Investment Thesis

Richemont, a market leader in luxury jewellery and watches, operates iconic brands in Cartier and Van Cleef & Arpels which are high-quality, resilient and durable with limited exposure to aspirational consumers. This quality has been overshadowed by segments such as online luxury and watchmakers which are cyclical and had unsustainable growth. With exposure reduced, the core Jewellery segment is now the key driver for group results. Richemont is a long-term compounder for the below reasons.

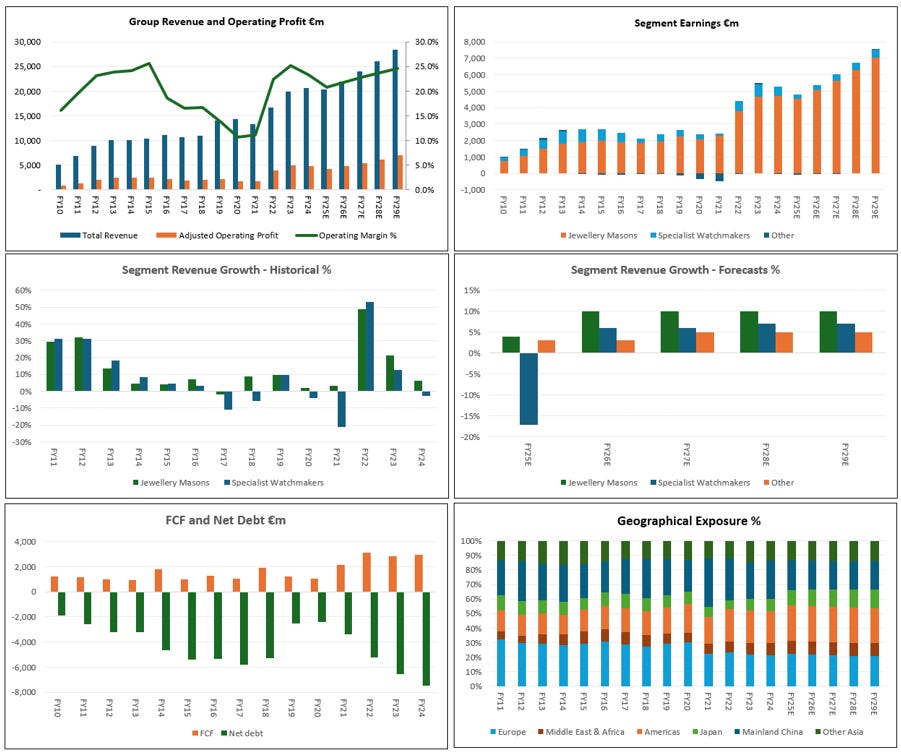

1. Jewellery Maisons sustainably grows revenue at high-single digits as the leader within an industry shifting from unbranded to branded products. The long-term tailwind sees branded grow at low-double digits annually as share shifts from 25% closer to the 80-100% levels seen in leather goods, shoes and watches. Richemont can maintain its position with its leading brand portfolio, while revenue estimates are well below the historical 13% constant annual growth rate (CAGR) since 2010.

2. Group exposure to Specialty Watchmakers has reduced to 6% of earnings, while margins are at cyclical lows. FY25 margins are below FY17 lows, excluding the COVID period while the earnings contribution has reduced from 15% in FY20 to 6% in FY25. The impact has come from an outsized exposure to China where watches spend per capita is at record lows due to an economic downturn. This is likely cyclical with the longer-term dynamics favourable as watch spend per capita in China remains around 83% below Japan and Europe.

3. As Richemont grows sales per store over its fixed cost base, Jewellery operating margins can expand towards 40%. This phenomenon has played out at Louis Vuitton and Hermes, where sales per store are 1.7x and 1.6x higher respectively while operating margins are 46% and 41%, compared to 31% at Richemont. With a similar store footprint and gross margin level, it is clear that higher volumes can bring operating leverage.

View – Accumulate, Richemont has become a better business with greater focus, diversification and higher exposure to Jewellery. The group is managed conservatively over the long-term with net cash at 10% of market cap while price increases have been managed well in comparison to industry peers (Chanel and LVMH). Following a rebasing of earnings in FY25, Richemont can grow revenue at high-single digits and earnings at 12%. Using a blended 50:50 discounted FCF (10% discount rate) and P/E multiple valuation, returns a target price €170 or CHF157. Would be buying the stock at €153 or CHF142, representing a 10% discount to target price.

Market and Variant view

Factset estimates have 3-year revenue CAGR of 5% and EPS of 7%, reflecting rebased earnings in FY25 and a return to growth across both jewellery and watches. The sell-side is broadly positive with 55% of analyst buy ratings and 45% hold. My FY27 EPS estimates are 7% above consensus with the variant perception around group margins. Richemont’s valuation discount to peers can also reduce as the market recognises the durability of its improved business model.

Company Overview

Richemont is a leading Swiss manufacturer of jewellery, watches and other luxury goods. The company was initially part of the Rembrandt Group which held assets in tobacco and mining. Through a series of capital management initiatives, current Chairman Johann Rupert divested Richemont and quickly established the group as a luxury goods leader by acquiring brands such as Cartier (1993), Vacheron Constantin (1996) and Van Cleef (1999).

Richemont has developed these brands by increasing the desirability via a conservative strategy investing in craftsmanship, creativity and innovation. While these core brands have prospered, Richemont has experienced issues in non-core areas such as online luxury (YNAP) and the distribution of watches. The group has since exited the online space and transitioned to a more direct retail model after repurchasing excess distributor watches stock. A summary of the three segments is detailed below:

1. Jewellery Maisons (69% of revenue) – brands include Buccellati, Vhernier, Van Cleef and Cartier which primarily sell jewellery and in some cases watches and other goods. Richemont has 37% share in the luxury branded jewellery market and 3% share in the global jewellery market. In the Swiss watch market, Cartier is the number two player behind Rolex with 7.5% share.

2. Specialist Watchmakers (18% of revenue) – operate eight brands that have centuries of history including A.Lange & Sohne, IWC, Jaeger-Le Coultre and Vacheron Constantin. The Swiss watch industry is cyclical, while Richemont has lost share to leading players; Rolex, Patek Philippe and Audemars Piguet. Richemont has developed a more sustainable business model with less reliance on the wholesale channel and a renewed focus on preserving the desirability of brands.

3. Other (13% of revenue) – include brands such as Mont Blanc and Dunhill with exposure to fashion and leather goods, writing instruments, pre-owned watches and others. These brands do not have scale, are loss-making and are not expected to form a material part of the group.

1. Are Richemont’s competitive advantages sustainable?

Richemont’s key jewellery brands have a combination of competitive advantages including brand, scale and process power. We explore this using Hamilton Helmer’s 7 powers:

1. Scale economies – yes, leader in jewellery with 484 stores globally. Cartier’s sales per store of €35m is double that of Tiffany. Scale provides purchasing power when sourcing previous metals with its lower cost profile reflected in leading gross margins of 68% and operating margins of 31%. Operating margins at Tiffany are estimated to be 17%.

2. Process Power – yes, luxury jewellery and watches are hand crafted by experienced artisans. There is IP around the complex designs and modern manufacturing process, which would take years to replicate at scale.

3. Switching costs – moderate, consumers have choice and can purchase from a range of unbranded jewellers. Although, within the luxury branded jewellery market, there are only a few leading brands with heritage and quality, which are primarily operated by LVMH and Richmont.

4. Brand – yes, the primary competitive advantage, Richemont’s brands have been cultivated over centuries, with time and famous associations integral to developing brand equity. The brand is further enhanced by iconic designs including Love from Cartier and Alhambra from Van Cleef. Importantly, Richemont has managed desirability well, with reasonable supply levels and products priced at a premium to the sector.

5. Cornered Resource – yes, preferential access to Swiss talent and resources which are considered high-quality and a symbol of elegance.

6. Counter positioning – no, they are the incumbent and market leader. Although they are positioned against unbranded (75%) as consumers seek products with associations.

7. Network economies – not really a network effect business.

2. What is a sustainable growth rate for Jewellery Maisons?

Since 2010, Jewellery Maisons has delivered a 13% CAGR, driven by a 16% CAGR in jewellery and a 7% CAGR in watches. Richemont has gained share through a combination of pricing, store expansions (362 to 484) and volume growth.

The Global Jewellery market is valued at around $353m and grows at 5%. As seen below, branded has consistently taken share, with forecast growth of 13% vs 1% in unbranded. The industry can deliver this grow as branded share of 25% shifts to 80-100% levels seen in categories such as leather goods, shoes and watches. Other market drivers include a growing emerging middle-class and increasing wealth effect across developed nations. Richemont is well positioned as the leading player with 13% market share.

The company competes within the branded luxury jewellery market consisting of LVMH (Tiffany & Co, Bvlgari and Chaumet) and Richemont who have a combined 70% share. The market is consolidated, rational, and focused on product quality and innovation rather than prices. Richemont’s high-quality brands have consistently gained share.

Going foward, Richemont can maintain share through its differentiated brands. The company delivers growth via the industry tailwind, store expansions, pricing and brand power. Low-teens jewellery and mid-single digit watches growth translates into high-single digit growth in the Jewellery Maison segment.

3. What happens to the Specialist Watchmaker segment?

Specialist Watchmakers is exposed to the Swiss watch industry which has seen cyclicality and lower growth due to distribution issues, aspirational customers and exposure to China. In response, Richemont has pivoted to a direct retail model that protects the brand from excess supply and gives it greater visibility into stock levels and real demand. Since 2017, margins have moved structurally lower due to a higher fixed cost base and lower revenue. See below.

In FY25, earnings are expected to fall >50% from the China slowdown, a high fixed cost base and the impact from the rising Swiss franc and gold price. Margins sit below 2017 lows excluding COVID, with a contribution to group earnings of 6%, down from 15% in FY20. The Watchmakers segment remains less material to group earnings.

Richemont’s largest market, China is experiencing economic issues with watch sales per capita at cyclical lows. Demand should invariably return given the emerging middle-class, and desire for status and wealth. Watch spend as a percentage of GDP per capita in China and also the US are well below that of Europe and Japan (see below), which provides a tailwind to long-term growth. The company has exposure via a multi-brand strategy across different price tiers.

4. Can Richemont grow Jewellery Maison operating margins to 40%?

Richemont has gross margins of 68% underpinned by scale and vertical integration, which have been sustained as pricing and volumes offset cost inflation. Below this are operating costs where approximately 50% is fixed around leases, store expenses and people. Margins can be volatile when volumes shift, as demonstrated during COVID. Scale is therefore key.

As seen below, the core Jewellery segment has very good unit economics with sales per store of €29m and EBIT per store of €9m, representing margins of 31%. While impressive, these unit economics are markedly lower than Louis Vuitton and Hermes, who generate EBIT per store of €23m and €19m respectively and operating margins of 46% and 41%. What these players have shown is the inherent leverage in the model when sales per store scales over a fixed store network.

For Jewellery Maisons, sales per store is 41% and 37% below Louis Vuitton and Hermes respectively. While exposure to rising gold and Swiss Franc may not see them reach 40%-50% operating margins, the company has ample room to improve from current levels of 31% via scale economies. Note, my margin forecasts imply 50 basis point annual improvements, which have accounted for impacts from limited pricing increases along with a rising gold price and Swiss franc.

Management and Positioning

The Rupert family are the key shareholders with 10% equity and 51% voting rights. Chairman Johann Rupert has continued to operate Richemont like a family business and is involved in most key decisions. Institutional ownership is low at 38% with the remainder in retail, representing 52% of equity. Richemont has re-established the role of CEO to Nicolas Bos (former CEO Van Cleef), while Louis Ferla (former CEO Vacheron Constantin) replaces Cyrille Vigneron’s (retired) as CEO of Cartier. The management team have long tenures, are well incentivised and have the capital to grow the business over the long-term.

Valuation

Richemont trades on a forward P/E ex cash of 18x, EV/EBIT of 13x and FCF yield ex cash of 4.5%. This represents a 20% discount to its 10-year historical EV/EBIT of 16.5x. Richemont also trades 20% below the sector average which includes LVMH, Kering and Moncler. Overall, the valuation is attractive, with potential multiple expansion if the market begins to appreciate the company’s resilience and improved fundamentals.

Risks to view

The counter view is that Richemont remains lower quality due to its cyclical watches business, conservative reinvestment profile and poor capital allocation. The key risks are:

· Brand damage – brand equity could be impacted by short-term decision making, poor marketing, overstocking, faulty items and ESG concerns. The brands are managed with a long-term mindset, while management is very conservative when launching new products.

· Regulation – tariffs and government intervention could impact pricing and the affordability of brands. China remains the largest risk for tariffs, with the region representing 20% of Richemont’s FY25 revenue.

· Capital allocation – management could make a large acquisition that destroys capital. This occurred with its venture into online luxury and subsequent €6b of write-downs. Past capital allocation has been suboptimal.

· Gold and Swiss Franc – a large portion of costs are exposed to the Swiss Franc and gold. If these continue to increase, the cost structure and margins could be impacted.

Appendix

Disclaimer: All posts on “cosmiccapital” are for informational purposes only. This is NOT a recommendation to buy or sell securities discussed. Please do your own work before investing your money.

Hi there

Great writeup on a great business.

Could you please provide a link to the source or dataset you used to calculate branded vs unbranded market share and growth rates?

Thanks!