When it comes to powerful business models, toll roads come to mind. They provide critical infrastructure enabling fast and easy transportation. There is generally a high willingness to pay as convenience and speed outweigh the costs. This translates into high recurring revenue, and a transaction-based model that benefits from increased utilisation. The incremental costs to scale are minimal and operating margins can typically reach 80-90%.

Significant upfront capital expenditure and the cornered resource of land means barriers to entry are high. Once the infrastructure is in place, the business model is highly attractive with strong economics. For these reasons, tolls roads are highly regulated.

Payment networks such as Mastercard and Visa are the modern day toll road equivalents, digitising the movement of money.

“The best business is one that collects a toll on the flow of money”

— Warren Buffett

Mastercard has developed a global infrastructure across >150m merchant acceptance locations, >3b cards and thousands of customers. It is a highly accessible alternative to cash, cheques or bank transfers - providing a fast, safe and convenient method of payment.

The company is the preferred payment network exposure. In the sections ahead we will explore why this is the case. Topics covered include:

Company history

Network participants

How they make money

Business model

Competitive advantages

Why they win

Services

Runway for growth

New flows

Risks

Financials

Management

Valuation

Company History

Mastercard was founded in 1966 as an association to run the payment network called Interbank for a consortium of banks including United California Bank, Wells Fargo, Crocker National Bank, and Bank of California. The aim was to replicate the earlier success and be an alternative credit card to Diners Club and BankAmericard (now Visa). Around this time, numerous small and large banks began to form their own regional associations with around 440 new card networks born out of this period. For much of its history, Mastercard has been viewed as the number two payments network.

To differentiate itself, Mastercard focused on international expansion and technology development. The group expanded into Europe, Mexico, Japan, UK and Australia.

In 1973, Mastercard developed the Interbank National Authorization System (INAS), the first computerised authorisation and clearing system which replaced the cumbersome telephone confirmation process with an automated system. Two years later, the Interbank Network for Electronic Transfer (INET) completely automated the authorisation process removing the need for mailed credit card slips. The two systems later combined to form Banknet, delivering seamless global transactions.

In 1980, former Amex executive Russel Hogg was brought in to take Mastercard to the next level and bridge the gap with Visa. Hogg changed the organisational hierarchy to one that was more horizontal, bringing more effective communication and faster decision making. He also targeted greater international investments where the runway for growth was higher and the competitive environment less intense.

Mastercard entered the debit card market in the 1990s through Maestro to replicate the Interlink debit system used by Visa. Initial uptake was underwhelming but grew to become a meaningful contributor.

In 2006, the company listed on the New York stock exchange and rebranded to MasterCard Worldwide signalling its intent to grow international share. In 2009, Ajay Banga joined as group CEO and shifted Mastercard from a credit card business to a payment technology giant.

Mastercard embraced emerging technologies and took big bets with a lens on the future. Initiatives included expansion into cybersecurity and data anaytics, e-commerce, artificial intelligence and mobile payments to reduce friction and grow financial inclusion.

These long-term investments have entrenched Mastercard within the payments ecosystem today. The network is digitising consumer to business payments (C2B), and expanding into new payment flows. It is increasingly becoming a data and platform business.

How do card payments work?

The payments ecosystem is complex and consists of multiple parties with varying fee arrangements. The ecosystem is referred to as a “four-party” network and includes the following players.

Issuer: mainly banks and FinTechs who issue cards to account holders like ourselves to transact on goods and services

Account holder: a person or entity who holds a card or another device that can be used for payments

Merchant: the place where an account holder makes a purchase

Acquirer: the financial institution of the merchant

To process a transaction, merchants use payment processors (Adyen/Square) while card scheme operators (Mastercard/Visa) enable the movement of money across the network. See below.

The UK Payments Systems Regulator explains the dynamic,“Four-party card schemes like Mastercard and Visa are two-sided networks. They serve issuers and cardholders on one side (the issuing side), and acquirers and merchants on the other side (the acquiring side). For the card payment system to function, it requires participation of both sides of the network. On the acquiring side, merchants must be willing to accept cards from the scheme; on the issuing side, issuers need to be convinced to issue the scheme’s cards to their customers, and cardholders must be willing to use those cards when making payments.”

The networks are not the ones making cards, payment terminals nor do they hold cash. Rather, they provide a critical service that ensures money gets from cardholder to merchant securely and efficiently.

How does each participant make money?

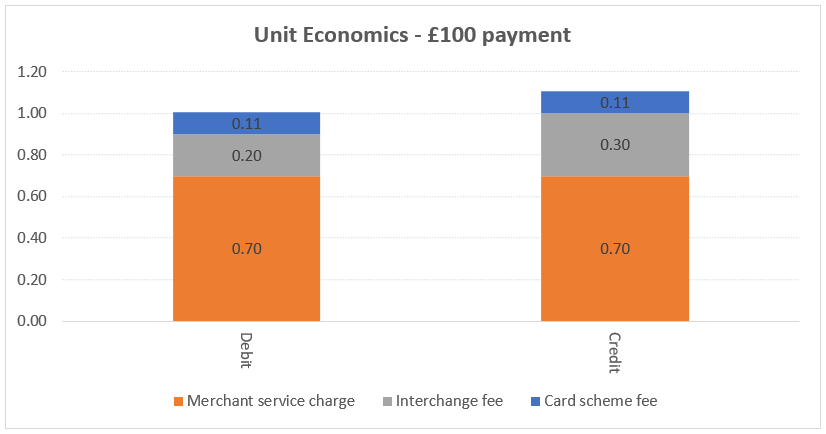

The below image provides an indication of what a typical transaction looks like and where the economics go.

There are a lot of moving parts. We try and break down the three main fees:

Interchange fee: the fee paid from the acquirer to the issuer on a per transaction basis. The issuer receives the fee as a reimbursement for the costs incurred to provide the services for all participants and the credit risk taken.

Scheme and processing fees: the fees paid from acquirers and issuers to the payment networks. The acquirer scheme fee is usually a straight pass-through from the acquirer to the merchant. While issuers pay a fee but are largely reimbursed by the networks through rebates and incentives.

Processing and acquirer fee: the net amount a merchant pays to acquirers and payment processors. The fee incorporates the risk assumed across chargebacks, fraud and disputes in card transactions and also enabling the transaction.

The merchant is ultimately the one bearing the cost that gets distributed to acquirers, issuers and schemes. The total charge usually ranges from 1-3%. In return, merchants get access to a digital method of payment that increases volumes and reduces the manual costs and time of managing cash and cheques.

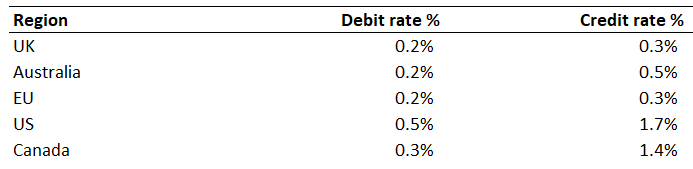

Below is a break down of what the economics could look like for a debit and credit transaction in the UK. The Adyen pricing calculator provides estimates and should not be taken as actual fees, which will differ depending on the type of transaction, amount and geography.

The UK has regulated interchange fees with debit capped at 0.2% and credit at 0.3%. The total transaction fee is also likely one of the lowest globally. Note, the card scheme fee provide is an approximate net yield.

We can see the schemes receive the smallest portion of the transaction - around 10%. Interchange fees are also not significant. The majority of economics flow to acquirers, who bear the cost of processing the transaction and the risk of the transaction. It is also an area that has seen less regulation.

The economics for Mastercard are shown below.

For every $100 domestic transaction, Mastercard receives a gross amount of 21c, returns half via incentives and ends up netting 10-11c. The actual net amount is likely lower given incentives are concentrated to domestic transactions.

The Adyen pricing calculator shows domestic scheme fee are less than 10bps across debit, credit, in-store and online transactions.

In summary, the card networks only take a small percentage of the transaction fee with acquirers generating the largest portion of economics.

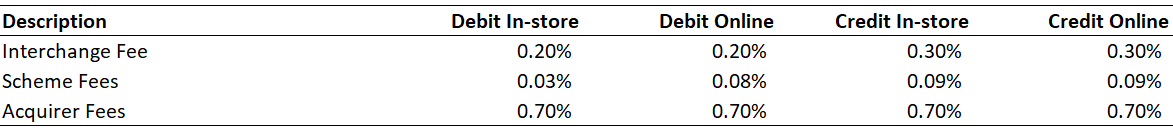

How does Mastercard make money?

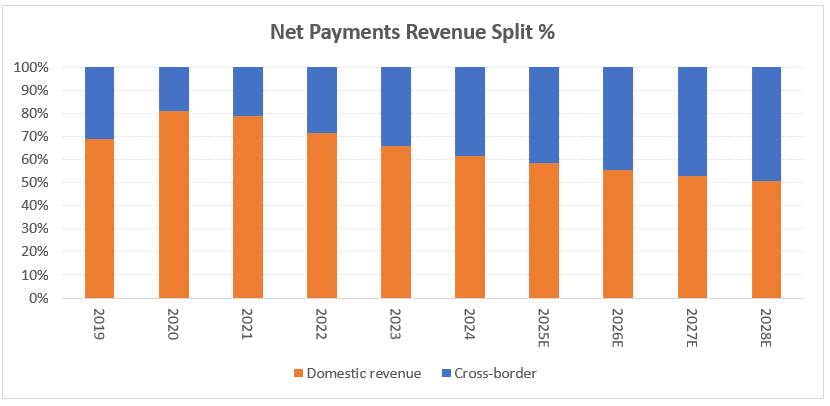

Mastercard has multiple revenue segments across its business. A breakdown of revenue across its core payment network is illustrated below.

Domestic Assessments

Domestic assessments revenue is derived from transactions where both the merchant and consumer use the same currency. Revenue increases as cardholders spend more. This translates into greater purchase volumes, a measure of the aggregate dollars spent using Mastercard branded cards. As the number of cards and average spend per card increases, purchase volumes rise.

For every dollar processed, Mastercard collects fees from issuers and acquirers. The take rate is around 13bps. My estimates show the take-rate has declined in recent years, likely driven by regulatory fee pressures.

This has seen revenue lag purchase volumes growth since 2019.

Purchases volumes have increased at a 11% constant annual growth rate (CAGR) since 2019, outpacing domestic assessments revenue at a 9% CAGR.

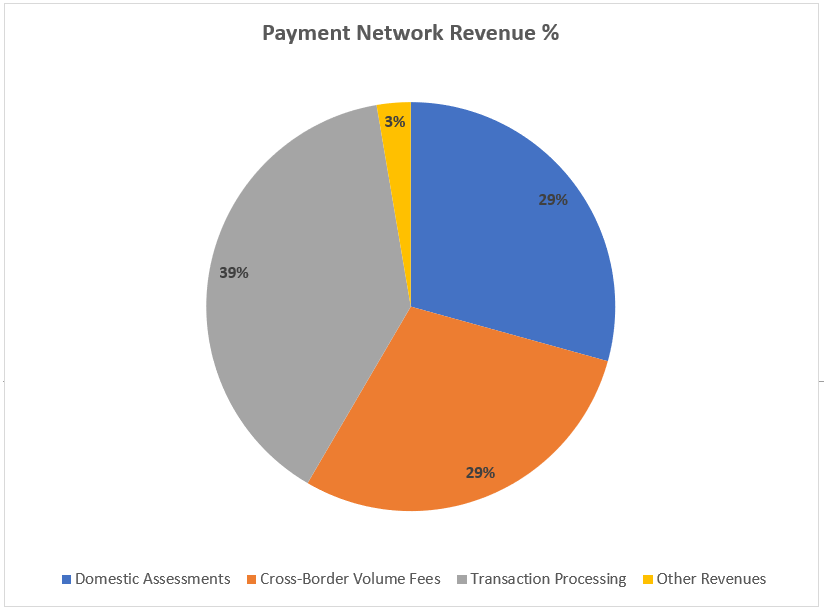

Transaction Processing Assessments

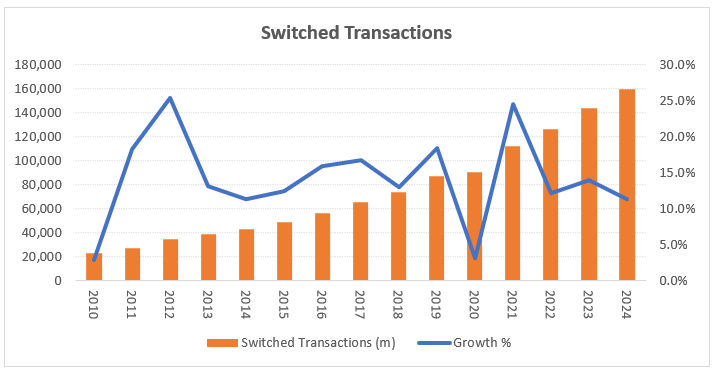

Revenue comes from the volume of switched transactions processed through Mastercard’s network. Switched transactions are when Mastercard’s systems authorise, clear and settle the flow of money. The percentage of switched transactions has remained stable since 2012.

Switched transactions have increased at a 5-year 13% CAGR. Account holders are using cards more often and in smaller increments such as tapping on at the subway or convenience store. Highly penetrated card regions show that having widespread acceptance locations drives more usage as consumers build greater trust and recurring habits.

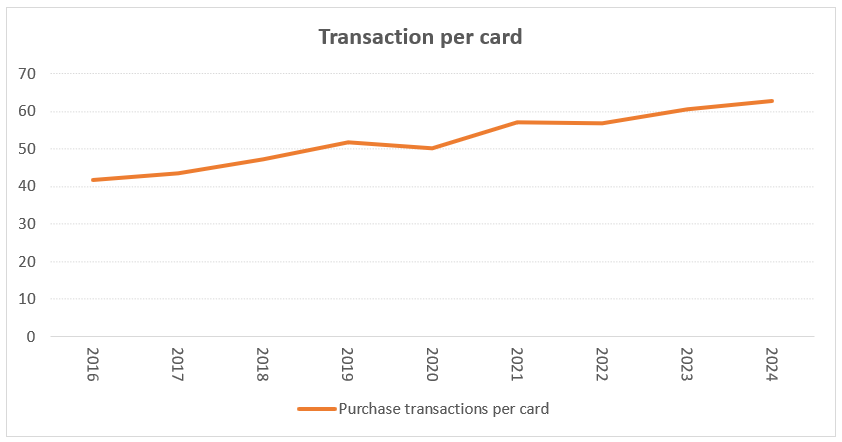

Transactions growth is driven by the amount of cards and how often these cards are used. Mastercard’s average transactions per card is 60 per year or 5 per month. This is low in comparison to mature regions and my own personal usage. If we look at Australia, where card penetration is high, debit card transactions per person are 650 per year in 2022 vs 300 a decade earlier. While not a direct comparison, it provides a view of where frequency can get to and implies current global usage is 10x lower than Australia - with considerable runway to keep growing.

Mastercard has seen a steady increase in transactions per card. We expect this trend to continue as friction reduces from higher adoption of tap to pay, phone terminals, click to pay and more.

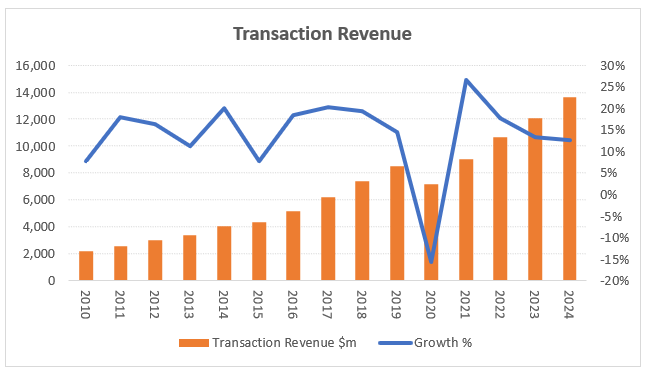

Every transaction sees Mastercard take a clip of around 8.5bps. The take-rate has remained stable despite the growth in cross-border transactions which implies domestic fee pressure.

The growth in switched transactions and stable take-rates has led to transaction revenue sustainably growing at double-digit rates.

Cross-border assessments

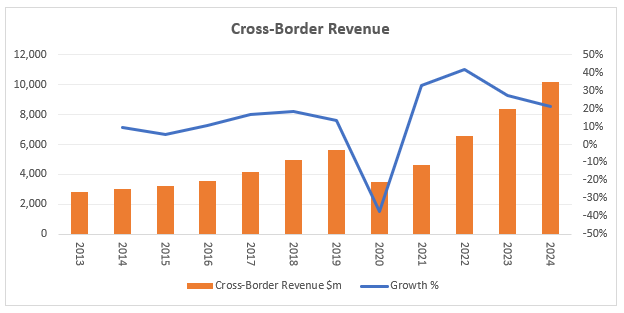

Relates to revenue from purchases where the issuer is in a country other than that of the merchant’s location. Common use cases are e-commerce and cross-border travel.

Cross-border fees are high given the added complexity of handling multiple currencies and additional security. Interchange fees range from 0.2% to as high as 2.4% across some regions. It is unclear what Mastercard’s take-rate is but we can assume it is considerably higher than the 10bps they net from domestic transactions.

The reopening of borders and lift in cross-border activity since COVID has seen growth consistently above 20%.

The segment has also benefited from pricing and mix effects towards international markets with higher fees.

Cross-border revenue has been robust and is a key driver for the group’s double-digit revenue growth.

Rebates and Incentives

As discussed earlier, Mastercard reimburses a large portion of core payments revenue back to network participants (issuers/ acquirers) through fixed or variable incentives. The majority is returned to issuers (ie banks) to incentivise and support them amid a widespread decline in interchange fees globally. In some instances incentives more than totally offset the total fees charged.

As the buying power of merchants has increased (Walmart, Amazon), the payment schemes have increasingly provided volume-based discounts to them as well. Rebates and incentives have continued to rise as Mastercard uses it as a lever to retain and win new deals. It now represents >50% of gross revenue and is expected to continue growing.

Mastercard notes that “rebates and incentives are typically more indexed towards domestic volumes, less indexed towards cross-border.” If we assume a 80/20 split of rebates and incentives across domestic and cross-border volumes, we get the below.

The result sees a mix-shift to cross-border as the segment grows faster and has lower associated incentives. The core domestic business has become a smaller contributor to net payment revenues. If we take the above rebate split, cross-border revenue could match net domestic revenue by 2028.

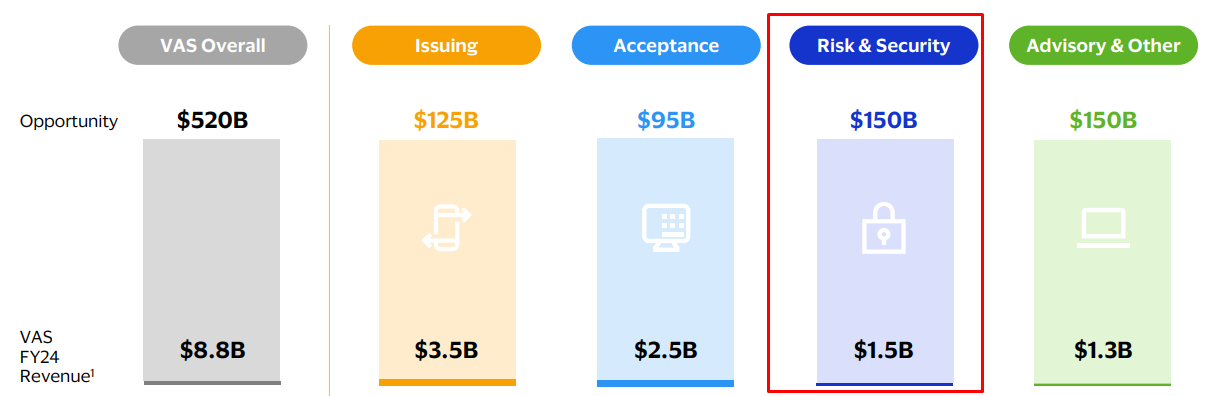

Value-added Services (VAS)

Mastercard has a wide portfolio of technology-led products for payment participants. Known as VAS - solutions include cyber and intelligence, data and services, processing and gateway, open banking and digital identity. We will delve deeper into this later.

Services are either integrated within payment network services or on a stand-alone basis. Since 2019, VAS revenue has grown at a 21% CAGR, significantly faster than the core business.

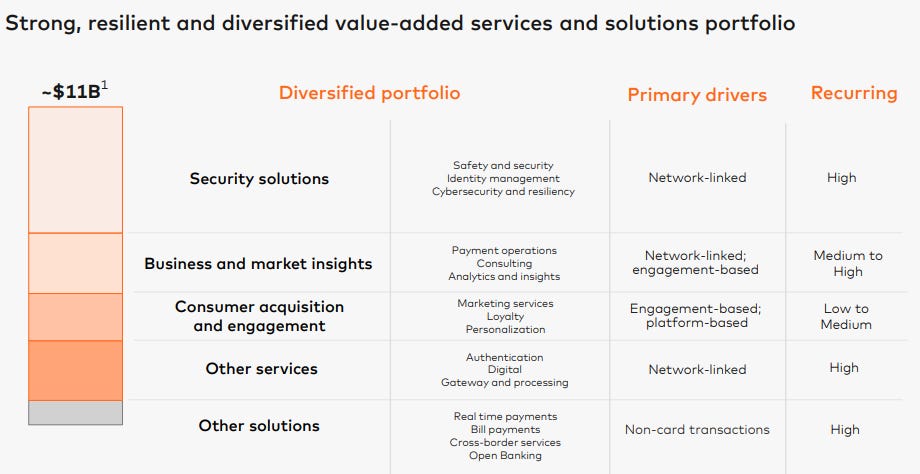

Network-linked services which are correlated with the the underlying payments growth opportunity represents 60% of VAS revenue. The remainder consists of subscription fees and non-recurring engagement fees. A breakdown can be seen below.

The segment is highly diversified and resilient with 85% of revenue recurring. We will explain in a below section why Services can continue to sustainably grow faster than the core over the long-term.

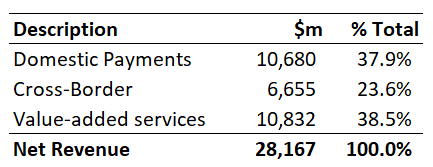

How does Mastercard actually make money?

We summarise the segment drivers below, which translates into net revenue growth in the low-double digits.

Mastercard is increasingly monetising via cross-border and platform (services) offerings. Purchase volumes remain integral as these flows invariably improve and power growth in other segments. The net revenue split is below.

Services and cross-border are growing faster than the core which underpins a mix-shift to these higher value segments.

The key drivers of net revenue growth have thus shifted to services and cross-border. This makes Mastercard a more valuable business in a world with increasing regulation on payment fees and where customers demand leading products from partners.

How does this compare with Visa?

Visa is experiencing the same mix-shift but are earlier on in the journey. Domestic payments represent 48% of net revenue in 2024 vs Mastercard at 38%.

Visa has lower rebates and incentives and makes more money from core domestic transactions. Its net take-rate is higher for domestic transactions.

Visa is thus more exposed to increasing regulatory pressures on core payments.

What makes the networks special?

Both payment networks are comparable and share similar competitive advantages over peers. They have scale across both the cardholders (issuers) and merchants (acquirers).

This has driven a two-sided self-fulling network effect where an increase in cardholders has seen more merchants willing to accept payments. Greater accessibility has in turn led to higher card usage and purchase volumes. More players are then willing to issue cards.

Switching costs are high once consumer habits are built given the convenience, low cost and safety around digital payments. While card acceptance becomes a must have for merchants as declining it likely results in lost revenue and the ability to sell to customers. This is why merchants accept cards even though the added cost can be burdensome as it not only drives higher volumes and reduces labour costs but also retains customers.

Merchants have commented that the networks are the “bare minimum payment methods” and that it would “be unthinkable to attempt to compete with even just one of the two”. Switching costs are thus high across both cardholders and merchants.

In relation to issuers, moving from one network to another is highly complex and involves significant risks to shift millions of cards. It is more often the easier decision to leave things the way they are.

Brand power is also strong with Mastercard 11th and Visa 7th in Kantar’s world’s most valuable brands. The networks have an association with trust and quality versus the smaller and domestic players.

In summary, both networks have durable competitive advantages which has led to the duopoly like industry structure with high barriers to entry. The combination of scale and network effects is the key driver. While high switching costs has seen continued uptake despite numerous disruptive threats. Brand extends the value proposition.

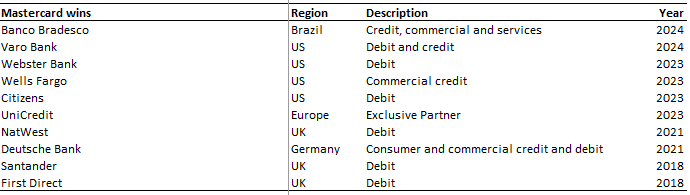

Why is Mastercard winning flips?

If the networks are comparable, then why is Mastercard winning flips and gaining share. The company goes head to head with Visa to win and retain issuers to use its network for debit and credit cards. Customers include traditional banks, Fintechs, merchants and others who are increasingly issuing co-brand cards.

Visa has historically used its scale and vast portfolio of incentives and loyalty solutions to retain and win customers. Mastercard has turned this around with wins in Europe and the US. As seen below, the approach is targeted and won in key areas.

We explained earlier that switching costs for issuers are high due to the risks of moving millions of customers to a new card. So for a shift to occur, the proposition needs to make sense financially and operationally.

Mastercard focuses on both. Firstly the company returns a high proportion of rebates and incentives to issuers and makes less money on the actual transaction and more through cross-border and VAS. See below.

Mastercard can therefore can go into negotiations with a lower initial price point and can make a shift economical for issuers. This is a form of counter-positioning as Visa would need to lower prices and cannibalise its existing business to compete. While Visa has increased rebates and incentives, the company is unlikely to match the level of incentives without significantly impacting its financials.

Although price is a factor, it is not the defining reason to flip. Rather, customers are seeking partners who can understand their needs and provide leading solutions. This is because issuers operate in highly competitive markets where disruptive technologies are increasingly eating into revenue and costs.

Mastercard has a differentiated services portfolio with broad capabilities to solve for these needs. The company regularly co-innovates and provides global services that can elevate these players.

At the UBS Conference Head of IR Devin Corr notes “I think we're differentiated. And if you look at a number of our wins, it's because of some of the services we can deliver that help with the conversion to help other aspects of our issuers business in understanding what it is. Each one is different. So it's not about showing up at the same services. It's understanding what their needs are and helping them grow the top line. So that's using marketing to stimulate an active cards, using personalization to bring people to deposit side of the business. Saving money on the bottom line, using cyber fraud insights to allow them to save costs on a fraud perspective.”

Mastercard wins due to its differentiated services portfolio (IP), cornered resource (culture) and counter-positioning (business model).

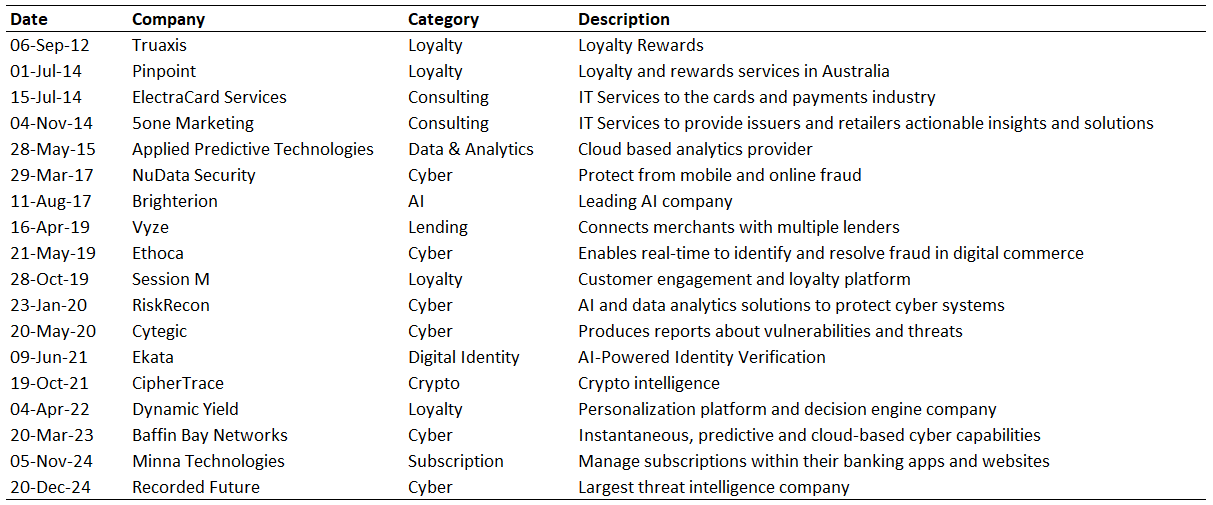

What makes Services differentiated?

Mastercard has become a data and platform business with a core strategy to differentiate in value-added services. A well curated and structured data approach has enabled them to leverage the depth and breadth of insights across its platform. Mastercard Chief Services Officer Craig Vosburg notes “But we've also, over time, systematically broadened that pool of data to include not just card transaction data, but identity data, device data, biometric data, real-time payments data, open banking data, payments gateway data, commercial card transaction data, buyer-supplier relationships and all of these things number in the billions, right? So this is data at scale. So we've broadened that dataset and can use that.” Other service providers do not have this level of information.

The company has consistently layered incremental services on top of this data via a well thought-out and long-executed acquisition strategy. See below.

Bolt-on acquisitions have been executed methodically along with internal development to increase the breadth of products to around 30-50 depending on the region. They support these products with global consulting and advisory expertise. Visa has made fewer acquisitions in services, cyber and loyalty and focused more on new flows and technology capabilities.

Mastercard has services across five categories of security solutions (cyber), business & market insights (data), consumer acquisition & engagement (loyalty), other services and other solutions. The portfolio has expanded since its last investor day in 2021 where there were three segments.

Each segment is detailed below:

Security Solutions - products that safeguard payments from fraud and cyber threats, offering solutions across multiple payment types from prevention to detection.

Business and market insights - data-powered solutions, insights and advisory services that enhance decision making. Key areas include advanced analytics, business intelligence and economic insights.

Consumer acquisition and engagement - marketing, personalisation and loyalty services designed to drive customer acquisition, engagement and retention.

Other services - products that support the wider payment ecosystem such as authentication and gateway and processing.

Other solutions - includes open banking and real-time account payments.

In Security Solutions, Mastercard has significantly expanded its capabilities with seven acquisitions in the past eight years. The recent acquisition of Recorded Future is an example of how the company continues to expand its SAM by extending into threat intelligence. As the increasing prevalence of data and AI heightens the threat of cyber, an end to end solution is critical for customers to understand the risks and prevent fraud. Around 40% of services revenue is related to security. And it is clear the breadth of solutions here is a differentiator.

For Visa, security and risk represents a smaller portion of services revenue. While not a like for like comparison, we can see from the number of acquisitions and revenue contribution that they are likely playing catch up.

Mastercard’s broad services portfolio, combined with leading data and a customer first approach sets the company apart. The culture prioritises understanding customer needs and using insights to drive better decision making. Conversations are moving beyond the C-suite and going deeper into other areas across the organisation.

Mastercard tackles the main challenges of growing revenue, cutting costs, and keeping consumers engaged head-on. Breadth and depth matter with each customer choosing Mastercard based on different needs as detailed below.

The financials also illustrate Services contributing a larger proportion of revenue and being more significant for Mastercard.

The Services strategy has proven to be valuable as it positions the company to win and retain more customers, reduce the exposure to core payment fees and drive more sustainable growth. As seen below the strategy drives another flywheel effect where growing purchase volumes leads to more data which further differentiates services and drives more new wins. Mastercard notes on its website “Payments and services are deeply interconnected. As we help digitize more payments, that opens more opportunities for us to deliver value-added services – including data insights, consulting and cybersecurity. The growth of those services drives more digital payments – and that flywheel keeps turning.” Share gains should continue.

How long can Services grow for?

VAS revenue is $10.8b and grows at high-teens. The company estimates the TAM is $490b and SAM is $165b. Mastercard has penetrated less than 7% of its SAM, which refers to current or late-stage development products. This points to a long runway for growth.

In core payments, Mastercard primarily competes with Visa. However, in Services, competition is more fragmented with a range of players offering point solutions that support issuers, acquirers, fintechs, merchants, small businesses, and more.

Mastercard has multiple levers that enables VAS to grow at mid-high teen levels:

Network-linked services (60% of revenue) growing in-line with underlying transaction growth at low-double digits. This is highly recurring.

Price increases for subscription products.

New customers and partners such as issuers, merchants and more.

Growing modules per customer. This has expanded from 3 to 5 services per transaction from 2021 to 2024.

Expanding the SAM by acquiring or developing new solutions. In Security, the company has converted $30b into its SAM since 2019 via bolt-on M&A. Mastercard has only converted 1/3 of its TAM.

With the core business growing transactions at low-double digits and multiple addition levers for growth, its reasonable to assume Mastercard can grow Services at at mid-high double digits. At its core, growth is about increasing partners, customers, and transactions and selling more services across the ecosystem. See below.

The result sees Mastercard become a better business as services grow due to stickier relationships and more diversified revenue.

Is there a durable runway to grow purchase volumes?

Mastercard operates in a duopoly-like structure with stable dynamics where the two top players have around 90% share of consumer to business (C2B) digital payments. If we include other players such as Amex, Discover and JCB, Mastercard has 34% and Visa 66% share. Note, domestic card schemes such as China’s Union Pay have been excluded.

The company estimates the SAM for C2B to be $44t excluding China. Carded volumes are $23t and 52% penetrated. There has been a consistent shift to carded payments if we assume C2B has grown at 4% annually.

The remaining runway is to displace cash and cheque ($11t or 25%) and other forms of legacy account to account payments ($10t or 23%).

More mature countries such as Australia have 77% card and 13% cash penetration. Global card penetration can get closer to these levels over time, albeit replacing cash and cheque at a slower pace than it has historically.

The main opportunities are to grow penetration in emerging markets such as Latin America, parts of Europe and Asia Pacific which have lower levels of digital payments adoption and where personal consumption expenditure (PCE) growth potential is higher. The total cash & cheque in these regions is high.

While there are pockets of opportunity in developed countries such as Japan (50% cash) and Continental Europe (25% cash & cheque share). Mastercard has a high mix in international markets and a solid opportunity to grow.

Consumer purchase volumes can increase via retail spend (4%) and card penetration growth (1-2%). Visa expects growth of 5-7%, relatively in line with the above forecasts. Mastercard has a few more levers to grow faster:

Share gains - increases the amount of credentials

Maestro Conversion - shift from Maestro to Mastercard debit cards, which is not included in purchase volumes. The conversion delivers a better cardholder experience, with the ability to shop online and across borders, and has seen a 2x lift in spend per card. There are 343m cards left to be replaced, around 10% of total cards.

These two drivers can probably add around 2% to volume growth and deliver high-single digit growth in purchase volumes.

In addition, both players have an incremental 2-3% growth coming from new flows such as Commercial (B2B) and Remittance and Disbursements. Market penetration is low with the ability to grow at double digits for a long time.

Mastercard can likely grow purchase volumes around 9-10%, with the company guiding to 9% at its Investor Briefing. There remains a durable runway to convert cash and cheque to digital payments. Importantly, Mastercard has multiple levers to deliver faster growth due to exposure of under penetrated International regions, share gains and the Maestro conversion.

New flows is expected to be the longer term driver given the significant untapped opportunity. Commercial flows represent 13% of gross dollar volumes (GDV) today. As this segment grows faster and becomes a larger proportion of volumes, it can offset the lower growth in consumer payments over the long-term.

New Payment Flows

The key driver of medium to long-term purchase volumes are new payment flows. New flows extend beyond the digitisation of consumer payments into other segments such as B2B, B2B, G2C and more. The three focus areas are:

Commercial point of sale - $17t SAM

Commercial invoiced payments - $63t SAM

Disbursements and remittances - $20t SAM

Commercial purchase volumes have increased from 11% in 2021 to 13% in 2024 of GDV, growing faster than the core. Disbursements and remittances is around 2% of GDV and has likely grown slower. New flows represents around 15% of purchase volumes with Mastercard’s share at around 1%.

The company has set four goals:

Reach more relevant rails and accounts

Simplify access through a single connection

Target specific flows and use cases through applications

Overlay relevant value-added services and scale distribution through B2B partnerships to drive volume.

Commercial Flows

Commercial consists of two segments.

Point of sale

The more addressable opportunity is in point of sale where $16t or 94% of the market is still using cash or cheque. This is when a business account holder makes a purchase at a card-acceptance merchant or a supplier point of sale. The expectation is that businesses should eventually adopt cards like consumers.

Mastercard is growing credentials by partnering with FinTech’s and expanding distribution into new geographies. The company is also integrating solutions around expense management, reporting, reconciliation and data insights to reduce friction. Mastercard has a solid proposition and has won multiple co-brand deals to position them for continued share gains.

Invoiced Payments

The larger opportunity is within invoice payments - a $63t market consisting of $2t or 3% in carded, $8t or 13% in cheque and $53t or 84% in bank transfers. The proposition is tougher as the networks are trying to displace bank transfers, which are electronic and essentially free. Rather, accepting card payments comes at a cost to businesses.

Virtual cards are important for differentiation, providing unique 16-digit card numbers with custom spending controls, inherent security and seamless flow of data. Payments can be readily integrated into software platforms such as Oracle and SAP to bring automation. Suppliers can also benefit from simplified workflows, better working capital and improved data reconciliation to reduce end-to-end costs. The value proposition is solid but is likely a longer-term play as the company grows the network by reducing friction, increasing trust and proving its value over bank transfers.

Since 2021, Mastercard has gained 4% share in Commercial and delivered growth above its core business.

Disbursements and Remittances

The final opportunity is in disbursements and remittances where Mastercard utilises its scale to deliver efficient transfer of flows across numerous use cases. Powered by Mastercard Move, the platform has the capability to reach 155+ countries, 10b+ endpoints and 95% of the banked population.

Use cases across domestic payments include gig economy payouts and early wage access. For cross-border, Mastercard enables FinTechs such as Remitly and Revolut to deliver instantaneous cross-currency transfers. Mastercard estimates the SAM is $20t.

Visa is likely winning in this segment given the significant focus, targeted M&A and investments in this space. The company estimates a higher TAM of $55t across multiple use cases.

Visa Direct has grown transactions at 40% CAGR since 2019 and is partnering with a range of leading players. The company likely has the stronger proposition here, especially within cross-border.

Risks

Payments is an industry experiencing rapid technological change, evolving industry standards and changing customer needs. The network business models are under constant threat from regulation and disruptive technologies. We explore these primary risks and explain why Mastercard is well positioned long-term.

1. Regulation

As Mastercard has become a dominant network, governments are increasingly seeking to impose regulation. Several jurisdictions have recognised the company as a “systemically important payment system” requiring more policies, procedures and requirements to remain compliant. We explore the main regulatory risks below.

Interchange fees

A constant trend has been to impose caps on interchange fees. Although the rates are set by the networks, the fee is received by the issuer. We have seen interchange fees compress across many developed markets, where previous rates >1% have fallen to the levels seen below.

Card issuers have managed to counter lower interchange fees by raising fees and reducing reward programs. In addition, Mastercard has lifted rebates and incentives to offset some fee pressure.

US interchange fees continue to remain higher than developed market peers. Debit regulation was first implemented in 2011 under Regulation II of the Durbin Amendment. This capped the interchange fee to no more than the sum of 21c plus 0.05% of the value of the transaction, translating into a maximum fee for a $50 debit card transaction of 24.5c or 0.49%. The Federal Reserve has recently proposed new rules to lowers the cap to about 14.4 cents, or 0.29%. While there is opposition from the American Bankers Association, the changes would bring debit rates on parity with other countries.

US credit interchange fees are high and have seen less regulatory pressure. The system has generous rewards programs that encourages more card spending. Merchants have increasingly shown dissatisfaction through legal cases as they are the ones paying for it. The rates are high, and we have seen in Europe and Australia that as card penetration gets to more mature levels, we should be pressure on interchange rates.

As explained earlier, Mastercard has increasingly generated revenue from services and cross-border. While rebates and incentives largely offset any fee received from issuers. The higher exposure to International markets also means they are less exposed to the interchange fee compression in the US. Further compression in interchange fees would thus have a minimal impact. The company has also taken advantage in markets with low interchange fees to gain share by incentivising customers via its differentiated value-added services.

Scheme Fees

Several regulators have begun to scrutinise the scheme fees charged by networks, primarily the automatic pass through fee paid by acquirers. There could be regulation which imposes caps over the long-term.

The 20-year merchant class action in the US initially saw Mastercard and Visa settle to cap swipe fees and lower them by at least 4bps with no increases to 2030. The UK payments regulator has sought similar fee reductions and estimated scheme and processing fees as a proportion of transaction value has risen by 25% from 2017 to 2023. My estimates imply Mastercard’s gross take-rates have decreased across domestic assessments and transactions since 2017.

While the net take-rate per transaction is 10bps, a small portion of the average 100bps fee per transaction.

The networks are more exposured to acquirer scheme fees than interchange fees. Despite this, Mastercard can navigate any pressure given its mix-shift to diversified non-payments revenues and lower net take-rate. My forecasts also already imply further fee pressure.

Cross-border Fees

Cross-border interchange fees are higher than domestic transactions. The networks receive a greater portion of the economics from issuers given the additional security and complexity to facilitate transactions across multiple countries.

Regulation has been more difficult to implement as cross-border is exposed to multiple jurisdictions. We have seen regulation in regions such as the EU and recently in the UK following its exit from the EU that saw the networks raise cross-border interchange fees.

Central banks are also cooperating across jurisdictions to enable cross-border payment integration and enable low cost transfers between countries. Thailand has established seven linkages with its PromptPay system to Japan, Cambodia, Vietnam, Malaysia, Indonesia, Singapore, Hong Kong and Laos. This is a risk for users who transfer money to foreign currencies first and then transact on cards.

Overall, there are limited signs for global regulation on cross-border interchange fees and any scrutiny seems specific to certain regions. If it does get regulated in the future, it would have a material impact on Mastercard.

Anti-trust

Regulators have taken action on network dominance via antitrust cases that prevent those with power from controlling prices unfairly or creating a monopolistic environment that harms consumers.

The notable recent example is the US Department of Justice (DOJ) and its lawsuit against Visa alleging they monopolised the debit card market via:

Exclusionary contracts with competitors and potential competitors to eliminate threats to its network dominance

Unlawful agreements with merchants making it uneconomical to route transactions to rival networks

The DOJ claims these exclusionary practices have likely prevented lower fees, better service, or greater innovation, and states “competition, not Visa, should control whether and how issuers, acquirers, merchants, and consumers interact with each other. Competition, not Visa, should set the fees that those issuers, acquirers, merchants, and consumers pay directly or indirectly to debit networks. And competition, not Visa, should set the pace of innovation—from both rivals and Visa itself—of features and services that benefit consumers, merchants, acquirers, and issuers in the markets for debit transactions.”

While Mastercard did receive a civil investigative demand from the DOJ in 2023, they were not targeted by the lawsuit - a positive for the business. Although Mastercard is not prone from the risk of antitrust. The company received a request in August 2024 from the EU seeking documents around anti-competitive behaviour of certain card schemes and also have a history of past cases.

As a large company with a strong position, scrutiny from regulators is expected. To date Mastercard has largely proven to act in the best interest of customers and stakeholders, and diversified the business with across services and international segments.

Merchants

Merchants such as Amazon and Walmart have grown larger with greater influence and buying power. These players have encouraged regulators to review scheme and interchange fees. While some have negotiated incentives from networks to accept their products. For example, Amazon threatened to stop using Visa cards in the UK due to high fees and struck a global deal before resuming payments. The growth of co-brand cards also provides further bargaining power merchants can use in deals with networks.

As merchants become larger, it increases fee pressure (they are the ones paying it) and likely sees higher rebates and incentives. Mastercard can manage this due to its own bargaining power and the high switching costs for merchants. The business is also diversifying away from core payments fees.

Credit Card Competition Act and Routing

US regulation under the Credit Card Competition Act is attempting to bring more alternatives to the duopoly industry structure. The act requires issuers to have a second payment network, where merchants can opt in to use the alternative which is often less expensive.

The changes would bring added complexity and costs. While rewards and security would likely reduce. Routing changes have already been applied to debit with minimal impacts on both networks. Merchants continue to prefer the security, ease of use and speed of the payment networks.

2. Competition/ New Technologies

Mastercard faces the risk of the market tipping to another payment method. This creates competitive pressure and the need to continue providing great outcomes to all users. The space is highly diverse and uncertainty drives constant innovation. The main threats are discussed below.

Digital Wallets

Companies such as PayPal, Block, Stripe and Revolut are facilitating account to account transactions that bypass card processing. Many of these providers have developed systems targeting e-commerce and mobile channels.

There are global players that have made solid progress. For example, MobilePay in Denmark has 4.4m users or three quarters of the population using its platform and almost all those between ages 20-39. The acceptance network is also solid with e-commerce platforms, shops, subscription businesses and events all allowing its payment method. In Poland, the account to account solution offered by Blik, launched in 2015, accounted for almost 70% of e-commerce spending in 2022.

Digital wallets offer real-time settlement, are easy to use and have achieved prominence in peer to peer transactions. There remain various limitations including:

The average transaction time for cards is six seconds, compared to 10–30 seconds for digital wallets.

Lower fraud capabilities and instantaneous settlement increases the risk of losses and decreases the ability to transact at higher amounts.

The fixed cost fee model is not economical for lower value transactions.

Consumers should continue to have a preference for cards due to its convenience, safety and global availability. Consumers have also built habits and it is difficult to change behaviours. While digital wallets have increasingly partnered with card networks to build scale and increase revenue opportunities. Mastercard thus benefits by providing the infrastructure and as wallet customers fund transactions via card payments.

Buy now pay later (BNPL)

Buy Now, Pay Later (BNPL) is an alternative payment method to credit cards that allows consumers to purchase on credit and repay across multiple installments. BNPL typically charges higher fees than cards, upwards of 4% to merchants. Sweden where the leading player Klarna is based, has seen BNPL account for a materially larger share of e-commerce transactions than credit and debit cards.

The BNPL market is valued at $486b and growing at 11%. There has been higher take-up among Gen Z and millennials. Most use cases are online.

BNPL providers have partnered with networks to issue cards to increase consumer convenience, which has enabled the networks to benefit. In addition, consumers generally pay back balances over four installments using cards, with networks generating additional transaction fees. Mastercard has also introduced its own Mastercard Installments product that allows banks to readily offer BNPL services.

Other card schemes

The other schemes include American Express, Discover and JCB. Amex operates a global network providing credit cards to consumers, small businesses and commercial customers. The closed loop ecosystem means they are the issuer and acquirer and allows them to collect the majority of economics.

Amex is a solid player in credit cards, but do not offer debit cards. The company targets a niche set of affluent customers with high spend in sectors such as travel and hospitality. Amex has a strong US presence and makes money from card fees, interest revenue and service fees, which makes it similar to a bank. The company can co-exist with the networks and competes within a smaller portion of the total market.

Discover is a US based network that is also closed loop. It is being acquired by Capital One, with the likely outcome that Capital One will move its debit and potentially credit over time to this network. Mastercard is the current network provider and should lose some revenue here.

The alternative networks are competitive but do not have the capabilities to disrupt Mastercard globally.

Open Banking and Real-Time Payments

The rise of open banking and real-time payments has made it easier for FinTechs to build account to account capabilities that can disrupt the networks. We have discussed this above under the Digital Wallets segment. The current fixed-cost method can be more economical for higher value transactions.

Open Banking has brought the availability and use of data to empower organisations of all sizes. This is creating a more efficient ecosystem with more automation and streamlined processes. FinTechs such as Plaid are connecting banks to apps and enable the seamless flow of data.

Management has been very attune to these risks and have invested upfront to ensure they are on top of the changes. Mastercard has grown its open banking capabilities with the acquisition of Finicity in 2020, to safeguard it from disruption and participate in the growth. The group provides a range of services across account opening, linking, data aggregation, protection and fraud.

Government backed solutions

Governments are increasingly seeking to control the domestic infrastructure and provide payments as a public good. National or domestic payment schemes with notable share include UnionPay in China, RuPay in India and Elo in Brazil. The schemes have an advantage as they receive substantial resources, preferential treatment and other forms of protection. UnionPay has 90%+ domestic market share, RuPay is the dominant debit provider and Elo with 14% share.

The schemes with the most success are in regions where cards usage is less prevalent. The local schemes tend to have lower technology investment, global acceptance and fraud capabilities. They also do not have cross-border capabilities.

Digital Currencies and Crypto

Blockchain based payments technology has been touted as an alternative, primarily around stablecoins and cryptocurrencies. The volatility of crypto puts them in the camp of a volatile asset rather than a currency. Stablecoins are more viable although the Distributed Ledger Technology (DLT) and financial integrity of it is uncertain. Although we have seen growing acceptance of the technology.

Mastercard has increasingly partnered with crypto wallets providing instant scalability and revenue opportunities. The company offers card products and provides the rails for blockchain based players to expand their network. Mastercard also offers programmable payments, which helps make transactions within blockchain ecosystems more secure, scalable and interoperable. The sector has evolved from a threat into a growth opportunity.

Summary of Risks

In summary, Mastercard faces multiple risks from regulation and new disruptive technologies. There are various other risks around customer concentration (top 5 represent 22% of net revenue), cyber and data, macro related slowdowns and market share losses.

While very much exposed to these risks, Mastercard has positioned itself by diversifying the business across International regions, Services and cross-border revenue. This has built a more resilient business and reduces the main risks around US regulation and payment fee compression.

The company is also highly attuned to disruptive threats and has invested and partnered early to turn them into growth opportunities. Mastercard has shown an ability to drive solid outcomes for the customer and not use its position to gain unfair advantages. Although the company trades on a higher valuation multiple, the actual business model and earnings are durable and likely less impacted by disruption than its main peer.

Financials

Payment networks are capital light businesses which require minimal incremental costs to scale. As the glue or middle-man facilitating the flow of money, the company does not build the infrastructure. Rather it is the merchants who need more payment processors and account holders who need more cards.

Gross margins are high, likely 90%+ and growing given the high fixed costs. Operating costs as a proportion of net revenue have continued to fall.

The main operating expenses are employee costs in product and technology, data processing and telecommunications and advertising and marketing. Mastercard has built a culture of reinvestment via organic and inorganic means. We compare the cost bases of Visa and Mastercard below.

While the total operating costs are comparable, Visa has much higher operating margins. One could explain this as Visa being the more efficient operator and scale delivering leverage.

However, we note Mastercard has likely invested earlier and more aggressively into International markets and differentiating its services portfolio reflected in the higher portion of revenue in these segments. The company has also remained vigilant with long-term investments across new technologies.

Despite this, Mastercard continues to increase revenue faster than expenses, which is a hallmark of the capital light business model and double-digit revenue growth. The business has a sustainable path to continue this and a roadmap to bridge the margin gap with Visa over time through scale economies, especially in services which is lower margin.

Taxation is expected to be a headwind for the business. Mastercard has benefited from tax incentives in Singapore which resulted in near zero taxes for Asia-Pacific revenues. From 2025, these tax benefits will likely be offset due to OECD Pillar 2 guidelines imposing a global minimum tax rate of 15%. The estimated tax rate headwind is 4%, which impacts future earnings by 4-5%. Mastercard’s 10K notes “we expect the Pillar 2 Rules will primarily offset the reduction to our effective income tax rate resulting from our incentive grant received from the Singapore Ministry of Finance. For the nine months ended September 30, 2024, this incentive grant reduced our effective income tax rate by approximately 4%.”

Mastercard has capex to sales of 4%, free cash flow to net income conversion of 100% and working capital to sales of 10%. The balance sheet is strong and operates with minimal debt with a net debt to EBITDA ratio of 0.5x.

Capital management is pretty simple, around 20% is distributed as dividends with the remainder in buybacks done at a reasonable multiple. They also make strategic bolt-on acquisitions if it makes sense, with nothing transformational and requiring significant implementation.

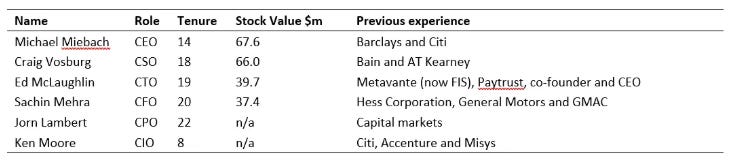

Management and Culture

The management team is well tenured and have executed well. There is a real focus on the customer, reinvestment and innovation. The team has depth and experience. They are aligned via a variable based incentive structure with CEO salary being 95% variable-based and around EPS and net revenue growth targets. Internal ownership is solid.

There is an internal culture to win, guided by the Mastercard Way to create value, grow together and move fast. The company has developed a high-performing, agile workforce that can collaborate and compete in a fast-paced, innovative environment. There are 35k staff with voluntary turnover of 5%, which is very low. The company has a 4.2 star rating on GlassDoor with a 92% approval rating for CEO.

For investors, we can trust the team to execute, especially during tougher markets where reinvestment and long-term decision making is more important.

Valuation

We won’t spend too long on valuation but it is important. The company trades on a forward P/E of 29x which is around the long-term average of 30x, but higher than Visa’s P/E of 26x. Amex is on 17x and Fiserv on 20x, considerable discounts in comparison. Mastercard’s premium valuation is justified due to its durable mid-double digit earnings growth, dominant business model, diversified revenue exposure and resilient business model. One could probably wait for a headwind to occur that impacts the multiple ie BNPL threats or recessions fears. Ultimately over the long-term the valuation matters less and earnings growth is the driver of returns.

If we assume the multiple stays the same, the stock can return EPS growth (14%) and yield (0.5%). Using a cash flow model, with a discount rate of 10% and terminal growth rate of 4.8% gets an IRR of 14%. The valuation looks quite reasonable here.

Summary

In summary, Mastercard is a high-quality, long-term compounder:

Leader in an attractive industry with long-term growth drivers

Superior product that is gaining share

Consolidated market with rational competition

Strong management team focused on reinvestment

Scalable business model with inherent operating leverage

Strong balance sheet with limited debt

Diversified business model across revenue, customers and geography

Solid financials with high ROIC and margins

There is a pretty high degree of confidence the business will be larger in 5 years time. It trades on a reasonable valuation. Looks good to me.

Thanks for your amazing work !