Richemont FY25 Results - Stock Analysis

An underappreciated business with Hermes like attributes

From a headline level, Richemont’s FY25 results looked disappointing. Full year revenue rose 4% to €21.4b and operating income (EBIT) fell 4% to €4.5b. But underneath the surface, the underlying performance was strong. The full year was a tale of two halves: 1H revenue declined 1% and 2H rose 9% with a marked sales improvement across all segments.

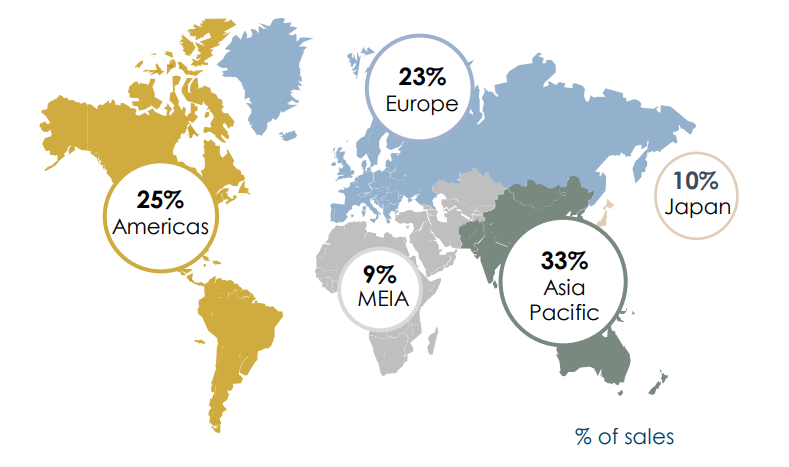

Across the regions, performance ex China was strong with double-digit growth on a constant currency basis across; Americas +15%, Europe +11%, Middle East & Africa +14% and Japan +30%. The main detractor was Asia Pacific -13%, mainly China falling a whopping 23%. The positive is that the decline has brought a more evenly distributed regional mix, with China now representing 20% of sales.

Jewellery Segment

Jewellery is the core group driver contributing 72% of revenue and 110% of operating profits. For the full year, sales grew 8%, EBIT rose 4% and operating margins fell 1.2% to 33.1%. The 2H saw a significant improvement with revenue +13%, EBIT +14% and margins improving 0.3% to 31.1%.

Jewellery continues to outperform luxury peers in challenging macro conditions. The below shows the quarterly growth rates vs peers, illustrating market leading growth that is comparable to Hermes.

Chairman Johann Rupert commented on peers and market share gains:

I think people are finding out that the business is more difficult than they thought when they bought the competitors. We are gaining market share against non-branded and branded.

Margin expansion in 2H was particularly impressive given significant headwinds from rising gold prices and a stronger Swiss Franc. The 1-year movements in gold and CHF/USD are shown below.

With most goods manufactured in Switzerland and made from gold, cost pressures remain a headwind. But the company has been able to offset this through pricing, cost control, and volume leverage, highlighting the strength of its business model.

Richemont is one of the largest buyers of gold outside of governments and gold’s continual increase remains a risk to margins.

Specialist Watchmakers

Watches had a weaker result with revenue -13% to €3.3b and EBIT -69% to €175m. Margins fell significantly from 15.2% to 5.3% suffering from cost inflation (as per above) and operating deleverage over its largely fixed cost base. I note that the segment represents 4% of earnings and is not a driver of the thesis.

In saying that, revenue did actually improve from -16% in 1H to -9% in 2H. The performance across regions was not bad but given the segment’s outsized exposure to China, revenue fell disproportionately compared to the group.

Watches does not have the same competitive advantages or scale compared to Jewellery. This means it is more susceptible to competitive pressures, especially in the mid-market space where peers are competing fiercely for customers. The industry is experiencing a slowdown - Swatch and LVMH are also struggling.

The group is much better positioned now than in 2016, having cleaned up the wholesale channel and aligned sales staff incentives. The company is on top of inventory management and end market demand. Chairman Rupert notes:

And had we been in the position where we were in 2016, now, I would have been concerned. But at this stage, I'm not concerned. Yes, there are watch maisons that are suffering more, who are more reliant upon mainland China and but that's across the industry.

Margins are now at all time lows.

Can it go lower? Yeah. Is it material to results? Not really but one to watch.

Richemont has some high-quality brands and are importantly focused on trying to maintain brand desirability. I think there is medium-term upside to margins, once China demand returns.

Other Financials

Capex rose 16% to €1.2b representing 5.5% of sales. Inventory +13% to €9b and working capital +13% to €7.8b. The company bought back some stock but it was around the edges, with the sell-in sell-out ratio at 100%.

Net cash rose from €7.5b to €8.3b, which positions Richemont well to overcome and capitalise on any potential market weakness.

China

China’s revenue contribution has declined from 33% in FY21 to 20% in FY25. While its contribution has fallen, the region remains a key driver to long-term growth. Revenue was down 23% this year, mainly from weakness in Watches.

Some headlines suggest a structural shift away from luxury goods, but the weakness appears more macro than anything. Its been reflected across the broader consumer sector and in competitor results as well where sentiment is low after prolonged lockdown effects and the property market crisis.

I think there will continue to be a desire for Chinese to show off status and wealth and luxury goods remains one of the ways to achieve this. Once macro headwinds subside, Richemont is well positioned to outperform—particularly through its quieter, classic brands like Cartier, Van Cleef, Jaeger-Le Coultre, and Vacheron Constantin.

Chairman Rupert notes:

We have evidence that where the lockdown was very stringently enforced, the scars are still deeper and the propensity to spend is lower

Pricing

The primary lever to offset cost inflation is pricing, with Richemont having latent pricing power across its high-quality brands. The group has leveraged this over many years.

Despite this, management has ensured careful price increases. For example, many peers aggressively raised prices post COVID, but Richemont took a more measured approach which has enhanced brand equity and client trust.

Management focuses on maintaining relative value compared to peers and adjusts prices mainly to offset rising costs rather than exploiting demand. Richemont fits into the bucket of companies that price for value.

Why now?

Beneath the surface, Richemont is emerging as a more focused, resilient and higher-quality business. Key changes include:

Divestment of its non-core online luxury unit YNAP to Mytheresa. While the terms are not very favourable, the sale removes a drag on performance and management. The group can now focus on its core strength; operating luxury maisons.

Renewed leadership team. This might seem like a bad thing but the internal changes have lifted experienced top talent to the helms. New CEO Nicolas Bos was the cornerstone for the strength at Van Cleef. Notably, the transition has been seamless and should drive more independence, creativity and innovation. Chairman Rupert commented:

And the transition there has been very good. I'm really quite proud of the culture of Richemont that when we dismantled SWM, that Emmanuel gratefully went to Panerai and Jerome asked to go to Jaeger. So, it really says something for our culture that we don't have arguments. And I must say even if it's in front of him, I'm glad that it took me about 18 months to persuade Nicolas to become the CEO. But thank you, Nicolas.

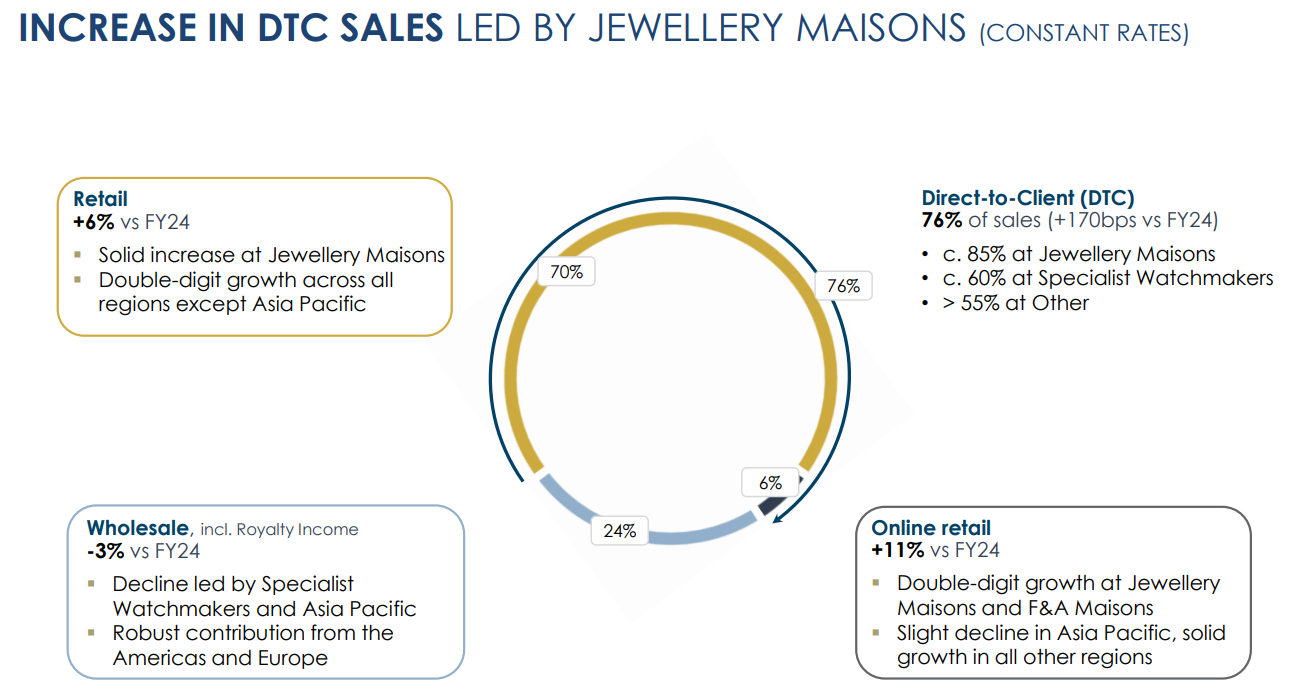

Greater direct sales. The group continues to grow its direct-to-consumer sales, enhancing control over the client experience and inventory management.

Diversification beyond China. As noted, the business is becoming less reliant on China, broadening its geographic revenue base.

FY25 was a step in the right direction—Richemont outperformed peers and proved its resilience. The more important thing is where the business is headed. And all things point up. The brands are strong, there is focus, the balance sheet is net cash and the corporate structure is better than ever.

I think Richemont has a durable runway to grow revenue at high-single digits and earnings at low-double digits. The business trades on a forward P/E of 20x excluding net cash. The key risks are Watches and cost inflation on margins.