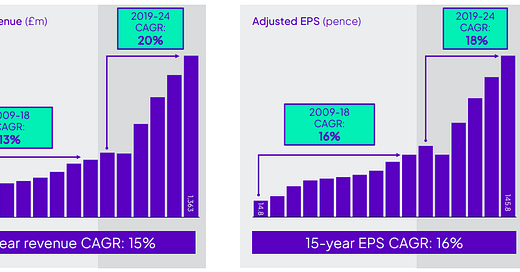

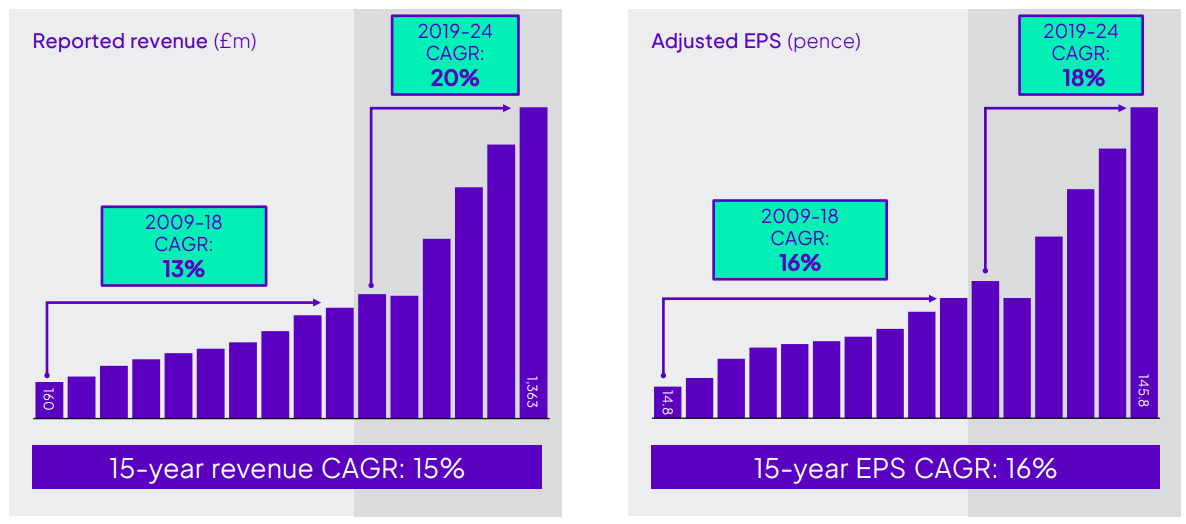

Diploma reported a solid FY24 result with revenue up 14% to £1,363m driven by organic +6%, acquisitions +10% and currency -2%. Adjusted operating profits (EBIT) rose 20% to £285m, with volumes and accretive M&A delivering 120 basis points (bps) of margin expansion to 20.9%. Organic growth across the segments was; Controls +10%, Seals +1% and Life Sciences +6%.

Peerless, acquired on 1 May 2024, delivered revenue of £54m and operating profits of £25m, representing an operating margin of 46%. Based on my estimates, operating profits were 80% higher than the comparable period last year. This was primarily driven by delays in the civil aerospace market from OEM challenges (Boeing), which are likely non-recurring and implies a margin profile that will revert back towards the thirties.

For FY25, Diploma provided guidance for organic growth of 6%, M&A to date of 2% and operating margins of 21%. The key result takeaways are:

The disposal of non-core businesses impacts financials but demonstrates discipline and strategic focus. Following the year end, Diploma divested 3 businesses at 7x EBIT multiples which were non-core and tougher to scale. Proceeds of £45 million implies a revenue contribution of around £43 million and EBIT of £6.4 million which will be absorbed in future years. These actions highlight a willingness to make tough decisions to create a more focused portfolio. The proceeds will also reduce net debt, allowing Diploma to target more aligned and scalable business models.

The decision to reinvest and restructure today positions Diploma for scalable, long-term growth. Often overlooked, this remains an important part of the strategy as the company develops operational rigour to drive future scale. CEO Johnny Thomson notes “the point we wanted to make really was we have a scaling journey as part of our strategy for all of our businesses, but we're being brave enough to use harder market environments to to maybe accelerate that in a few instances.” In Seals, Diploma has reinvested in talent, technology and facilities to capture demand when industrial spend invariably improves. In Life Sciences, the European portfolio has been rationalised and is leveraging a proven playbook which has seen double digit growth in Australasia and Canada.

Going forward, acquisitions are likely self-funded given scale and balance sheet capacity. An important aspect of durable compounding is growth without dilution. Since 2020, Diploma has raised capital twice but have now confirmed they can grow independent of this. Importantly, the dividend payout ratio continues to reduce, (now at 40%) and although still too high, is likely to come down further. These actions indicate that management continues to see runway for M&A.

Overall, my revenue and EBIT forecasts have reduced by 3% reflecting divestments and more normalised earnings for Peerless. The business trades on a forward FCF yield of 3.8%, compounding revenue at 12% and earnings at 13% over the next 4 years. Based on this, the valuation seems reasonable. Importantly, the business is heading to a better place with improving organic growth, scalability, margins, returns on capital and management depth. They have achieved double-digit growth this year amidst a tough economic backdrop, highlighting the resilience of the group and latent potential when the industrial environment improves.