced interchange fees. See my estimates of UK economics for £100 payment representing a 1-1.1% fee.

For US merchants they can save 1-2%. Countries with high interchange rates such as Canada, Japan, Argentina and more can also benefit. The cost difference is less prevalent in countries where interchange fees have been regulated to lower levels. More savings means either lower prices for consumers or higher margins for merchants.

Then there is the advantage of receiving stablecoins straight away which can drive more efficient working capital and an overall better payments ecosystem. Speed and cost are the main benefits for merchants - I will explore the risks in more detail below.

What is the value for consumers?

Today in developed countries you can go pretty much anywhere with your phone and pay for something. It’s low cost, convenient and fast. The risk controls are strong and the fraud dispute process is clear. Banks take the credit risk and are therefore reimbursed via interchange fees.

Now for stablecoins this changes.

As described above, consumers need a digital wallet to purchase stablecoins. There are transaction fees involved. So a portion of merchant cost savings are actually being passed directly to consumers.

There is no real differences in terms of payment. It should take a similar amount of time, especially if paying using a stablecoin enabled card. It does add friction where you need to transact between your fiat currency and stablecoin.

The risk and fraud dynamics are not clear. Since the transaction is almost instant, there is likely the risk of more fraud. Who will bear that risk? Not sure. The system still needs figure that out.

And then the number of stablecoin acceptance locations is low.

Overall, there are multiple consumer barriers around cost, ease of use, fraud, convenience, service and more. In addition, the technology does not provide anything new. Account to account payments are also straight through and lower cost in some instances.

Emerging market companies such as Grab, Mercado Libre and Nubank have adopted stablecoins which seems to be where most value add is given the lack of trust in local currencies. People there are likely willing to bear the risk and cost given the devaluation of the local currency.

Risks

While there is opportunity, there are also risks to consider. This is an unproven technology with past issues. These include:

Market dislocations - rapid redemptions or extreme scenarios can impact the value of the stablecoin. For example, in 2023 stablecoin issuer Circle had $3b with Silicon Valley Bank (SVB) before its impending receivership, causing a temporary price dislocation for its USDC. The company noted:

In 2023, USDC went through an extended period of circulation decline related to a number of factors, including an increase in U.S. short-term interest rates, a decline in digital asset prices, and an associated decline in leverage in the digital asset trading ecosystem, as well as the impact of a temporary price dislocation in the secondary markets in March 2023 resulting from the collapse of certain U.S. regional banks that caused some market share to move to a competitor. We will no doubt continue to face challenges in the future.

Loss of investor confidence - back in 2022, the stablecoin TerraUSD which was backed by LUNA (a crpyto coin) faced insolvency and went to zero as investors lost confidence in the tokens. It forced Voyager and Celsius Network into bankruptcy. Stablecoins are subject to so called ‘bank runs’.

Bad players - could see malicious platforms with limited histories defraud consumers. The industry has had many bad actors. Circle notes:

For example, since the inception of blockchain technology, there have been incidents of smart contract developers acting maliciously and misappropriating funds, and numerous digital asset businesses and platforms have been sued, investigated, or shut down due to fraud, illegal activities, the sale or issuance of unregistered securities, manipulative practices, business failure, and cyberattacks or security breaches.

Loss of coins or funds - if you incorrectly enter your bank account details, there is the risk that your funds will be permanently lost with no means of recovery. You can also transfer stablecoins to external wallets that are not yours. Once it’s gone, it’s likely gone.

Interest rates - the stablecoin providers make money mainly via interest on cash assets. If the interest rate falls then revenues decline. Circle makes 39% gross margins which is relatively low. Transaction fees for stablecoins have been able to be kept low or free due to this dynamic.

These are the main risks to consider with potential impacts for both consumers and merchants. The technology is unproven. Stablecoins backed by real US dollars are considered safer but risks still remain.

Stablecoins cost more, are riskier, add friction and are not widely available. Its difficult to understand why a consumer will use it for everyday payments when card payments work much better. Crypto bulls and those already in the space are probably the ones that adopt it.

The use case is greater in emerging markets. Think Venezuela or Argentina who have experienced hyperinflation and where there isn’t easy access to US dollars. That is where stablecoins can work - citizens can protect their wealth from currency devaluations.

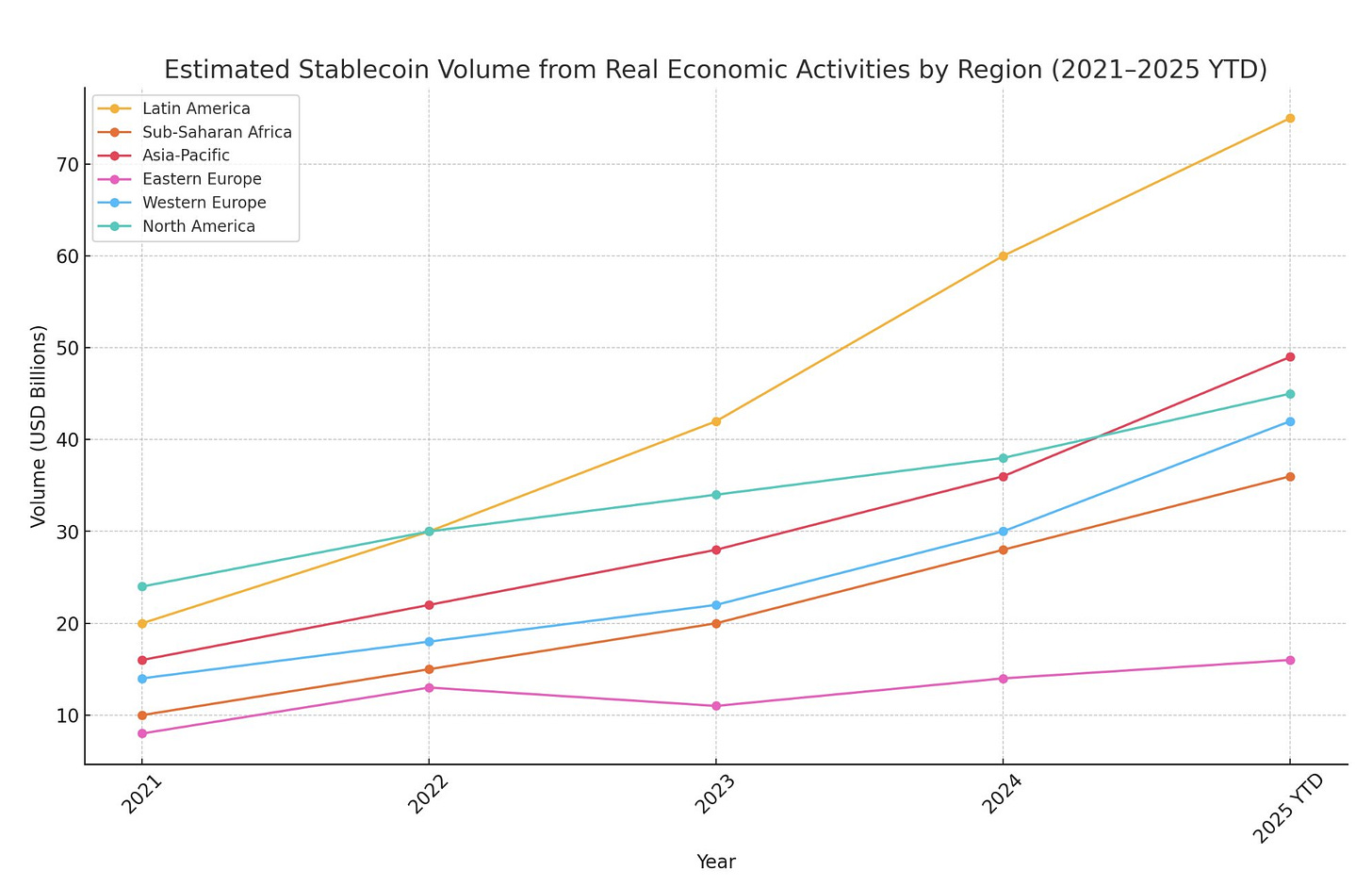

As you can see from the above, the greatest adoption so far has come from Latin America and Africa.

The only way merchants can make this work is if they reimburse the costs and incentivise consumers through meaningful cashbacks or rebates - more so than the rewards provided for credit cards.

Mercado Libre is trying to do this in Latin America. The MELI dollar stablecoin created by the company is designed to only be used within Mercado Libre's ecosystem. To drive adoption, the company has removed all transaction fees, which are usually 1.5% for other digital assets.

This should be a market with a strong use case and adoption, given the exposure to the Brazilian Real, which has experienced inflation and currency devaluation, undermining financial stability. Adoption here is one to watch.

The risk is if Amazon tries to do something similar where it issues its own token and provides rewards through cashbacks. It is something the networks do fear.

The challenge for Amazon is the company does not have its own payment wallet at scale (unlike Mercado Libre). The consumer need is also much lower in developed markets. The company would also need to make the economics work for them while providing significant incentives beyond what credit cards provide. Pretty tough.

The WSJ notes that Amazon, Walmart, Uber, Apple and Airbnb are also exploring the possibility of stablecoins. There will likely be players that trial stablecoins over time.

Overall, I think the value for stablecoins has been overstated. It shifts the costs from merchants to consumers and adds friction. The technology is unproven and stablecoins have various risks.

There are better alternatives out there such as account to account payments. What happened to that?

How do payment networks participate?

If a portion of volumes do shift to stablecoins, the networks can still make money by:

Providing its network to connect stablecoin platforms to fiat currencies

Offering settlement and fraud technology to power stablecoin transactions

Using stablecoins for cross-border payments

Issuing stablecoin linked cards

This is the power of the network. They partner with disruptors and find ways to participate in new flows. Circle explains this:

Increasingly, leading payments companies are integrating the Circle stablecoin network into their offerings as a means of settlement (directly or indirectly) for their customers. As the global digital assets ecosystem grows, these companies are building products that are “future proof” and enabled for increasing integration with the financial system. This includes payment processors, credit card networks, and money remittance services. We are working with leading payments companies like Visa, Mastercard, Stripe, Worldpay, and MoneyGram to facilitate stablecoin settlement on the Circle stablecoin network

Mastercard is exploring ways to further enable stablecoins, the company noted:

It’s also clear that on their own, stablecoins don’t offer the global acceptance, security, reliability, consumer protections or scale that have made card payments trusted and preferred by billions. To make them scale, we need to deliver convenient, secure, and dependable experiences. We are bringing our expertise, our unparalleled network, state of the art services, leading partnerships to bear to integrate stablecoins into the financial mainstream.

Much like other disruptive technologies such as Buy Now Pay Later (BNPL) and account to account payments, the networks have found ways to embed themselves.

What about cross-border payments

If we think about cross-border transfers, the average cost is around 0.3% in developed countries and 0.7-1% in developing countries (estimates based on Wise take-rates). Already lower than what Coinbase describes as the stablecoin thesis:

Comparatively, the average transaction cost of sending remittances using stablecoins is a far lower 0.5-3.0% of the transfer amount, with the potential to trend lower due to new innovations.

The cost of stablecoins should be fundamentally higher given the network participants involved:

Digital wallets

Digital asset exchanges like Binance

Custodians to store and custody USDC

Stablecoin providers

These players all need to make money from the transaction. And then there are the costs of mining these coins.

Stablecoin platforms such as Circle are funding these coins through interest income while not charging transaction fees. If interest rates decline, then the sustainability of this low fee model is questionable.

The consumer also bears significant costs when off ramping from a stablecoin to the recipient’s chosen currency. ie transferring from USDC to Euros. The has yet to be solved.

Overall, the costs to enable stablecoins are actually not as cheap as described.

In comparison, players like Wise and AirWallex have already directly connected to central bank payment networks where the costs are extremely low. These players have removed intermediaries and delivered a solution that is far cheaper and with less friction than stablecoins. For developing countries, Wise has a higher take-rate but so too do stablecoins.

Stablecoins are expected to get cheaper. But as explained there are way too many middlemen and I think the costs are being masked by high interest rates.

Importantly, Wise is getting better. Its take-rates are coming down. The company is connecting directly to more payment networks. Transactions are getting faster too. Wise has already solved for a lot of the benefits stablecoins bring. Its not really providing much more value. Rather, it feels very much like noise.