Auto Trader - Investment Thesis

A dominant online marketplace with increasing prominence

Investment Thesis

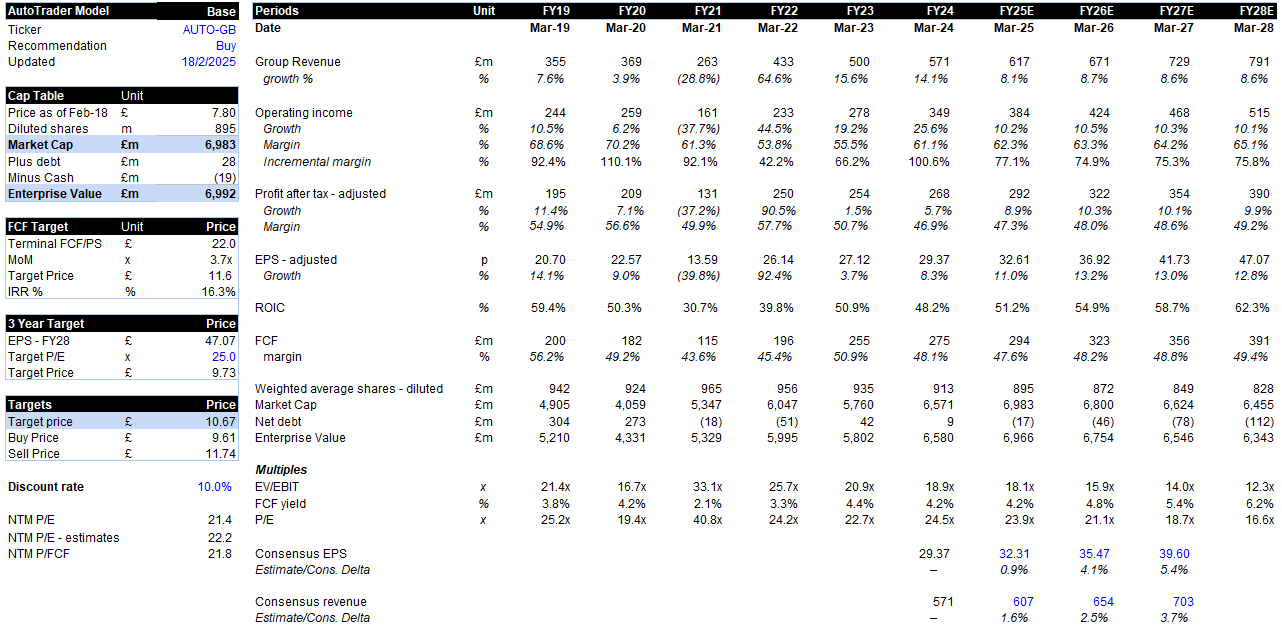

Auto Trader is the UK’s leading used car marketplace with 450,000 listings and 10m unique monthly visitors. As the outright market leader, the company captures the majority of industry profits with core EBIT margins of 70%, while competitors are barely break even. The group has become an enabler for customers as they embed products with data and automation to support the shift to digital, improve margins and reinforce its value proposition in a changing market landscape. Auto Trader can deliver double-digit earnings growth over the long-term. See below.

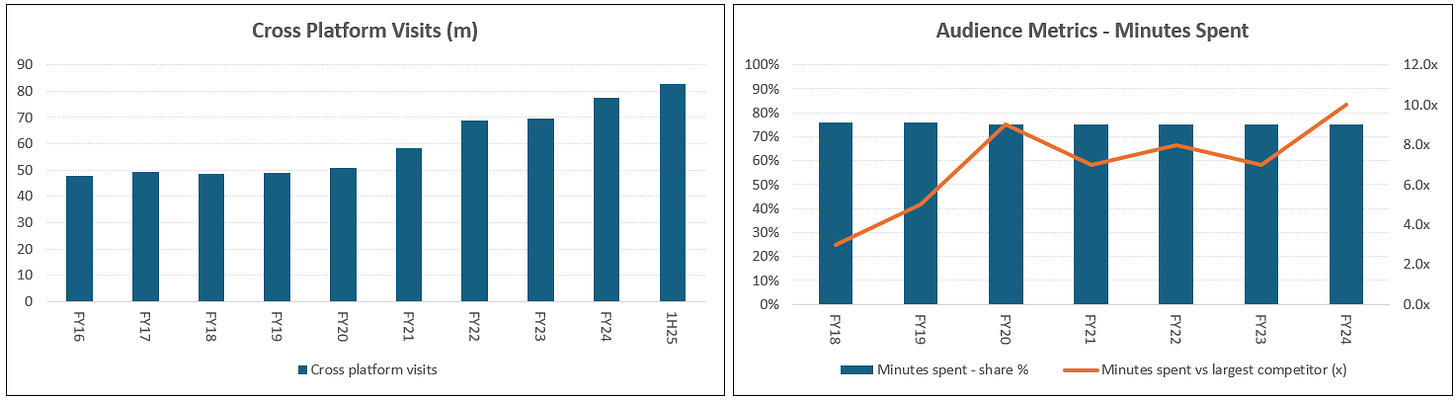

1. The competitive moat continues to grow due to a self-fulfilling network effect, reinvestment and weaker competition. Auto Trader attracts 3x more unique monthly visitors and 10x more user minutes than its nearest competitor, which is up from 3x in FY18. Previous challengers have scaled back investments given the time, effort and capital required to disrupt the network effect of a clear market leader. With the most engaged audience, Auto Trader drives outsized value via faster sales and better pricing for customers, enabling them to command premium pricing.

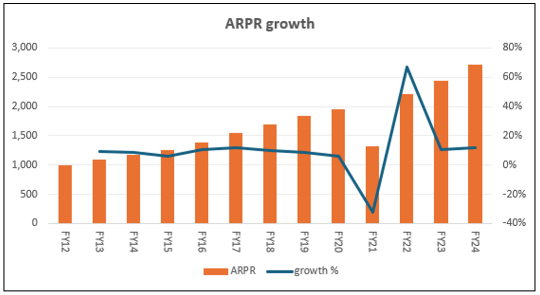

2. Auto Trader has a clear path to grow average revenue per retailer (ARPR) via price and product. Its yield on customer gross profits of 6% is below the 7-10% levels seen at leading peers of carsales.com.au, REA Group and Rightmove. The company can capture more value by embedding innovative data driven products into customer workflows that optimise car selling, reduce costs and increase retailer margins. Additional initiatives across new car, digital retailing and product depth are further growth drivers, especially as industry conditions improve.

3. With the leading marketplace of car buyers, Auto Trader is well positioned to capitalise in a changing auto landscape. The UK is experiencing a government mandated shift to electric vehicles (EV), new original equipment manufacturer (OEM) agency models and finance regulation that could impact car demand and dealer margins. The need for Auto Trader only increases as a key partner providing integral data and automation to support customers with this shift. While the group is poised to benefit via other revenue streams in Autorama (car leasing), Deal Builder (digital retailing), new car and advertising.

View – Accumulate, near-term impacts on used car stock are likely cyclical, providing an opportunity to invest in a high-quality compounder with a strong management team, culture and leading financials. Operating margins are 62%, ROIC is 51%, FCF conversion is 100% and capex to sales is <1%. The competitive position has never been stronger while there is significant operational momentum. The business trades on a forward P/E of 22x and FCF yield of 4.5%, with EPS growing in the low-teens. Using a blended 50:50 discounted FCF (10% discount rate) and P/E multiple valuation, returns a target price £10.7. Would be buying the stock up to £9.60, representing a 10% discount to target price.

Market and Variant view

Factset estimates have 3-year revenue CAGR of 7% and EPS of 10%, which reflects continued revenue and earnings growth. The sell-side is broadly positive with 50% of analyst buy ratings, 33% hold and 17% sell. My EPS estimates are mid-single digits above with higher product and stock growth.

Company Overview

Auto Trader was founded in 1977 as a classified magazine for auto dealers and consumers. Contrary to most traditional players, the company took the difficult decision to disrupt its existing business and shift to a new digital platform. The last magazine was published in 2013 while the group also divested its overseas operations to become a fully digital business focused solely on the U.K.

The two-sided marketplace serves >90% of U.K. retailers (dealers) and an audience (car buyers) of 10.2m unique monthly visitors who spend 556m minutes per month on the platform. The primary customers are retailers, which consists of large car supermarkets, franchises and independent retailers. The market is highly fragmented with no retailer at meaningful scale, highlighting the need for a platform to enhance the visibility of cars.

Retailers account for 79% of group revenue and are monetised based on stock advertised and the level of packages. The company also delivers products for home traders, logistics providers, consumers, lessors, OEMs which represents 21% of group revenue.

1. How durable is Auto Trader’s competitive position?

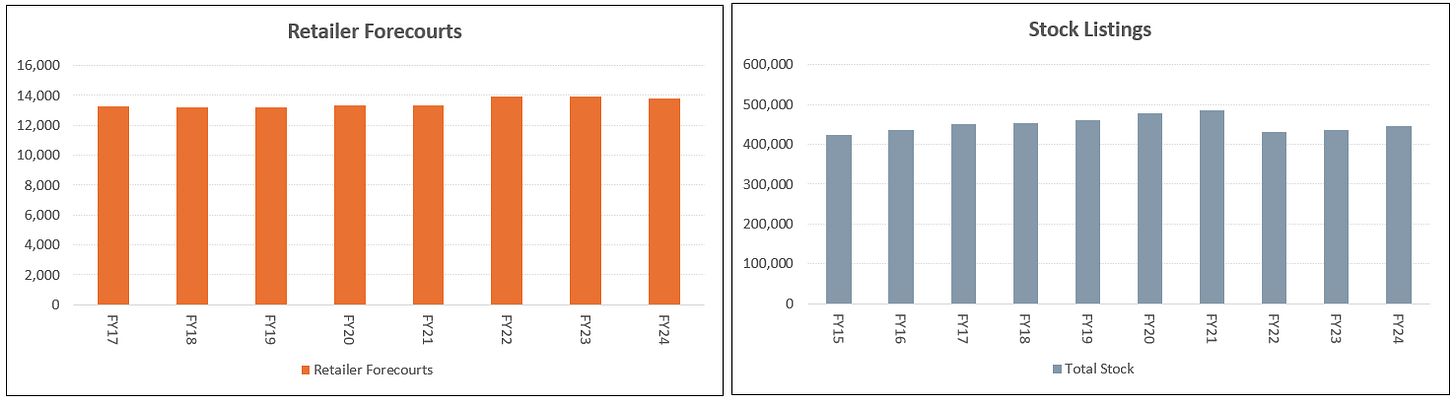

Auto Trader has long established relationships with 14k retailers (franchise and independent dealers), representing approximately 90% of the market and is at all-time highs. The efficient platform and support of 350 customer facing professionals helps drive the most listings to its site - around 450k cars, 1.5x higher than its nearest competitor.

The most listings combined with investments across product and marketing has driven outright audience leadership. Auto Trader has 10m unique monthly visitors, 3x larger than its nearest competitor and over 556m monthly minutes spent on platform, 10x higher than its nearest competitor. This translates into 75% market share of time spent across UK auto online classifieds. The brand is strong with 89% unprompted awareness and 65% consumer trust compared to 20% at its closest peer.

Leadership across both buyers and sellers creates a self-fulfilling network effect that grows over time as seen by other industry peers; Rightmove 7x more consumer time share than the nearest competitor, REA Group 4x more monthly average visits, carsales.com.au 9x more time on site and Hemnet 10x more visits. The leader often accumulates a disproportionate share of revenue and profits, with operating margins above 60% and significant pricing power. While building the number 2 brand is challenging as it requires significant time, effort and investment with minimal profitability. This has been the case for Auto Trader.

Customers value a platform that reduces days to sell and increases the average selling price. Auto Trader’s large and engaged audience is critical here while additional products across data and automation enhances these outcomes. As Auto Trader embeds themselves into customer workflows, this further increases switching costs and the willingness to buy which is demonstrated by retailer customers growing to all-time highs despite recent pressures on profitability. Often the marketing budget for the number 2 or 3 player gets cut first.

Auto Trader’s importance has increased while competitors have weakened. The closest competitor, Gumtree, has re-platformed after Adevinta’s forced sale to private equity. CarGurus, the leading U.S. auto classified, has shifted its focus to profitable growth after an investment heavy period attempting to replicate the successful playbook from its home market. Auto Trader’s monopolistic position underscores the high barriers to entry and its multiple competitive advantages including scale, brand, network effects, IP and switching costs.

2. Can Auto Trader grow Average Revenue Per Retailer (ARPR) at high-single digits?

Since its listing in FY15, Auto Trader has grown retailer ARPR by 9% driven by stock (+1%), price (+3%), and product (+5%). As noted, the company’s strong competitive position enables annual price increases, likely around 7-8% including mandatory product uptake and free stock. This has resulted in resilient growth, excluding the COVID period when packages were offered for free.

To grow ARPR, Auto Trader focuses on developing products and solutions that enable customers to succeed and improve profitability. The company has a platform known as Auto Trader Connect that enables two-way connectivity and provides retailers with market leading data and technology. Products like Retail Check (pricing decisions) and Co-Driver (generative AI) bring more connected selling capabilities, buying experiences and operational efficiencies which supports dealer margins. As annual product releases consistently improves the value proposition, Auto Trader can effectively price for this.

Although Auto Trader is a premium offering, its yield on customer gross profits is 6%, compared to leading peers like Rightmove, REA Group, and carsales.com.au with yields of 7-10%. There is potential to bridge this gap as Auto Trader delivers a multi-year product runway within existing packages and across other levers including:

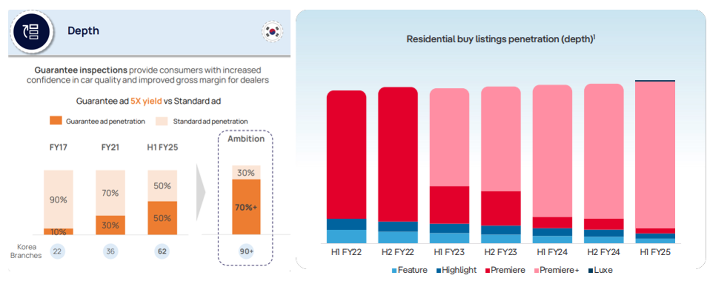

- Advanced (depth) packages – the share of stock above standard packages has grown from 0% in FY17 to 35% in FY24. There is still room for further growth as dealers seek to differentiate stock in more balanced markets. The below shows Korea’s SC Encar’s (left) depth growth to 50% while REA Group (right) has continually layered new depth products over time.

- Online transactions – Deal Builder, a product designed to bring more of the car buying journey online through reservations, financing and parts exchange. Monetisation has only just begun at 0.25% of the car price, with 1,500 retailers on trial and 56k cars listed on site. The product goes beyond customer marketing budgets and aims to reduce the inefficiencies at traditional retailers, where labour costs account for 45-60% of the cost base. As customer begin to understand the value proposition, product adoption should increase.

- New car sales – retailers can replicate the sale of used cars with new cars. 40% of retailers are live, with 20k units listed on site. The proposition remains a work in progress and has been impacted by operational issues and a weak new car market.

The long product runway and annual pricing enables Auto Trader to sustainably grow ARPR at high-single digits.

3. How does Auto Trader fare in a changing car landscape?

The UK auto market is undergoing significant change including the shift to EVs, manufacturers adopting direct agency models and new regulations impacting car financing. These changes create uncertainty around the role of retailers and ability to sustain profitable growth.

Retailers have traditionally served as the bridge between car sellers and consumers offering scaled distribution, service capabilities and parts availability. Given the U.K. is predominantly a used car market, retailers continue to play a role regardless of the car type. In addition, the new car direct model still relies on retailers to act as agents while the unit economics remain similar. Notably, most recent new entrants have chosen the traditional franchise model instead of the agency route.

While there remain risks to the role of retailers, they provide value and are likely to play a continued role for both new and existing stakeholders. What is clear is the need for Auto Trader’s services should only increase with the opportunity to take grow share of retailer spend.

Industry changes also present opportunities for Auto Trader to add value and broaden its role in the car market. The company’s investments into new car, digital retailing, car leasing, data and advertising have positioned them to capitalise with the market shifts. By way of example, the acquisition of Autorama captures the rising popularity of new usership models through EVs. While investments in data can provide insights for retailers and support the broader adoption of EVs.

The uptake of these products have been slower than expected, partly due to challenges such as lower used car stock, new car sales, and dealer margins. These factors are due to cyclical or one-time causes of higher interest rates, cost inflation, weak economic conditions and higher taxes. As these headwinds subside, a more balanced market should see Auto Trader benefit from an increasingly diversified revenue stream.

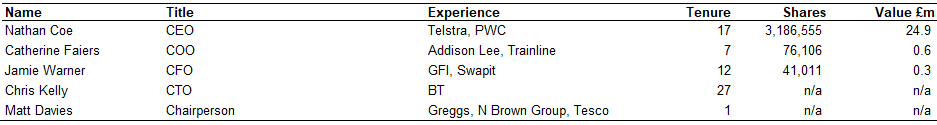

Management and Positioning

Auto Trader has a strong corporate culture with low employee turnover, employee engagement of 97% and a Glassdoor Rating of 4.6/5. The group is digital first and agile with an inherent customer focus as demonstrated by the Trustpilot rating of 4.7/5 which is world-class. The management team has good depth and experience and are aligned to long-term outcomes with incentives mainly variable-based around revenue, operating profit and EPS. Institutional ownership is high at 88%, with long-term shareholders including Blackrock, Baillie Gifford and Kayne Anderson Rudnick.

Valuation

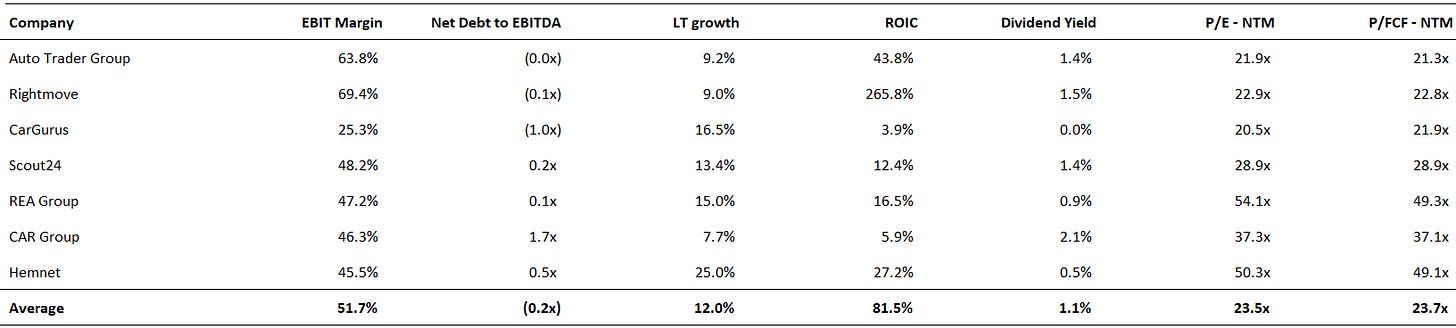

The company trades on a forward P/E of 22x and 4.5% FCF yield, a 7% discount to 10-year historical multiples and 7-10% discount to peers. These multiples are attractive for a dominant business with leading financials, durable growth and strong management. Peers such as Hemnet, REA Group and CAR Group are shown below but excluded from averages due to high valuations.

Risks to view

The counter view is that Auto Trader is a mature business that faces structural pressures from market shifts and lower dealer margins. The key risks are:

· Retailer profits – 79% of revenue comes from the retailer network. Lower profitability could impact the ability to pay premium Auto Trader fees or lead to industry consolidation. There are multiple industry changes clouding this view as well as cost inflation and interest rates pressures. Prolonged lower used car prices are also a headwind. As a key enabler, Auto Trader needs to continue delivering a strong value proposition that help customers overcome these challenges and protect margins.

· Industry changes – Auto Trader could fail to innovate and adapt to changing consumer behaviours and market dynamics. This could see new challengers bring unique products which reduces the reliance customers have on Auto Trader. Management is focused on product development and have invested ahead of the curve to increase exposure to emerging areas such as digital retailing, car leasing and generative AI.

· Competition – large technology companies such as Google, existing marketplaces including Gumtree and CarGurus or new entrants could increase competitive pressures. This could impact the ability to push through price increases. We have seen CoStar owned OnTheMarket disrupt UK real-estate portal Rightmove and cause market uncertainty. The leading marketplaces have invariably been difficult to disrupt with Auto Trader having already overcome multiple past challengers.

Appendix

Disclaimer: All posts on “cosmiccapital” are for informational purposes only. This is NOT a recommendation to buy or sell securities discussed. Please do your own work before investing your money.

As to valuation, what is the appropriate country risk premium to apply to Auto Trader vs listed peers globally?

I understand the UK has elected a hard-left socialist government looking to tax and regulate private sector activities.

Really interesting and well-written analysis! I do have one question about the valuation:

If the company is dominant and has a moat, why is it trading at a discount to its peers?