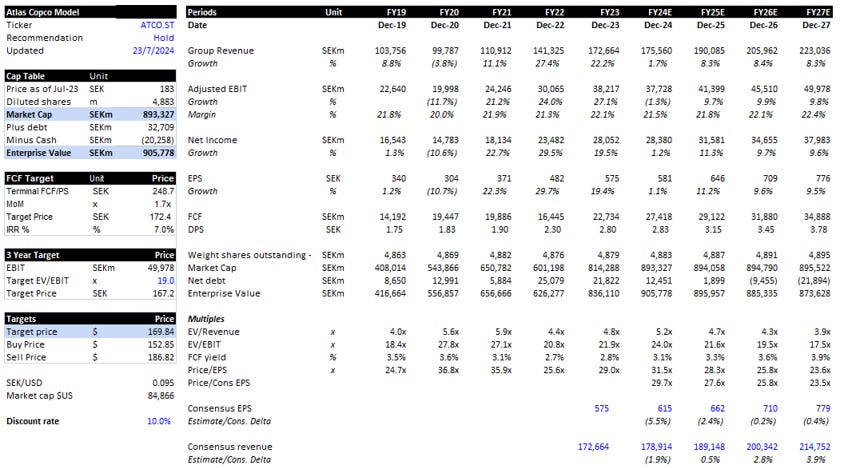

Atlas Copco - Investment Thesis

Atlas Copco trades at a premium despite slowing revenue growth and margin pressure

Investment Thesis

Atlas Copco is a leading diversified industrial with notable scale and IP advantages across segments such as compressor and vacuum technology. The business has delivered durable growth across cycles driven by consistent share gains and pricing power. Despite this, Atlas Copco remains exposed to cyclical end markets and as a result has seen growth temper. Albeit the company continues to trade at a 20% premium to 10-year historical averages.

1. Revenue contribution from dilutive M&A increases from 23% over the last four years to >50%, impacting operating margins. Since 2020, volumes, price and mix have been the primary drivers of margin expansion, offsetting acquisitions which had an average margin of 0.6%.

2. Order growth normalises following three years of solid demand. These dynamics have already played out in semiconductors while softness is being seen in others such as electric vehicles. My estimates have 4-year annual volume growth of 4.1%, well above pre-COVID levels of 2.6%. In addition, benefits from currency and price rises are also subsiding.

3. Valuation multiples should re-rate downwards to reflect a more modest financial outlook. Atlas Copco trades at a premium forward P/E of 28x and EV/EBIT of 20x, which is 20% above historical levels and 10% above the industry average. As margins contract, its valuation multiples should also fall.

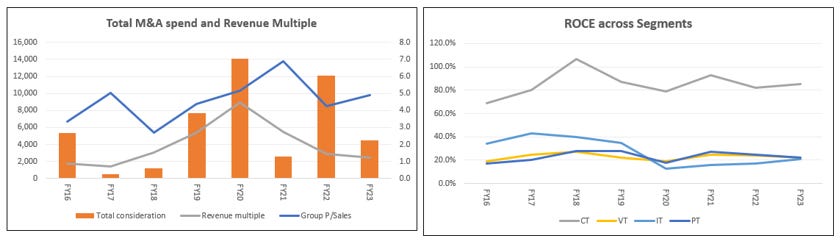

View – Hold, while a high-quality business with strong reinvestment capabilities (ROCE of 30%), the normalisation of earnings and high multiple keeps us on the sidelines. Using a blended 50:50 discounted FCF and EV/EBIT multiple valuation returns a target price of SEK174, which is 5% below current levels. Would prefer to purchase around SEK156, representing a 10% discount to target price.

Market and Variant view

Factset estimates have 4-year revenue CAGR of 6% and EPS of 8%, reflecting a normalisation of growth. The sell-side is mixed with 9 buy ratings, 11 hold and 7 sell. The variant view is around margins implying greater downside from lower volume growth and mix shift to M&A.

Company Overview

Atlas Copco is a diversified industrial leader delivering smart, sustainable and highly efficient manufacturing solutions. The company has targeted leadership in profitable niches where solutions are differentiated, rather than commoditised. Its products are seen as mission-critical towards manufacturing outcomes and are key in driving improved volumes (uptime), costs (performance) and sustainability (efficiency). The four operating segments include:

· Compressor Technique (44% revenue) – broad range of compressors that produce significant amounts of energy used to power all types of applications across the manufacturing and construction industries. It is often referred to as the fourth industrial utility. Atlas Copco is the outright market leader, with around 3x sales of its nearest competitor and continues to grow share by acquiring smaller distributors and suppliers. The key driver is the growth of industrial production.

· Vacuum Technique (25% revenue) – vacuum and related products reduce pressure in industrial applications across the semiconductor, scientific and industrial industries. Atlas Copco is the dominant leader, with >50% market share and has extensive product capabilities. Key segment driver is growth in semiconductor fab capex, which currently represents 59% of revenue.

· Industrial Technique (16% revenue) – includes power tools, machine vision and assembly systems predominantly servicing the automotive (54% revenue) and process industries. Key driver is growth in automotive capex and production. Atlas Copco is the market leader in most of its operations here.

· Power Technique (16% revenue) – portable air and power and flow solutions including specialty rental of compressors, generators and industrial pumps. The division can be more cyclical with rentals representing 28% of revenue. Acquisitions and growth have shifted Construction revenue contribution from 43% in 2018 to 30% now. The key driver is growth in infrastructure investments.

Atlas Copco operates a capital light model outsourcing 75% of inputs to external suppliers, while keeping unique IP and assembly in-house. They can therefore flex the cost base and bring agility when responding to market conditions, as seen during COVID. The revenue model consists of upfront equipment sales and recurring services such as repair, spare parts and maintenance, which represents 35% of revenue.

Atlas Copco’s Competitive Position

Atlas Copco has continuously grown its market position while sustaining industry leading margins. We explore the extent and durability of Atlas Copco’s competitive advantages using Hamilton Helmer’s 7 powers:

1. Scale economies – yes, being the market leader enables greater buying power with suppliers and higher volume throughput over its fixed cost base. This has brought per unit costs down and gross margins higher, while enabling more reinvestment into R&D (2% of revenue in 2014 to 4% in 2023), M&A and distribution. Scale in services is a key differentiator, with its broad capabilities across teams key to delivering better uptime and customer service. The company has customer centres across 71 countries, production facilities in 26 and generates revenue in 182, reflecting a global reach that enables close customer collaboration and reduces the risk of supply chain bottlenecks.

2. Counter positioning – they are market leader in most markets so there is no counter-positioning. Atlas Copco has scale advantages and IP, close collaborations with customers and high levels of reinvestment which increases the barriers for disruption. The company also has a history of making shrewd acquisitions which has improved its capability in weaker areas.

3. Process Power – yes, extensive portfolio of highly connected and energy efficient products that have durable characteristics. The culture has encouraged innovation via new or adjacent solutions through internal investments or M&A. This leading portfolio has global scale and for a new player to challenge them would require significant time and high levels of investment.

4. Switching costs – moderate and above industry average. This is due to the industry dynamics where only a few players have scale, as well as the risk of disruption for customers replacing machines. Would see switching from either a poor customer experience or product defects. With its services led approach, Atlas Copco consistently identifies issues earlier which delivers a more positive experience due to greater uptime. The company prices its products and services at a premium.

5. Brand – yes, strong brand image underpinned by its customer first mentality, product innovation and high-performance culture. They are well trusted and have built this reputation in demanding industries for semiconductor and electric vehicle manufacturers. This enables the company to continue increasing prices, especially in service contracts.

6. Cornered Resource – its decentralised structure, corporate culture and tenured management team brings an owner’s mindset that has enabled great decision making around acquisitions.

7. Network economies – no real network effects.

1. Where are we in the cycle?

Since 2019, Atlas Copco has grown revenue above trend at 13.6% compound annual growth rate (CAGR), driven by an uplift in volumes, price increases to offset inflation and opportunistic M&A. The company saw a shift in orders in 2021, as end markets such as semiconductors benefited from an uplift in demand. Atlas Copco has been driving higher manufacturing output to meet this demand.

We have seen end markets such as semis and EVs soften, while the Global Manufacturing PMI index has hovered around the neutral 50 mark since 2023. Previous tailwinds such as price inflation and currency have also begun to abate. The result is order growth trending downwards, especially in more cyclical segments such as IT and PT. This is seen below.

With the demand-supply equilibrium and competitive dynamics normalising, growth will be harder to come by. Since 2019, volumes have grown at a 4.1% CAGR, which is much higher than historical growth of 2.6% pre-COVID. My expectations are for volumes to continue normalising from these high baseline levels.

Some expect VT to provide upside as the industry rebounds in 2025. Atlas Copco’s high market share of 50% highlights growth will likely be more industry related rather than through share gains. My estimates factor in 11% segment order growth from 2025, and this includes slower than expected contribution from industrial/ scientific. This is above industry estimates for semiconductor capital spend to grow 7% in 2025.

2. Can M&A contribute 4% to annual revenue growth?

Atlas Copco has a strong track record of opportunistic M&A, which has contributed 4% annual revenue growth since 2015. These acquisitions are usually done at a revenue multiple below 2x when market conditions are weaker. Management undergoes a structured and conservative process with a focus on culture, and driving profitable growth without synergies. The company has consistently been able to improve earnings over time, reflective of group ROCE of 30% which tends to dip then improve.

This is a sustainable strategy given the fragmented markets they operate in and the runway of businesses they can buy across all segments. The company has a sizeable balance sheet with low levels of debt and capacity to make multiple small bolt on acquisitions (average spend of SEK393m or US$36m) and the odd large one. The company is also buying businesses that are less profitable with lower margin profiles where they are usually willing sellers in tougher times. Annual M&A growth of 4% is therefore reasonable and reflects a continuation of trends.

3. Can Atlas Copco continue growing operating margins?

Atlas Copco’s operating margin profile since 2011 has ranged from 18% to 22%. It currently sits at 22.1%. Reinvestment (raising R&D from 2% in 2014 to 4% of sales in 2023) and dilutive M&A have offset scale efficiencies. The company has delivered meaningful margin expansion since 2020 primarily from volume/ price/ mix.

My future expectations reflect near-term margin pressure for the below reasons.

1. Dilutive M&A – since 2019, the average operating margin from M&A was 0.6%. As M&A becomes a larger portion of its revenue mix (23% to 50%), this dilutive impact will become more prevalent.

2. Lower volumes – a slowdown in end markets along with high base levels means volume growth should temper. As reflected above, volumes have generally been the primary driver of margin expansion via higher throughput over its fixed manufacturing lines. As volumes slow, margins generally fall.

3. Reinvestment – with the supply-demand relationship normalising, Atlas Copco will likely reinvest more to capture market share. This is already being seen in IT, where margins have fallen from 21.8% to 20.8% in the 2Q24 off the back of higher investments in R&D and digitisation.

4. Currency normalisation – Atlas Copco has benefited from a rising USD (revenue) and weaker Euro (costs). These benefits are subsiding and could become a headwind.

Management and Positioning

The key shareholders are Investor AB (Wallenberg family) with 17% shares on issue and 22% voting power and a range of Swedish financial companies and individuals who together represent 47% of the register. Atlas Copco is very well known and respected locally. It continues to operate like a family business, with long-time majority owners, the Wallenberg Family still heavily involved having 3 members on the Board. Management has largely been stable, although CEO Mats Rahmstrom stepped down in 2023. The group culture is strong, reflected in management tenure.

Valuation

Atlas Copco trades at forward P/E of 28x and EV/EBIT of 22x. The company has seen considerable earnings growth and multiple expansion, leading to high shareholder returns.

Atlas Copco trades at a sector premium due to its leading ROCE, strong margin profile and pricing power.

The 20% premium compared to historical 10-year multiples is challenging in a declining operating environment. My preference is to be buying closer to historical multiples of forward P/E of 25x and EV/EBIT of 20x to provide a margin of safety.

Risks to view

The counter view is that Atlas Copco experiences sustained revenue growth, while margins remain resilient amidst an easing of supply chain inflation and manufacturing efficiencies.

· Demand – end markets such as semiconductors and electric vehicles could inflect and improve the demand for VT and IT respectively. Generative AI could drive the next leg of growth. My estimates already reflect an 11% improvement in orders from 2025 on a high baseline number.

· Resilient margins – could see margins grow beyond historical levels. The company could delay reinvestment and focus on optimising margins. Management has a history of reinvesting, and we are already seeing this being prioritised.

· M&A – an opportunistic acquisition could improve revenue and earnings growth.

Excellent analysis.

Is it time to start a position or is it too early?

I'm undecided between Atlas and Investor AB, which holds a position in Atlas.

Cheers,

Antonio