The online classified business model is one of the best out there. What generally happens is the outright market leader benefits from a self-fulfilling, two-sided network effect that makes it next to impossible for competitors to profitably gain share. This translates into a winner takes most industry with the majority of economics flowing to the leader.

This is absolutely the case in Sweden where Hemnet is the dominant real estate online classified. I have watched the company in awe from the sidelines (I do not own this stock). The financials have exploded across revenue, earnings and margins.

To give some more context into the financial history:

Revenue has grown at a 26% 5-year constant annual growth rate (CAGR)

Operating income (EBIT) has grown at a 45% 5-year CAGR

Operating margins have expanded from 22% in FY19 to 45% in FY24

FCF to net income conversion is 112%

Capex to sales is 1.5%

The company currently employs 152 people. Revenue translates to US$150m and revenue per employee of $1m. As you can see, it is a great business with extremely attractive economics and incredible growth.

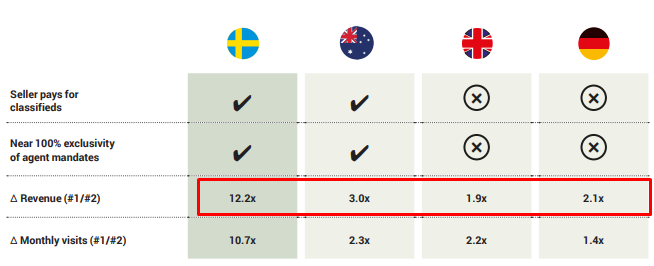

Hemnet has similar attributes to Rightmove in the UK and Scout24 in Germany. It is often referred to as an earlier stage REA Group (Australia). Former REA CEO Tracey Fellows and former Rightmove CEO Nicholas McKittrick are both on the Board. Fair to say Hemnet knows what it needs to do and is deploying a proven playbook.

Competitive Position

Hemnet has dominant attributes. According to Google Analytics, the company has 42m visits per month which translates to around 10-11x more monthly visits than its nearest competitor Booli. The below is a chart from Hemnet’s prospectus.

The company estimates that 9 in 10 properties sold in Sweden are listed on Hemnet.

When a marketplace has the most consumer eyeballs, it attracts the most sellers who want the fastest and highest priced sale. This drives more listings to the platform and subsequently brings more consumers. The classic two-sided network effect.

To provide perspective, Hemnet has 10x more consumer visits than its nearest competitor. Rightmove has 7x more consumer time share and REA 4x more monthly average visits. It is fair to say that Hemnet is dominant and it would be extremely difficult for the number 2 or 3 player to disrupt this.

The Story

Hemnet was founded in 1998 as a joint initiative between the Swedish real estate industry and Swedish newspapers. The company transitioned from a not-for-profit utility into a commercial entity in 2013. Hemnet only introduced its first tiered pricing model in 2015.

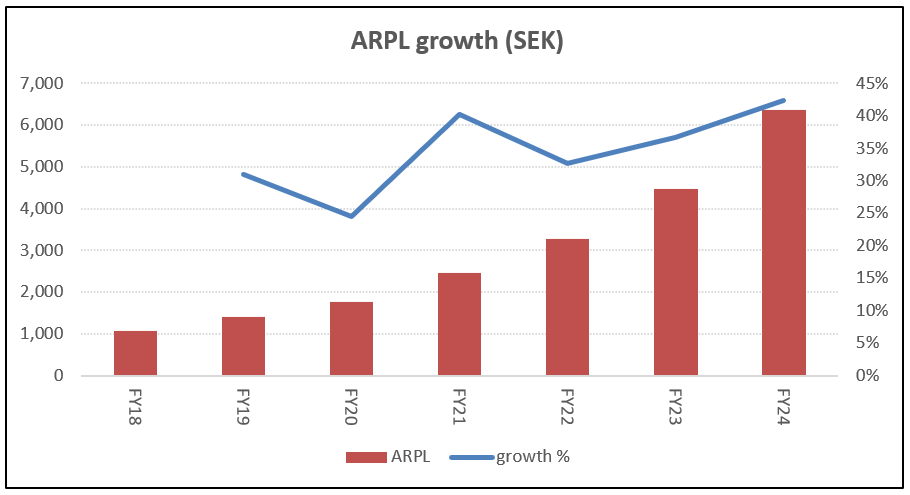

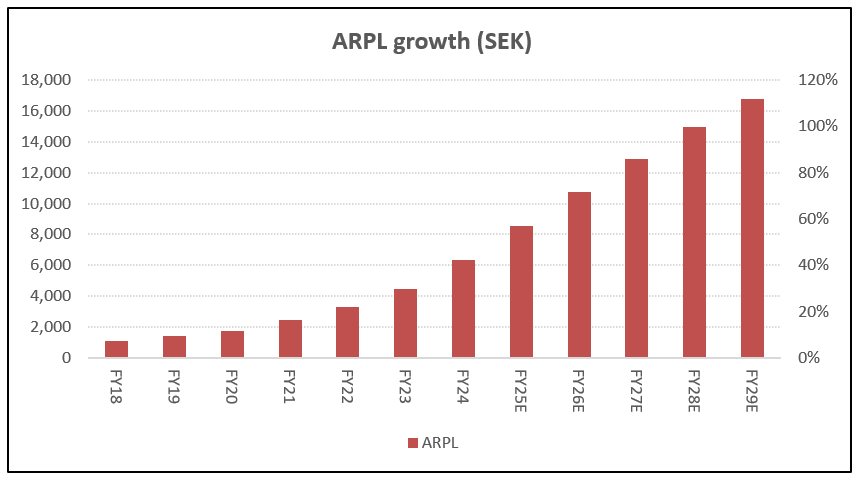

In 2017, General Atlantic (private equity) and other investors acquired Hemnet and fundamentally shifted the platform from a sleepy leader into a money making machine. The new owners leveraged the untapped pricing power to grow Average Revenue Per Listing (ARPL) 6x from 2018 to 2024. Pretty remarkable.

As listing volumes are relatively stable, growth in ARPL has driven the explosion in group financials.

In 2021, Hemnet listed on the Nasdaq Stockholm exchange and in early 2023, General Atlantic sold the last of its shares.

Business Model

Unlike Rightmove and Scout24, the company operates a seller pay model. What this means is that payment comes from the home seller and not the agent.

Hemnet explains the seller pay model:

Firstly, it is the seller who pays for the listing. Hemnet has a direct relationship with the home seller, who selects a listing package and pays for the service directly to Hemnet. This provides Hemnet with an effective channel through which products aimed at home sellers can be sold.

The model is highly advantageous as sellers are price takers who often do not know better and just want their homes sold quickly and at the highest price. The advertising fee is also a small portion (<0.2%) of the total property price. It is why the leader in seller pay industries tend to dominate.

In contrast, the agent pay model often gets push back as price increases directly impact agent profits, making it more difficult to monetise. See below.

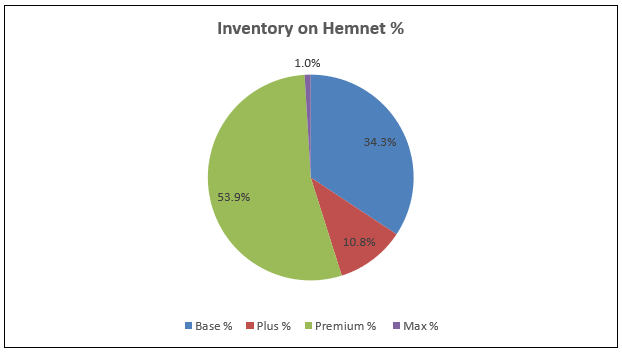

The playbook is pretty simple. Raise listing prices every year and add more premium products (depth) with additional features and better visibility. REA has done this for years. See below REA’s evolution of depth uptake.

Hemnet has deployed the REA strategy to a tee and seen ARPL lift 30-40% every year - split around 50/50 across price and depth. This implies 15-20% price rises over the past 4 years.. wow. While the expectation is that the runway to grow product depth is longer than REA, having started later and operating with fewer tiers.

The history of new tier releases has been:

Plus and Premium launched in 2019

Max launched in March 2025

The recently launched Hemnet Max provides a larger ad size, targeted emails to select buyers, greater exposure on the homepage, top placements and more.

Using an automated proprietary data tool, Premium and Base packages are the most popular. Max adoption remains minimal at around 1-2% of listings.

Commission Structure

One of the keys to increasing product depth has been Hemnet’s commission structure with agents. Hemnet explains how the incentives work:

The home seller’s real estate agency thereafter receives a share of the listing fee as an administration compensation for all listings published on Hemnet, and a commission-based compensation for sales of additional services, subject to the real estate agency having signed a commission agreement. The compensation model thus strengthens the “win-win” relationship between Hemnet and the real estate agents.

The model incentivises agents to promote higher tier products by increasing the commission associated with them.

The model moved to fixed administration fill and the commission is based on total revenue from all seller products, rewarding the real estate agents who actively lean in and recommend Hemnet and these products. The model has been a success, driving in more than 20 percentage points increase in agent recommendations and significantly boosting conversions, particular to Hemnet Premium. The new model has been the main driver of our impressive ARPL growth during the second half of the year.

The agents are effectively Hemnet’s sales force. The company itself thus does not need sales staff, rather just relationship managers.

Hemnet has consistently changed the commission structure to better align agent incentivises with growth in higher tier products. The history of changes can be seen below:

The incentives have gone from a flat 50% admin fee to now being a fixed admin fee with commissions ranging from 0-30% of total revenue, based on volumes sold. What this means is that if your agency brings more listings and sells more higher tiered ads then you will get more commissions. This has been a key driver of Premium depth uptake and ARPL growth.

How much further can prices go?

As discussed, the two drivers of ARPL are price increases and product depth uptake.

Depth uptake has been solid. Based off qualitative management commentary and my internal estimates, the overall uptake of VAS products has increased year on year.

Using the proprietary data tool, the last 1.5 months has seen new basic listings represent 30% of ads, Plus 8%, Premium 61% and Max 1%. This highlights that depth penetration has continued to rise to around 70%.

The barrier moving forward is getting the final agents recommending more depth products. In 2023 around 50% of agents were doing so. The new commission model in 2024 has driven more uptake with the company noting:

The model has been a success, driving a more than 20 percentage point increase in agent recommendations and significantly boosting conversions, particularly to Hemnet Premium.

There will always be a tail who will choose to list on other sites. Although, I think Hemnet can still transition a portion of this tail.

Uptake of Hemnet Max remains low representing 0.5-2% of new listings on any given day (using the proprietary tool). Similar to REA with its new Luxe model, adoption should take time.

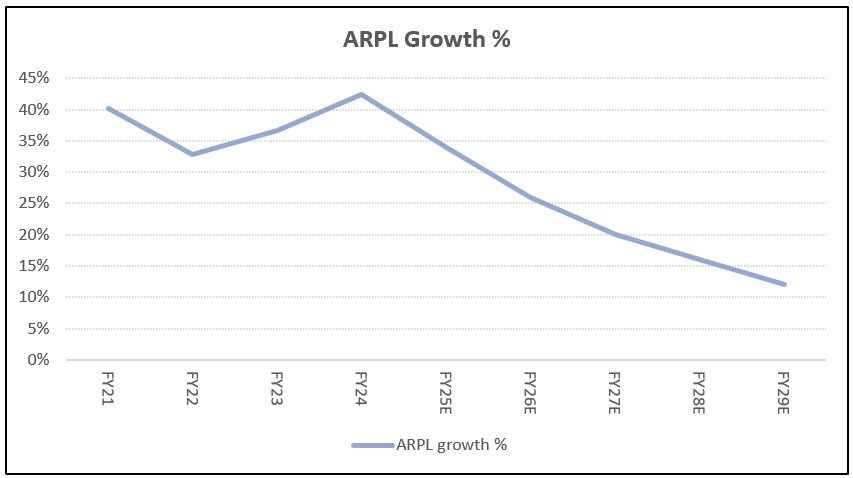

Overall, my ARPL estimates are in-line with consensus, implying percentage growth slows but absolute growth remaining strong. To get to these numbers, pricing needs to grow by around 10-15% per annum with the remainder coming from depth.

Are listing prices expensive?

The view from Swedish home sellers is that Hemnet is expensive which is based on the rate of price increases over the past few years. For the home seller, average listing prices have gone from US$100 in 2018 to US$637 in 2024 and doubling to an expected US$1,290 in 2027. How do prices compare to other leading marketplaces?

Hemnet in its prospectus showed real estate classifieds advertising spend as a percentage of property value in 2019. Back then, there was a huge gap between peers.

To provide comparison now, I have used ARPL as a percentage of average property value. My estimates imply Hemnet’s percentage listing costs have increased from 0.05% in 2019 to 0.17% in FY24 and assuming a 3% property price rise per year from 2024 - it reaches 0.33% in 2027. Similar to levels in Australia from 2019.

The absolute dollar listing value is lower than the US$2-3k REA Group charges while the average property price is almost 45% lower than Australia.

The ramp in pricing in such a short amount of time is remarkable. The company is ultimately a monopoly so it can keep going if it wanted to. Although, it is getting harder to justify these significant price increases.

The only thing really stopping Hemnet is regulation, which I will explore soon.

Volumes

The number of listing volumes has been less of a driver in the past given the explosive growth of ARPL. It is important though. The below shows listings have returned to pre-COVID levels.

Based on data to 2024, the days to sell a property has increased significantly.

Naturally you would think Hemnet is a beneficiary. A tougher market to sell means more sellers list on the site that has the most eyeballs - Hemnet.

The opposite has happened with new listings falling by 16% and 14% in the past couple of months. Note, this data may not be 100% accurate given the historical data has changed. The weak macro is driving high supply of listings and an extended time to market.

There are suggestions that its nearest competitor Booli is gaining share. Booli is a free platform that scrapes listings from multiple real estate websites. The company is known for its soon to be listed feature which enables homeowners to list properties in advance. In a tough economic environment where properties are not selling, homeowners are more inclined to use Booli rather than pay the high fees at Hemnet.

The issue is Booli is not an actual online classified, rather an aggregator. I think the market dynamics have favoured the platform today but it is not a viable disruptor over the long-term.

Overall I think Hemnet should continue to dominate with the near-term impacts on listings macro related rather than structural.

Management

Hemnet is a business where the strategy is clear - it largely comes from the Board down which makes the company pretty easy to run. Despite the significant success achieved, the core management team from the IPO have actually all left apart from two - the Chief People Officer and Chief Sales Officer.

The refreshed management team is shown below, with the earliest appointee in 2022.

The Hemnet business is quite simple so having the right management team is not as important. Although it still matters.

The high turnover in leadership is something to watch. It might just point to the normal course of business or maybe something deeper - such as past management seeing cracks in the story and better potential elsewhere. To note, I have not spoken to management and do not have any insider knowledge here.

Market estimates imply that the growth story continues with new management.

Risks

The risks to Hemnet are detailed below.

Competition is touted as a risk. Hemnet’s position is being questioned in a weaker Swedish macro environment where some sellers are using the free listing service provided by Booli. As discussed, I think Hemnet’s leadership position enables it to continue winning with Booli able to do well around the edges.

Hemnet’s strategy has started to cause wider backlash. The issue is if you keep raising prices and pushing more premium products with limited value then something is going to break.

Monopolies are okay to have, but if you are incentivising agents to sell higher priced products while continuously increasing prices, it creates a conflict of interest and raises questions. The multiple changes that have been made to commissions is also questionable and has created an environment where Hemnet and agents win but the seller (home owner) loses via higher prices.

There is also the added conflict of the real estate industry association known as Mäklarsamfundet Bransch owning 10% of Hemnet, where approximately 86 percent of real estate agents in Sweden are members.

These issues have come to the fore with increasing talks about regulation. A recent news article from affarsvarlden (Afv), Sweden’s largest weekly business magazine notes:

Afv can now report that the Swedish Real Estate Inspectorate is close to taking action and that the Swedish Competition Authority is concerned about Hemnet's dominance. The question has also been raised whether the Swedish Real Estate Association, which is supposed to protect the interests of real estate agents, is instead favouring Hemnet - where it is a major owner.

Mari Gremlin from the Swedish Estate Agents Inspectorate (FMI) expressed her concern:

The mere suspicion that a broker could recommend a more expensive advertising alternative in order to receive higher compensation himself, even though it may not be the best for the client, would fall under antitrust activity

The magazine even asked Martin Mandorff, the head of unit at the Swedish Competition Authority about Hemnet. Mandorff noted:

It is clear that this market is not about to open up and that pricing has skyrocketed. That makes us more concerned now.

And when questioned on what they would need to open an antitrust case:

Based on the competition law and the abuse rule, it can be concluded that a company has contractual terms or pricing that excludes other players. It can also be that the prices are too high, although this is more unusual. In that case, we can order the company to stop doing it. There is also the possibility of a competition fine if it has harmed competition.

I think the commission model is rightly coming under fire. It incentivises agents to use Hemnet, push higher tiers and exclude competition. The outcome is negative for competition and consumers. Thus there are merits for anti-trust in my opinion.

The commission based model could get regulated somehow. This would cause business disruption and force Hemnet to hire sales staff. Maybe it becomes a better business, but it would take time to flow through.

Price rises are fine to do but there needs to be associated value. If you look at Hemnet’s website, it is not the most technically advanced and eye catching. The company would argue significant investments have been made to provide greater overall value.

REA Group monetises at higher levels but the company has invested considerably in building a leading platform with an efficient mobile app, data tools, mobile apps and a range of other products. REA employs 3.4k people and has core operating costs of $405m.

Hemnet employs just over 150 people, has operating costs of A$66m and the platform is frankly average. The company will need to invest more in product and technology to justify continued price increases.

As a result, I think there are risks that could impact the level of price rises, commission model and costs.

Summary

Hemnet operates a highly attractive model and has benefited from a dominant market position. The company continues to pretty much be the only player in town. Without regulation Hemnet should continue to raise prices and grow depth penetration.

The valuation has de-rated to a more attractive forward statutory P/E of 35x with earnings growth of 26% over the next 4 years. The issue is that this forward valuation assumes continued ARPL growth of 24%, which is now getting harder and harder to justify.

The risks are on the table. The commission based business model and limited associated price to value has led to greater scrutiny. The rate of price increases is also too big to ignore. If I was a regulator, I would be taking a harder look - especially if given this chart. There is more to go for ARPL..

If people are complaining today, then there may be an upheaval in 5 years. By then, ARPL would have increased by 16x in 11 years.

Ultimately, if you are growing revenue >20% and its mainly through pricing then something will eventually break. It’s unsustainable. I think revenue expectations need to come down. The company itself has targets of 15-20% revenue growth, which is more reasonable. Consensus forecasts have Hemnet growing revenue at 28% and 22% for the next two years.

For these reasons, Hemnet is one I am happy to continue watching from the sidelines.

Why is it a no?

To summarise, it is a no for the following reasons:

Significant price increases with limited value

Potential regulation and conflicts of interest

Refreshed management team

High revenue expectations

I will revisit this if the circumstances or my view on any of the above changes.

Price: SEK 275

View: Pass

Disclaimer: All posts on “cosmiccapital” are for informational purposes only. This is NOT a recommendation to buy or sell securities discussed. Please do your own work before investing your money.