In today’s environment, investors have a lot think about. Tariffs, recessions, inflation, wars and yield curves - all layered on top of company specific risks. While these issues are relevant, they matter less in the long-term.

What is truly important is getting the business quality and destination right. As Nick Sleep puts it “Destination analysis is consciously central to how we analyse businesses these days. It helps us ask better questions and get to a firm’s DNA” and “the only real, long term risk, is the risk of misanalysing a company's destination.”

Some of the key questions worth asking are:

Will the business be stronger 5-10 years from now?

Is there a long runway for growth?

Does the company exhibit leadership qualities?

Can the balance sheet withstand the inevitable setbacks?

Does the company focus on the customer and innovation?

This report is the first of a two-part series examining Amazon in depth. Part one focuses on its core Ecommerce business — exploring the competitive position, business model, growth runway, and more. If you make it through, I hope you see why for Amazon, it’s still Day 1.

Summary of Topics

History

Management and Culture

Competitive advantages

Revenue segments

Business Model

Competition

Runway

Revenue forecasts

Margins

Valuation

Capital Allocation

Risks

History

Amazon’s origin story is well documented across numerous podcasts and articles. This section will be brief but explain the various key moments and how they have shaped the business to become what it is today.

Jeff Bezos founded Amazon in 1994 after quitting his high profile role at hedge fund D.E. Shaw to pursue what he saw as a once in a generation opportunity. To make the decision, Bezos used the regret minisation framework - projecting himself at 80 and questioning whether he would regret not having tried it. That bold and long-term thinking has become a hallmark of Amazon’s culture.

Books were the natural starting point, a category with low unit costs, universal demand and an almost limitless amount of titles. The firm was originally called Cadabra but quickly rebranded to Amazon, inspired by the vast and powerful South American river.

Amazon officially launched in July 1995 with a selection of 1m titles. By 1996, sales grew to $15.7m and in 1997 $54m, prompting Amazon to raise external funding through an IPO. Having initially bootstrapped the business with capital from family, friends and venture investors, Bezos now had ample resources to accelerate growth.

The company expanded into new product categories including CDs, videos and computer software and launched international operations in the UK and Germany. It also pursued acquisitions in Bookpages, Telebook, Accept.com, IMDB and more. By 1999, revenue had grown 39-fold to $610m (from 1996) while significant reinvestment saw operating losses widen.

Amazon was part of the dot-com boom where internet companies like Pets.com, Boo.com, Webvan, and Kozmo delighted investors with rapid growth and ambitious visions. But when the bubble burst in 2000, capital markets tightened, the Nasdaq fell nearly 80% over two years, and most of these high-flying startups went to zero.

Amazon was nearly one of them. One of the main reasons for its survival was a $672m convertible note raised just before the crash, which provided liquidity to navigate the slowdown in demand. The stock fell >90%, debt ballooned to $2.1b and cash losses increased to $130m. Bezos wrote in the 2000 annual report:

Ouch. It’s been a brutal year for many in the capital markets and certainly for Amazon.com shareholders. As of this writing, our shares are down more than 80% from when I wrote you last year. Nevertheless, by almost any measure, Amazon.com the company is in a stronger position now than at any time in its past.

The experience was formative for Amazon. It instilled a discipline to manage growth within its financial means, prioritise cash generation and maintain a strong balance sheet. In 2001, through significant cost cutting, Amazon reached profitability for the first time and has since self-funded growth through multiple cycles.

From the outset, Amazon set out to disrupt traditional retail by innovating and doing things differently. In 2000, the company introduced marketplace services, a counter-intuitive move allowing third-party sellers (independents) to compete alongside its own products. This was a way of increasing selection.

Bold decision-making and adaptability were also hallmarks of Amazon. In the early 2000s, Costco founder Jim Sinegal met Bezos and articulated a clear strategy to deliver everyday low prices. Not too long later, Amazon cut its prices on books, music and video products by 20-30%.

In 2002, management made another bold move with the introduction of Amazon Web Services (AWS), selling cloud infrastructure to external businesses. The model was unique and disrupted traditional in-house data centres. The offering solved two critical pain points - reducing the time and cost associated with maintaining internal infrastructure while increasing the speed of innovation for developers.

Former AWS CEO Selipsky recalls the rationale for AWS to “build a shared layer of infrastructure services that all these teams can rely on, and none of them have to spend time on general capabilities like storage, compute capabilities, databases.” The initiative was led by now CEO Andy Jassy, launched after 3 years and did not get any competition for the next seven years.

In 2005, Amazon launched Prime, a membership program that initially provided free 2-day shipping and over time expanding into video, music, storage and more. The following year Fulfilment By Amazon (FBA) was introduced, a service where Amazon took control of merchandise for sellers and managed the shipping, refunds, returns and customer service process. This would become a mainstay for sellers and enable same-day shipping via Prime.

Amazon would also expand into new categories such as health care, groceries and pharmacy and into new geographies such as Turkey, Brazil, Mexico, Australia and more. Today, Amazon operates in 21 regions and has become a one-stop destination for any product online.

The company has consistently shown a willingness to innovate and disrupt itself. New products include Kindle (e-book reader), Alexa and Echo (virtual home assistant) and Fire tablets. These innovations along with the other milestones above have underpinned Amazon’s evolution from an online bookstore to one of the most diversified and durable businesses in the world.

Management and Culture

I usually end with this, but given how critical management and culture has been to long-term success, I thought it made sense to bring it up front. As discussed above, the group fosters a culture of innovation where employees are challenged to think differently, act like owners and take long-term views.

The company has a day 1 mentality that prioritises insatiable curiosity and reinvention while resisting complacency. CEO Andy Jassy reinforces this in the 2024 annual report:

We’ve found one of the most important keys to unlock these doors has been a simple question: “Why? “Why does this customer experience have to be this way?” “Why can’t it be better?” “What are the constraints— why must we accept them?” “Why can’t we invent around that?” “Why will it take so long to get to customers?” Why?

He continued:

That’s because Amazon is a Why company. We ask why, and why not, constantly. It helps us deconstruct problems, get to root causes, understand blockers, and unlock doors that might have previously seemed impenetrable. Amazon has an unusually high quotient of this WhyQ (let’s call it “YQ”), and it frames the way we think about everything that we do.

I would encourage you to read the recent annual report here, its a classic.

Amazon has consistently reinvented itself, often at the expense of existing revenue streams. It has also repeatedly disrupted industries and norms while many peers have watched and followed behind. AWS is a clear example.

The company has achieved this by consistently obsessing over customer outcomes. In each meeting room, a seat is left empty for the “customer” to remind employees to always base decisions on their best outcomes.

At the highest level, we’re aiming to be Earth’s most customer-centric company, making customers’ lives better and easier every day…We operate like the world’s largest startup in large part because of our culture of Why. We don’t always get everything right, and we learn and iterate like crazy. But, we’re constantly choosing to prioritize customers, delivery, invention, ownership, speed, scrappiness, curiosity, and building a company that outlasts us all. It remains Day One.

Unlike a lot of companies that grow big, the group has maintained a real high-performance culture that demands excellence and limits bureaucracy. Amazon hires exceptional talent and importantly incentivises them with a low base salary and long-term stock grants with vesting requirements of 5 years. This fosters an owner’s mindset and is important in aligning staff to make bold, long-term decisions that can be loss-making for the first few years.

The management team is experienced and are mostly internal hires that have been with the business for years and can instill its unique culture.

Competitive Advantages

Amazon is widely known as the Ecommerce behemoth with unrivalled scale. This is very true. But why has this been the case and why can it persist for the coming decades?

It all begins with the DNA and culture - customer obsession and delivering the best value proposition. The following is from the 1999 annual report:

Amazon.com seeks to be the world's most customer-centric company where customers can find and discover anything they may want to buy online.

To achieve this mission, Amazon has needed to build scale. Bezos notes:

Market leadership can translate directly to higher revenue, higher profitability, greater capital velocity, and correspondingly stronger returns on invested capital. Our decisions have consistently reflected this focus.

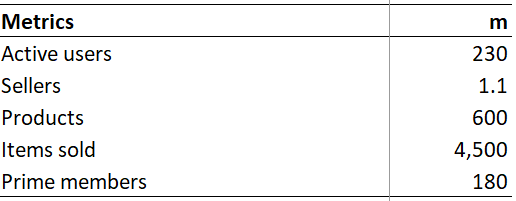

Thus, Amazon prioritised market share gains ahead of near-term profit margins. The result being a dominant market position today where in the US, the company has ~230m active users, serves 90% of the adult population and >80% of households on Prime. Amazon has the largest audience of online shoppers and is the 4th most visited website behind only Google, YouTube and Facebook.

The marketplace also has scale. In the US, there are >1.1m active sellers that offer >600m products across various categories.

As Amazon achieved leadership across both buyers and sellers, it drove what is called a two-sided network effect. Consumers gravitate to the platform with the widest selection, while sellers go to where there is the most traffic and potential customers. This created virtuous cycle that tends to strengthen the leader while peers find it difficult to catch up. The number one player tends to generate the majority of the economics.

The dominance today is not just a function of scale and network effects, but also a maniacal focus to return scale efficiencies back to consumers via lower prices, faster speeds and broader selection. This strategy has been integral to extend its moat, drive greater adoption and increase the barriers to entry.

Amazon could have chosen to reap the benefits of scale. However, Bezos has long warned against the perils of complacency (staying stagnant) and highlights the importance of continuous reinvention:

You can be two years ahead of your competitors and if you stop investing, you're going to fall behind in two years. A big piece of the value we provide to customers is invention. We're willing to plant seeds, let them grow—and we're very stubborn. We say we're stubborn on vision and flexible on details.

In the world of retail, competition is intense, consumer trends change quickly and switching occurs based on a bad experience or better alternative. Failed retailers of the past include Sears, Montgomery Wards, Toys R Us, JC Penney and A&P. The latter is featured internally at Amazon as a cautionary tale, a dominant grocer that fell victim to regulation and where its competitive position eroded over time.

So why would Amazon not end up like the retail giants before them?

The answer is it can. But unlikely.

Outright leadership is one aspect. But what truly sets it apart is this scaled economies shared approach that drives relentless innovation to improve the customer value proposition. Brad Stone notes:

Years ago, he [Bezos] had learned that there were no annuities in retail. Customers were fickle and could change their loyalties at the moment they were presented with a better offer elsewhere. Amazon could only stay ahead of rivals if it kept inventing new technologies and improving levels of service.

Bezos also put it simply in his Amazon's 2008 annual letter by inverting:

It is difficult for us to imagine that ten years from now, customers will want higher prices, less selection, or slower delivery.

I will break down below how Amazon can stay ahead in the three key areas of price, convenience and scale.

Price

The key to a consumers wallet is to offer everyday low prices. Successful retailers like Walmart and Costco used this approach to great success - and now Amazon too.

Amazon benefited from a structural advantage in its early days leveraging a sales tax exemption for companies without a physical presence across certain states. This enabled the group to undercut traditional competitors and provide a strong incentive for consumers to shop online. The loophole was closed in 2012, thereby levelling the playing field.

Despite this, Amazon has continued to maintain low, competitive pricing. CEO Andy Jassy highlighted in the 1Q25 earnings call:

Customers continue to want Amazon to be the place they rely on for sharp pricing. In the fourth quarter, consumers saved more than $15 billion with our low everyday prices and record-setting events... Additionally, Profitero's annual pricing study found that entering the holiday season, Amazon had the lowest online prices for the eighth year in a row, averaging 14% lower prices on average than other leading retailers in the US.

Amazon is estimated to be even cheaper than Walmart.

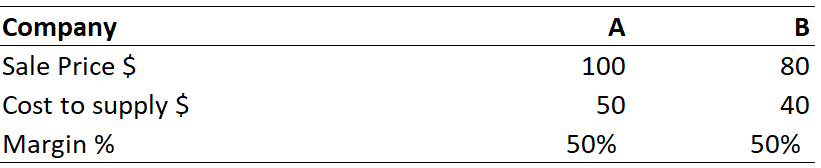

Amazon can sustain low prices due to scale economies and a low cost to serve. To explain, if cost to serve is lower, a business can sell the same product at a lower price than peers and maintain healthy margins. See below.

Ecommerce is a scale driven business. Cost to serve improves as unit volumes increase over a high fixed cost base. Amazon notes:

We strive to improve our operating efficiencies and to leverage our fixed costs so that we can afford to pass along these savings to our customers in the form of lower prices.

The model has required Amazon to forward build a significant logistics network of warehouses and fulfilment centres and develop a personalised platform that can support customers. As more volumes flow over these fixed investments, the cost to serve per unit falls, allowing the company to reduce prices while maintaining or even improving margins.

Variable costs generally change directly with sales volume, while fixed costs generally increase depending on the timing of capacity needs, geographic expansion, category expansion, and other factors...To minimize growth in fixed costs, we seek to improve process efficiencies and maintain a lean culture.

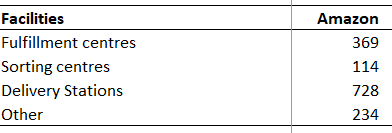

In the US, Amazon has the lowest cost to serve for the below reasons:

Scale across Gross Merchandise Value (GMV) of $500b, representing 40% market share and more sales than the next 15 largest US online retail firms combined.

Large infrastructure network of 369 fulfilment centres, 728 delivery stations and 348 other facilities.

Decades of know-how operating a complex logistics network.

Technology led operations increasingly using advanced automation and robotics.

There is a long runway to bring down cost to serve, become more efficient and reduce prices. Jassy explains:

We also remain squarely focused on cost to serve in our fulfillment network, which has been a meaningful driver of our increased operating income. We've talked about the regionalization of our US network. We've also recently rolled out our redesigned US inbound network. While still in its early stages, our inbound efforts have improved our placement of inventory so that even more items are closer to end customers.

Low pricing is thus sustainable. For consumers, this has created a high degree of trust and loyalty - knowing that Amazon will consistently offer the best value.

Selection

Offering the broadest selection helps meet diverse customer needs and maximises choice. While a core set of products usually satisfies the majority, having a long tail of niche items attracts the incremental shopper.

Amazon’s decision to integrate 3P sellers alongside 1P saw an unprecedented rise in products available. This has led to:

3P sellers contributing >60% of units sales and 80% of products.

>600m stock keeping units (SKUs) vs nearest peer Walmart at 400m SKUs.

Why does selection continue to grow?

Amazon benefits from a two-sided network effect driving more sellers to its platform. Having the largest audience is critical for sellers to increase sales and gain exposure. The average seller makes >$250k in sales and the top 10k sellers made >$1m. Sellers take advantage of a highly automated platform and managed service enabling them to focus on the product and brand.

A large audience is one thing but it also needs to make financial sense. Sellers are charged referral, fulfilment and other fees which can reach 50% of the product value. While these fees are slightly ahead of Walmart’s, Amazon compensates by delivering greater volumes and overall profitability for sellers. The most recent quarter saw more notable names join the platform.

We welcomed well-known brands such as Ara Rings, Michael Kors and The Ordinary as well as a new shopping experience with Saks that offers a refined luxury assortment of fashion and beauty items from brands like Dolce & Gabbana, Balmain, ERDEM, Giambattista Valli and Jason Wu collection.

With the most sellers and a reinvestment mindset, Amazon should continue to maintain the broadest selection.

Convenience

Convenience, a reflection of speed, has become Amazon’s most significant competitive edge. The relentless pursuit for super fast deliveries has reduced consumer friction while also providing an effective marketing tool.

Amazon has spent almost three decades developing a large and sophisticated last-mile logistics network. My estimates imply Amazon has spent >$250b in capex to develop this network. The group is solving a massive logistics challenge which has taken decades of experimentation, iteration and capital to scale effectively.

The speed advantage is considerable in the US with Walmart’s standard shipping taking 3-5 business days and 2-day free shipping only available across a select number of items. This compares with Amazon:

300m products with free same-day or next-day shipping vs 1m in 2005

Shipped >5b items same or next day globally

The company is not stopping there driving more innovation via the expansion into air hubs, regional sortation centres and last mile delivery facilities which allows Amazon to reach more customers faster. While its network leverages advanced AI algorithms to predict product demand and improve inventory placement. CEO Jassy notes:

And I think that if you look at what we're doing with Prime Air, the promise there is for a number of items that we'll be able to deliver items to customers inside an hour. And I think, when you're ordering everyday essentials where you need something more quickly, it's a big deal. And you see it, it's had impact on our everyday essentials. It's had a big impact on our pharmacy business, where people are able to get items same day now in lots of cities throughout the US. And they're just using us much more frequently than they had before.

The engine is simple, drive efficiencies and consistently reinvest scale back into the network. The barriers are high, with new entrants requiring considerable time, effort and investment to potentially earn low-single digit margins.

Loyalty

By offering the lowest prices, fastest delivery and unmatched selection, customers are already likely to continue shopping on Amazon. The below illustrates the flywheel effect that drives repeatability and growth.

Amazon has gone one step further and replicated the membership playbook at Costco with Amazon Prime. For an annual fee of $139, consumers get free same or next day delivery, video and music streaming, storage, gaming and other benefits.

Prime has driven significant customer loyalty and repeat purchases. The Consumer Intelligence Research Report suggests members spend 133% more than non-members annually. Amazon’s internal analysis implies that when a customer joins Prime,

There is a causal and substantial increase to a customer’s annual spend with Amazon —buying more frequently and across a broader set of categories.

Costco co-founder Jim Sinegal describes the power of the membership model:

“The membership fee is a one-time pain, but it's reinforced every time customers walk in and see forty-seven-inch televisions that are two hundred dollars less than anyplace else. It reinforces the value of the concept.”

By having the best value proposition along with a membership model, customers are inclined to shop more at Amazon every year. It has meant that customer willingness to buy and switching costs are both high.

Summary using Helmer’s 7 Powers

Amazon has a combination of competitive advantages that bring market power.

Scale - across GMV, customer penetration, sellers and infrastructure.

Network effects - more buyers → more sellers → more selection → more buyers

Counter positioning - disrupting traditional brick and mortar retailers with an online model that has fast-delivery, low prices and a broader selection. Legacy players find it hard to mimic as Ecommerce requires a different capability.

Process power - highly automated systems across logistics enabling fast and efficient delivery. Also layering AI and data across its platform to enhance the customer and seller experience.

Switching costs - strong value proposition along with Prime drives repeatability.

Brand - Kantar ranks Amazon as the world’s 4th most valuable brand.

Cornered Resource – long-term orientated and high-performance culture creates an owner’s mindset that enables innovation. Incentives encourages this by rewarding employees with long-term stock grants that vest over 5 years or more.

These competitive advantages along with a culture of reinvestment positions Amazon to further widen its moat.

Revenue Segments

Amazon is a global technology powerhouse with a range of revenue segments.

Online Stores - First-party (1P)

The 1P business is where the journey began. Amazon acts as the retailer, purchasing inventory directly from vendors and selling it to customers via its platform. The group assumes inventory risk and manages the listing, marketing and fulfilment process.

Despite contributing only 38% of unit sales, the 1P segment remains the largest contributor of revenue, due to it being recognised on a gross merchandise value (GMV) basis. The result is lower margins - gross margins range from 20-30% and operating margins in the low-single digits.

Over time, 1P has expanded into private label brands, new product categories and devices. Revenue growth has compounded in the high-single digits and benefits from higher volumes, inflation and the continued shift to Ecommerce.

Third-party Seller Services (3P)

Represents the sale of goods by external third-party sellers on Amazon’s marketplace. The seller program serves individuals, small businesses, and large branded businesses and enables them to compete alongside Amazon’s 1P products. 3P sellers deliver the majority of unit sales, representing >80% of products and 62% of units sold on Amazon.

Revenue is derived from sales commissions (referral fees), fixed fees, fulfilment services and other charges. Because Amazon acts as a platform rather than a retailer in this model, sales are not recognised on a GMV basis, with revenue per unit thus lower. This results in higher gross and operating margins, although Amazon notes 3P is not as profitable from an absolute basis than 1P.

3P has grown rapidly since 2014 driven by an increasing seller base, fee uplifts and higher volumes.

Fees have largely grown to offset inflation from 2021. The below provides an estimate of fulfilment fees for an 8 ounce package since 2014.

Physical Stores

Amazon’s physical stores consists of Whole Foods, Amazon Fresh, Amazon Go and various other branded stores. The segment is a work in progress as Amazon invests to enhance the physical experience by experimenting with Just Walk Out technology and new store layouts.

Since 2019, Physical Stores revenue has grown at 4% per annum, lagging group revenue growth. Margins are likely low as well.

Subscription Services

Includes revenue from Amazon Prime and Grocery membership. The substantial value offered relative to the low subscription cost drives high retention and untapped pricing power. Amazon has only raised subscription prices three times in the US. See below.

Subscription services is a $44b segment with the key driver being new subscriptions and pricing. The segment has compounded at 18% since 2019.

Prime is adopted by 85% of US households while International penetration is much lower. New user subscriptions should come from International regions. While the new grocery membership in the US should also drive growth there.

Given the costs associated, the segment has been a loss-leader driving greater uptake in the core retail and advertising segments. By way of example, Prime Video and Music had an estimated spend of $19b in 2023, higher than Netflix. While the additional costs to bring same-day and next-day delivery are notable.

With scale, the segment could be profitable on a standalone basis. Netflix became FCF profitable in 2020 after $25b of revenue. While Spotify showed higher profitability coming off $16b of revenue in 2024. It is clear that once subcription companies reach a certain size, the incremental costs to grow are low and margins tend to inflect higher. CEO Jassy validated this with the below comments:

We have increasing conviction that Prime Video can be a large and profitable business on its own.

Advertising Services

Advertising Services is a newer segment - first broken out in 2021. Having only started building in-house advertising technology and services around 2012, Amazon has seen remarkable growth. It is now the 4th largest revenue contributor and likely 2nd biggest profit generator. See below.

Monetisation primarily comes through Sponsored ads, where customers can promote their products and brands across Amazon’s platform. The service has expanded to Display, Stores and TV & streaming, enabling customers to reach target audiences via a multi-channel approach.

Amazon benefits from a wealth of customer data across first (internal) to third-party (external) which has become increasingly valuable following platform data privacy changes. This data helps advertisers optimise campaigns across the customer journey, from awareness to purchase and beyond. Brands can leverage more capabilities with Amazon as noted by CEO Jassy:

Full funnel is from the top of the funnel with broad reach advertising that drives brand awareness to mid-funnel responsive brands that companies specify certain keywords and audiences to attract people to their detailed pages or brand store on Amazon, to bottom of the funnel, where Sponsored Products help advertisers service relevant product ads to customers at the point of purchase. We make this easy for brands to sign up for and deploy across our growing advertising.

The advertising model transitioned from direct sales to an auction-based system where sellers bid for advertising placements. Sponsored Products, Sponsored Brands, and Display ads operate on a cost-per-click model, where advertisers pay when customers engage with the ad.

Amazon has substantially increased the number of placements and supply of impressions on its website. The company has also expanded the products offered to include streaming ads across music and video which has contributed to recent growth. There are multiple drivers of growth.

I will delve deeper into the advertising, Ecommerce and subscription opportunity later.

Business Model

Amazon is an incredibly complex business with multiple layers of growth. While I will try to provide an overview, it’s important to note that certain details will inevitably be overlooked as this is an outsider’s perspective.

At its core, Amazon operates two primary business models: 1P and 3P. For 1P, Amazon purchases goods from wholesalers, sells them within 15-20 days and collects customer payment instantly. The group does not need to pay suppliers until around 50 days, which leads to what is called a negative working capital model. Amazon has used the additional cash on hand to fund growth.

For 3P, Amazon provides a platform and services for sellers as a percentage of GMV. Amazon will keep its share and make payment to sellers every 14 business days. This means 3P is also a negative working capital model with the added benefit that they do not take any inventory risk - effectively acting as the middle-man and logistics provider. Cash flow generation and working capital is thus highly favourable for Amazon.

Moving on to costs, online selling is theoretically a more cost effective model as it alleviates the high expenses associated with operating stores including rent, utilities, people and inventory management. In addition, Ecommerce operators are able to build infrastructure in lower priced areas and operate one online platform readily available to its entire consumer and supplier base.

The below provides an illustration of what the cost structures can look like selling a $150 pair of jeans (assuming identical sourcing and marketing costs). Operating margins for Ecommerce are 30% vs retail 15%.

Amazon explains the model which involves high upfront costs and scale benefits over time:

Since many of our costs, such as software engineering, are relatively fixed and many of our variable costs can also be better managed at larger scale, driving more volume through our cost structure reduces those costs as a percentage of sales.

The high fixed costs and scale needed is why there are only a few Ecommerce players across many regions and only a few winners. For instance:

South Korea: duopoly with Coupang and Naver

China: oligopoly with Alibaba, JD.com and Pinduoduo

US: duopoly with Amazon and Walmart

It is difficult for medium sized operators or single category players to succeed.

So why has Amazon had such low margins for so long?

At Amazon, there is actually a maniacal focus on costs and efficiency with management embodying the core values of humility and frugality. Cost to serve should be lower than peers.

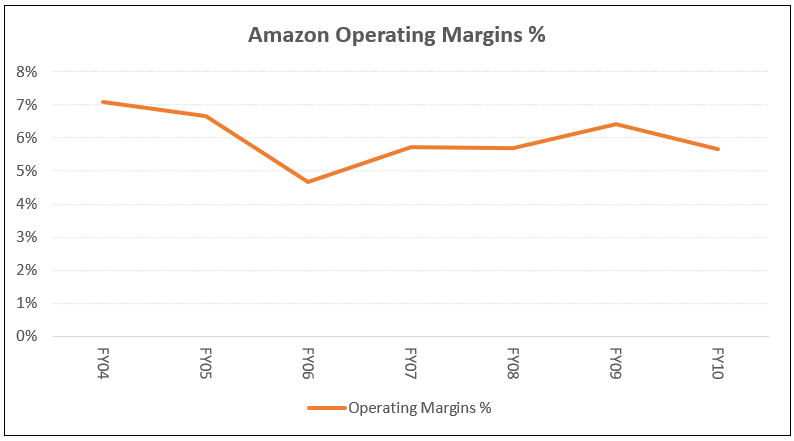

Furthermore, what may surprise some is that from the early 2000s, Amazon had reasonable operating margins of 5-7%. The business was largely Ecommerce and despite lower pricing, still delivered higher profit margins than peers. Traditional retailers had operating margins closer to 3-5%, with Walmart around 5%.

Yet long-term reinvestment has masked its true profitability. From 2011, Amazon started aggressively building its own logistics network and reducing reliance on third party logistics providers. This required significant upfront investment but was always the better long-term play.

The below graphs show the ramp in property, plant and equipment across NA and International. Note, 2020 and 2021 were significant capex years.

The result was a ramp in D&A and start-up costs associated with operating the infrastructure network. These investments are upfront and fixed, meaning there was an immediate impacts on margins while the benefits would come later as volumes scaled.

Further reinvestment across other areas included:

Prime Video and Music - $19b investment in FY23

Same-day and next-day delivery

Additional Prime features ie Storage, Twitch

Devices - Kindle, Fire TV and tablets, Echo & Alexa

3P Sellers - initially cannabalised the 1P business and was unprofitable

Project Kuiper - initiative to increase global broadband access

Ultimately, the customer has been the clear beneficiary. Millions of products are available at low prices, delivered same or next day, supported by a frictionless returns system and responsive customer service. Devices like Alexa and the recently launched AI assistant Rufus further enhance the experience, while Prime bundles a wide array of value into a single membership.

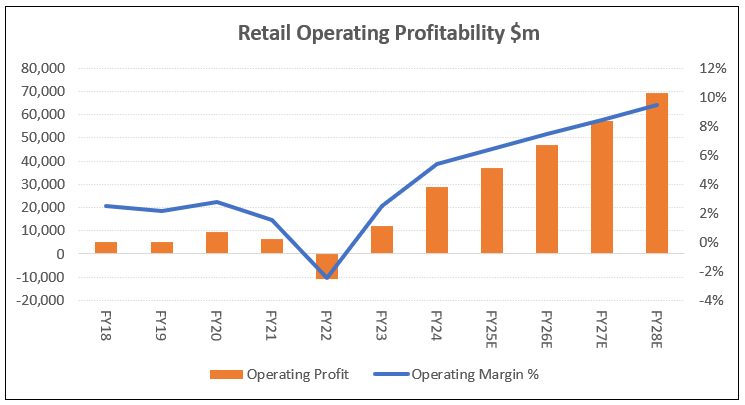

This consistent reinvestment has driven strong revenue growth but also kept NA operating margins below their FY04 peak. As the chart below shows, margins have historically been volatile, reflecting cycles of reinvestment and other variables, but more recently there has been a marked improvement.

Amazon is likely past peak infrastructure build so as volumes increase and revenue scales, the company should finally see the higher margins associated with Ecommerce come through.

Each of the previous goals I’ve outlined contribute to our long-standing objective of building the best, most profitable, highest return on capital, long-term franchise.

Competition

I have so far explained how Amazon has leveraged its leadership and strategy to retain a loyal customer base. This section will explore the main threats to Amazon’s dominance.

In the US, Amazon has GMV of around $500b, representing 10% of total adjusted retail sales. The landscape is quite fragmented. The largest comparable peers are Walmart, Costco and Target while Kroger, CVS and Walgreens play in grocery and pharmacy.

The Ecommerce market is estimated to be worth $1.2t or around 23% of total adjusted retail sales. There has been an consistent shift to Ecommerce as seen below.

Amazon is the outright Ecommerce market leader with >40% market share, while its nearest peers are Walmart at 8% and Target at 3%. The remaining competitive set is quite fragmented as seen below.

Amazon’s peers are much smaller and predominantly legacy retailers transitioning to Ecommerce. Amazon has a distinct advantage here as a pure play that does not operate any legacy stores. The company has accumulated years of know how - having scaled Ecommerce over decades, which cannot be replicated overnight. In addition, the company is technology led. I will explore the main competitive threats below.

Walmart

Walmart is Amazon’s closest peer in the US. The company has a significant footprint of 4,700 Walmart and 800 Sam’s Club stores and has 90% of the population living within tens miles of a store. Not too dissimilar to Amazon the focus is on delivering everyday low prices and convenience.

Walmart really started to make its stamp in Ecommerce in 2013 building out dedicated infrastructure and then purchasing Jet.com, an Ecommerce platform for $3.3b in 2016. The business continues to transition into an omnichannel player, and has now consolidated all activities onto the one platform.

Ecommerce began as a 1P business mainly providing pick up, but has now expanded into 3P while operating a broader logistics network with 34 dedicated fulfilment centres. The launch of its own membership service Walmart+ has seen 59m members shop more frequently and in higher amounts. The strategy is working with the CEO noting:

The e-commerce opportunity for us is growing at 20 percent year-on-year consistent. We’re just seeing a lot more customers that are coming to us in a manner that they haven’t historically, where maybe historically we were more of a brick-and-mortar business.

Walmart has some advantages over Amazon:

Omnichannel offering with in-store, pick up and delivery options.

Range of in-store services ie auto care (oil changes), pet services (vet care), and pharmacy (vaccines).

Loyal existing customer base.

Store network that enables fast fulfilment - offers one or three hour same day grocery delivery at a fee of $5 and $10 respectively. There is high demand for this which Amazon has not matched. The company notes:

Our coverage of US households with same-day delivery has grown by 22% over the last two years. We reach 93% of US households today, and are still expanding. Whether it's being delivered from a store, a club, or a fulfillment center, or whether it arrives on the ground or through the air with a drone, we're getting things to people faster.

While Walmart is investing in two sets of infrastructure, it has managed to achieve profitability due to higher margin revenue from advertising, data, fintech and membership, supplementing the low margin delivery business.

Walmart aims to grow revenue at 4% and operating earnings at 6%. The company has historically delivered a 4.8% 10-year revenue CAGR with the growth coming from Ecommerce and other new revenue streams. Excluding higher growth segments, Walmart’s core US business is growing below market at around 3% annually.

This points to a large portion of Ecommerce volumes coming from existing customers shifting spend online rather than share gains from peers. The trend is expected to continue with Ecommerce accounting for 60% of sales growth over the next five-years while growth in the core business stagnates.

The below also shows customers have wanted to shop in different ways. Walmart has benefited, with just under 50% of the Ecommerce volumes being pick-up.

Walmart also remains a grocery business with the category contributing 60% of total US sales. The company has 29% share of the $183b online grocery market which translates into $53b or roughly 59% of its Ecommerce sales. Walmart is the number one player, with Amazon the number two.

The company has done very well transitioning customers to online grocery. The business has a large store presence that gives it the advantage of offering customers 1-3 hour delivery windows at an additional cost.

Amazon has its own grocery subscription service at $10 per month offering unlimited grocery delivery on orders >$35. The company operates Fresh, focused on lower prices and Whole Foods catering to products that are local and organic and are sold at a higher price. The latter was a $13.7b acquisition where Amazon has since embedded checkout technology and lowered prices.

Walmart probably has the better offering and its quick delivery is resonating with customers. Insider Intelligence has estimated Amazon’s share of online grocery to have fallen while Walmart is gaining with 26.9% share in 2024. Amazon has yet to crack grocery, but it has really only been doing it since 2017. It will be a battle between these two giants while smaller competitors such as Kroger and Target lose ground.

Walmart’s remaining Ecommerce revenue comes from other categories sold via 1P and 3P. The latter has been the fastest growing area as seller presence increases across Walmart’s marketplace. The company has replaced eBay as the second most important channel, growing sellers by 50% to over 150k in the most recent year. Walmart is growing revenue across general merchandise in categories such as sporting goods, kids apparel at above 20%.

Sellers can access a different customer base via Walmart and diversify interest away from Amazon. In addition, the total fees charged are lower, with Walmart noting fees are around 15% below market. I have validated this using Amazon and Walmart fee estimators.

The unit economics may seem favourable, however, selling on Walmart can lead to issues around fake returns, incorrect chargebacks and commissions. Overall profitability for sellers is generally higher on Amazon due to greater volumes. For consumers the lower selection and slower delivery times also makes it less attractive.

3P is now five years old, is coming off a low base and has room to grow. While Walmart is gaining share, evidence suggests it is mainly coming from existing in-store customers. While online grocery leverages stores, fulfilment of general merchandise for 3P is a challenge and requires dedicated infrastructure build.

Amazon has the advantage over Walmart as the incumbent player with scale and focus. The advantages in speed and cost to serve can support fast delivery and consistently low prices. The company is also 5x larger in Ecommerce. As Amazon grows faster and increases its scale advantages, the value proposition should expand, especially in grocery.

It is difficult to see Walmart competing against a pure-play like Amazon with scale, know how, innovation, technology and IP. The continued integration of generative AI and robotics into its operations should enable them to extend its differentiation.

Temu and other Chinese drop-ship players

The most notable threat comes from the Chinese drop-ship players, primarily Temu owned by PinDuoDuo. Other companies include Alibaba, Shein and Tiktok. These players sell directly from manufacturers in China to consumers, removing the need for a middle-man distributor (independent seller) and bringing down prices.

The strategy has been very aggressive, with significant marketing investments and ultra low prices on comparable goods - up to 80% lower than Amazon. The drop-ship players also capitalised on the de minimis rule which allowed items <$800 to enter the US duty free.

Temu has attracted the value conscious consumer, metrics include; average selling price of $7, 5 items per order and average order values of $35. Global GMV has increased from $18b in 2023 to $51b in 2024, quite remarkable. The main categories include clothing, accessories and shoes.

Temu has the inherent advantage of being China owned and having semi-managed logistics that can integrate into local seller systems. This reduces delivery times. It is estimated more than 60% of Amazon’s China top sellers are on Temu.

Amazon has long understood the risk from a trip to China years ago as detailed by Brad Stone:

Factories across China were going straight to shoppers online, bypassing traditional stores, and providing great value for consumers. In other words, massive disruption was coming to retail, despite the problems of fraud, counterfeits and low-quality items. “It was unbelievable what we saw,” Faricy said. “We realized that people charging ten to fifty times what products actually cost to make, based on a brand name, wasn’t going to last and consumers would be the winners.”

In the US, Amazon has now launched its own low cost platform for items under $20 called Haul. The company has the advantage of an efficient localised returns process, a strong brand and a trustworthy screening process that protects shoppers from lower quality goods. Prices are competitive but slightly higher than Temu.

Temu also continues to operate at a loss as it invests to build global scale and brand recognition. The recent decision by the US to remove the de minimis tax loophole brings questions into the profitability and economics of the model. Other regions are also considering new tax policies to drive up import costs for Chinese exporters. Temu will likely need to raise prices.

Temu is also unlikely to have an impact on essential items where speed is required. This represents around 1/3 of purchases.

Overall, Temu is undoubtedly Amazon’s largest threat. Amazon is wary of this, continues to invest and its Haul offering shows intent to take on these players head to head. As Temu seeks to transition to profitability and increase prices, the competitive threat is weakening. The removal of the de minimis rule and Trump tariffs should also create short-term headwinds.

Shopify

Shopify is a platform provider for independent merchants and brands who wish to sell directly to consumers. These merchants can set up individual branded online stores to either bypass or complement their Amazon storefront.

Shopify has US GMV of $166b, or around 14% Ecommerce market share and is gaining share. The offering resonates with merchants who are increasingly seeking to build brands with direct customer relationships. The unit economics are generally better if merchants can generate enough sales.

The two players provide different value propositions and don’t really compete directly. Amazon is a marketplace that enables merchants to reach a large audience of 200m+ monthly visitors. The substantial marketing, brand power and scaled fulfilment network means merchants can focus on just getting the product and brand right. While Shopify offers more control, sellers need to organise the marketing, logistics and general operations themselves.

There is room for both players to succeed and often successful sellers will have a foot in both camps. Shopify has also integrated Amazon’s Buy with Prime feature to help sellers consolidate fulfilment.

Summary of Competitive Intensity

To summarise, Amazon is dominant. The largest peer, Walmart is getting better but is still well behind in terms of market share and fulfilment capabilities. Temu is one to watch but faces various challenges, targets low-cost categories, and is trying to reach profitability. The overall competitive intensity is moderate.

There will always be new threats that come up. But what keeps me comfortable is a combination of scale and a day 1 culture that continuously improves the customer value proposition. For new entrants, there are significant barriers to overcome, primarily the billions in infrastructure investment needed. As the only pure play, technology led Ecommerce player in the US, it is difficult to see Amazon’s dominance eroding.

Is the company gaining share?

In the US, Amazon is the clear market leader in an attractive industry growing at high-single digits. Despite competitive threats emerging, the company has gained share since 2020.

Share has mainly come from eBay, while Walmart has also grown share.

Runway

I will assess the runway opportunity in Ecommerce, Advertising and Subscription.

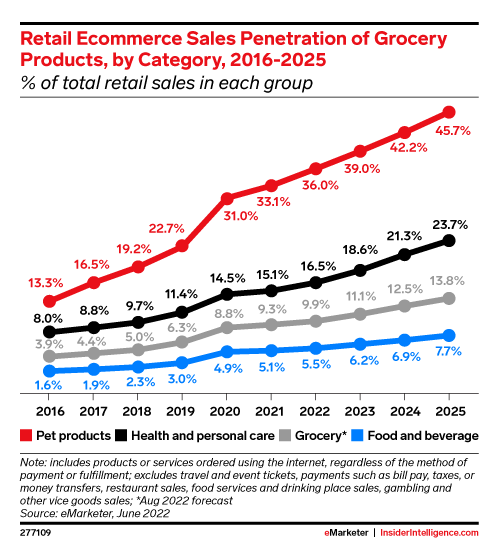

In the US, Ecommerce penetration sits at around 23% of adjusted retail sales. According to eMarketer, the more penetrated categories include general merchandise, apparel, furniture and home and computer and consumer electronics. See below.

Lower penetrated categories include groceries and health and personal care. These are understandably the faster growing segments.

Although some investors have pointed to investments in grocery being a capital allocation misstep, I believe the decision is prudent.

Grocery is a $1.6t category making up 31% of adjusted retail sales. It’s where consumers transact most frequently and spend the most time. To win in retail, grocery needs to be a success. Take the case of Walmart. The company actually started in the 1960s not selling groceries, but turned into the juggernaut today by investing and largely winning in grocery.

Amazon’s aspiration is to be able to deliver groceries, general merchandise, prescriptions and more in a few hours. What this can achieve is a more loyal customer base that will spend more per shop.

Doug Herrington, current CEO of Amazon Worldwide Stores was the leading advocate of the push into grocery. Brad Stone explains the rationale well,

If Amazon’s retail business was going to grow to $400 billion in gross merchanise sales, it needed to transform a model based on infrequent shopping for relatively high-priced goods to more regular shopping for low-priced essentials. In other words, if the company was going to join the ranks of the biggest retailers, the S-team had to figure out a way to profitably sell supermarket items. If they didn’t, Amazon was going to be vulnerable to rivals who already enjoyed the shopping frequency and cost advantages of the grocery model.

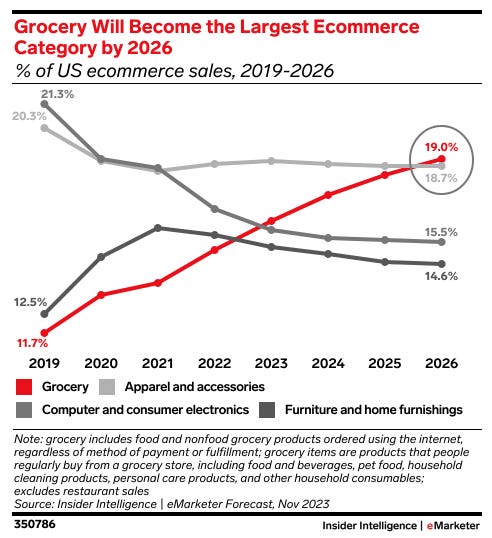

To be the dominant retailer for decades to come, Amazon needed to enter grocery. The segment is growing very quickly as seen below.

The overall runway is still significant, with Amazon well positioned in underpenetrated categories such as grocery and health and personal care. As the business reduces friction and creates innovative experiences, more consumers should be incentivised to shop online. I will explain why below.

Where can Ecommerce penetration get to?

As evidenced from the dynamics during COVID, people still enjoy the experience of going into stores and browsing. There will likely always be a role for in-store retail experiences. The question is how much more will consumers shift spend online, especially if friction continues to reduce.

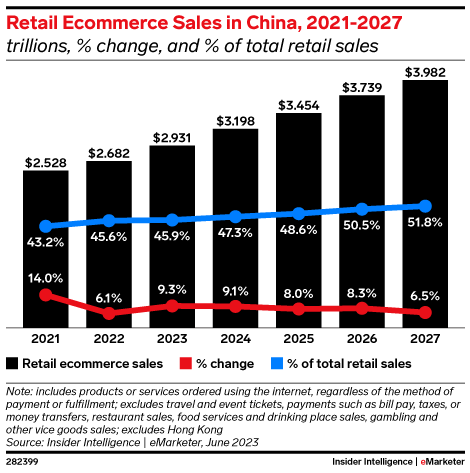

China as the most penetrated Ecommerce region can provide a barometer for this, even though it is still growing and getting better. Ecommerce represents 37% of sales (according to HSBC) translating into $350b GMV in 2023. eMarketer suggests this number is closer to 47%.

The country has some clear structural differences such as high urbanisation rates (67%) and a digital first shopping culture. This has enabled couriers to deliver hundreds of packages to single buildings and thereby reduce delivery costs. In the US, delivery costs average $5-$15 while China is 2-2.5 renminbi (US$0.31).

Intense competition between the top 3 players has further driven innovation and reduced costs for consumers. As more consumers shop online, it drives a flywheel of greater investment that reduces friction and attracts more consumers. The experience is now highly accessible, convenient, personal and cheap.

Practically speaking, if someone can order something online in seconds and get it delivered in an hour at the same price, then why not save the time and effort of going into a store. China has made it extremely easy to do this. It is difficult to see the same level of ease in the US given the low population density.

However, I think the Ecommerce experience will get markedly better and adoption will continue to trend higher. The US can probably get to 40% levels with plenty of runway before it gets there.

The trend over the past few years has seen penetration grow at around 1% annually. My estimates have penetration increasing at 0.75%, translating into market growth of 7% vs 4% overall retail sales. Amazon can grow slightly above market.

Advertising

The digital advertising industry is highly attractive. There is an underlying shift from traditional media channels such as newspapers, radio and TV to newer areas of social media and streaming platforms. Digital ad penetration by region is shown below.

The top 5 platforms are Google, Meta, ByteDance (Tiktok), Amazon and Alibaba who own half the global ad market. The industry grows at high-single digits to low double-digits. Amazon is gaining share and has grown revenue >20% over the last 3 years.

This growth has been driven by Sponsored Ads, which allow sellers and brands to leverage Amazon’s unique data insights to reach a large, targeted audience and deliver ROI. For sellers to differentiate in a crowded marketplace, getting products in front of customers is the most effective way to drive sales and outperform competitors. Sellers are therefore inclined to use advertising to grow.

Amazon is now effectively monetising this demand, turning its high-traffic platform into a powerful advertising engine.

Amazon ads also differentiates via a broad channel mix of audio, display, online video, streaming and physical store ads - allowing brands to reach relevant audiences across all domains and and unlock deeper audience insights. According to Forrester:

Amazon Ads offers a full-funnel DSP solution “with high-yielding inventory and a verifiable revenue impact,” according to the vendor profile. Amazon Ads is also noted for “differentiating its vision and innovation for AI-driven decision-making based on a variety of uniquely strong signals.”

My estimates have >70% advertising revenue coming from NA with market share around 14%. Amazon has a clear runway to grow ads in International with greater scale and more monetisation of sponsored ads and brands.

I think Amazon continues to gain share from the likes of Google and smaller players such as Snapchat. The digital ad market can grow around 10%, with Amazon increasing revenue at 15-17% over the next 4 years. This is achievable given the low base and multiple drivers for growth such as driving more placements and impressions and new channels such as Prime Video.

Subscription Services

Subscriptions Services can achieve sustainable revenue growth due to its high retention levels and pricing power. Research Firm ContiMod implies:

Amazon Prime members have a 93% retention rate after one year and a 98% retention rate after two years.

Future growth is dependent on:

Pricing - Amazon has historically raised prices every 3-4 years.

Volumes - growing the number of subscriptions. The US has been a big driver but with 85% household penetration, future growth should come from International where penetration is considerably lower. Prime was launched later and the proposition continues to evolve with scale.

The runway remains significant particularly in International. Subscription services has grown at 12% over the last three years. My forecasts have growth slowing to high-single digits over the next four years.

International

The opportunity to grow in International markets is more profound. The below graph highlights this and shows that Germany is the only nation where both market share and penetration is higher than the US.

According to Shopify, the runway is more significant in International regions than NA.

Amazon’s annual report shows the largest regions ex US being Germany, the UK and Japan. Note, this includes AWS revenue.

Amazon has dominant positions in Germany, the UK and France. However, competition is stronger in regions such as Japan, India, and Latin America, where Amazon has yet to establish clear leadership. The competitive position is less prevalent and its reflected in NA revenue delivering a 22% 10-year CAGR vs International at 16%.

Despite a weaker competitive position internationally, Amazon has significant growth potential in these underpenetrated markets. It can leverage its proven US playbook and proprietary tech (generative AI and robotics) and bring this to international markets. My forecasts assume International grows slightly faster than NA over the medium term.

Revenue Forecasts

To put this altogether, I expect both NA and International segment revenue to grow at high-single digits, supported by the higher mix of faster-growing Advertising and Subscription revenue. My forecasts are similar to consensus numbers and are probably somewhat conservative.

What happens to margins?

Amazon is at a point where a combination of lower cost to serve and a mix-shift to higher margin revenue enables operating margins to inflect higher. The company can achieve this while continuing to reinvest.

There has been an increased focus on cost to serve with initiatives such as the regionalisation of fulfilment centres, increased same-day deliveries, automation (robotics) and scale all contributing to success. Robotics is a key area and has shown the ability to reduce processing times by up to 25% and increase the frequency of same-day delivery items.

CEO Jassy has further taken steps to improve efficiency by winding down loss-making projects, laying off thousands of workers, and eliminating middle management to reduce bureaucracy. As a result, Amazon has achieved a second consecutive year of lower cost to serve per unit, leading to faster and more efficient deliveries.

Importantly, there is ample runway to continue lowering cost to serve. CFO Brian Olsavsky highlights this:

Looking ahead, we have several opportunities to keep lowering our costs through even better inventory placement, which also allows us to deliver items to customers faster. In the US, we're tuning our inbound network and continuing to expand our same-day delivery network. Globally, we're adding automation and robotics throughout our network.

Vertical integration is an advantage here as Amazon can generate real-time workflows and use computer vision and other machinery across the supply chain to ensure inventory flows are optimal for customers. In addition AI can improve forecasting, protect demand, match it with supply, and take out all of the costs and other friction that goes along with imperfect freight flow. The possibilities are vast.

From a revenue perspective, higher-margin categories like Advertising, 3P and Subscription sales are growing faster than the core retail business. Margins are higher here due to:

Advertising - peers such as Google have operating margins of 35% and Meta 50%. Amazon does not have the same scale, but advertising is essentially an add-on with minimal costs associated with it. I assume margins are circa 40%.

3P - revenue is calculated based off referral, fulfilment and other fees rather than GMV.

Subscription - the incremental margins are likely high now given the scale of the segment.

The below table shows an estimated breakdown for the drivers of earnings. It assumes Advertising margins have gradually risen from 35% to 40% and other revenue is loss-making. Retail profitability has improved but the key driver is advertising.

Estimated retail profits as a percentage of GMV (retail margins) are shown below, which sit at around 2.2% - not yet back to FY18 levels.

As explained earlier, Ecommerce should theoretically be a higher margin model than traditional retail given its capital light structure. Traditional retailers earn anywhere from 3-5% operating margins, which is well above current retail margins.

Ultimately, Amazon’s retail margins can go higher than 5% (2.2% now). The company had operating margins of 8% back in FY04 when it was largely just an Ecommerce business. In the ultra competitive Chinese market, players have retail margins around 2.5% and do not participate in logistics.

Overall, Amazon can lift operating margins by lowering cost to serve and increasing revenue from higher margin segments. Notably, the company is likely past peak investment, with the focus now more to drive efficiencies. See below my estimates for Amazon’s overall profitability in retail, which is predicted to inflect higher.

Valuation

I will keep valuation short and sweet and expand upon it in part 2.

Taking FY28 retail operating profits of $69b (GAAP number which includes no adjustments and is pretty clean) and applying a 25x EBIT multiple gets an EV of $1.7t. I think the multiple used is reasonable considering the dominant market position, runway opportunity and earnings growth >20%. Discounting this back at 10% WACC gets an EV of $1.3t today. This compares favourably to the group EV of $2.1t.

Capital Allocation

Most commentators have viewed Amazon as a poor capital allocator due to is low profitability and various loss-making ventures. The company suggests otherwise highlighting its strict focus on cash flows, costs and dilution:

Our financial focus is on long-term, sustainable growth in free cash flow per share. Free cash flow is driven primarily by increasing operating income and efficiently managing working capital and capital expenditures. Increases in operating income primarily result from increases in sales of products and services and efficiently managing our operating costs, partially offset by investments we make in longer-term strategic initiatives. To increase sales of products and services, we focus on improving all aspects of the customer experience, including lowering prices, improving availability, offering faster delivery and performance times, increasing selection, increasing product categories and service offerings, expanding product information, improving ease of use, improving reliability, and earning customer trust. We also seek to efficiently manage shareholder dilution while maintaining the flexibility to issue shares for strategic purposes, such as financings, acquisitions, and aligning employee compensation with shareholders’ interests. We utilize restricted stock units as our primary vehicle for equity compensation because we believe they align the interests of our shareholders and employees.

Amazon has delivered low returns on capital by delaying profitability (lower NOPAT) and increasing capital investments (invested capital). Bezos has continually stated Ecommerce is a high returning business given the lower operating structure.

My estimates for return on capital employed (EBIT/ assets) for the NA business is 12%. Its quite low but heading in the right direction. Importantly, we are likely past peak capex (sits at 6% of NA sales) with incremental ROCE inflecting higher with improved profitability.

Risks

Amazon faces numerous risks in Ecommerce. I break this down below.

Regulation

Amazon’s market dominance has attracted significant regulatory scrutiny, particularly concerning anti-trust issues, data privacy, and taxation.

In the US, the Federal Trade Commission (FTC) has brought an anti-trust case alleging Amazon’s use of monopolistic power over sellers to artificially raise prices and disadvantage competitors. The risk here is that negative regulation impacts innovation, lead to penalties or even some sort of breakup (ie Google Chrome).

I see this as unlikely as Amazon has a solid case due its focus on customer outcomes and that its low prices compare favourably across both offline and online retail. However, this is the biggest risk and somewhat out of the company’s control. I encourage those interested to read the anti-trust documents, it provides a clear breakdown of the moat at Amazon.

The company also faces scrutiny across Europe and India, particularly around data security.

Competition

As discussed, retail is a highly competitive space and Amazon faces numerous potential and existing challengers. Walmart is particularly strong in grocery where owning a network of stores has been an advantage.

The most significant threat comes from the Chinese drop-ship players, mainly Temu, who have a form of counter-positioning as they ship directly from local warehouses. China represents >50% of Amazon’s top sellers. While 100% of Amazon Haul sellers are based in China.

As discussed earlier, the economics are unclear and tax loopholes are coming undone. Temu also attracts value conscious consumers who seek lower priced goods which are highly discretionary and have less impact on Amazon’s bottom line. I discuss the competitive risks in detail above.

Inflation and Tariffs

Inflation can have a negative impact on Amazon’s business. To offset cost pressures, Amazon can either raise product prices or seller and fulfilment fees. In normal inflationary environments Amazon has managed well.

However, in extreme cases like 2021, where costs surged across labor, shipping, logistics, and product inputs, Amazon felt the brunt force and saw negative operating margins in 2022 across both NA and International. This was exacerbated by the aggressive infrastructure investments made just before.

The near-term risk is tariffs, as a significant portion of Amazon’s goods come from China and other emerging markets. For 3P, Amazon acts as the platform and has less exposure to product cost increases, with the impact to be felt more on the seller. The company may face more difficulty in 1P, and will need to pass on higher prices to offset tariff costs. This may be difficult to achieve given the size of tariffs and could pressure core retail margins.

The bigger risks lies in labour and logistics inflation. Amazon is focusing on automation and operational efficiencies to mitigate these risks and reduce their impact over time.

China

A large portion of goods are sourced from China. There are geopolitical, supply chain and other risks that may impact the ability to source effectively from the region. Local competitors also have better access to the main suppliers.

Amazon is working more closely with local Chinese players, increasing infrastructure and people spend in the region. Amazon faces the same China risk as peers, however, its competitive marketplace means issues there can be offset with goods from another country.

Generative AI

Generative AI is rapidly reshaping industries, and shopping is no exception. Agentic AI or chatbot-driven commerce could drastically reduce friction for consumers, posing a risk that shoppers migrate to more intuitive or engaging platforms - leading to share losses for Amazon.

Social media platforms like Instagram and TikTok are well-positioned to capitalise on this shift. In China, similar platforms have already seen a rise in commerce-driven engagement, which serves as a potential model for the West.

Amazon is responding by investing heavily in AI to defend its lead. Innovations like Rufus, its shopping assistant, and next-generation Alexa chatbot aim to elevate the consumer experience and maintain platform stickiness.

International

Amazon has expanded into emerging markets like Egypt, Mexico, Poland, Saudi Arabia, and Turkey to capture long-term growth. However, these regions come with challenges - exposure to new and potentially unfavourable regulations, local economic and political instability, and infrastructure limitations.

In many of these markets, Amazon lacks the dominant position it enjoys in the U.S., and faces stronger local competitors. Its ability to scale profitably will depend on navigating country-specific risks, adapting to local consumer behaviour, and complying with often-evolving regulatory environments.

Summary

In summary, Amazon’s retail business is a high-quality, long-term compounder:

Dominant player in structurally growing industry

Superior offering that is gaining share

Runway to continue growing for decades

Limited pure play Ecommerce competitors

Strong management team and culture focused on reinvestment

Scalable business model with inherent operating leverage

Strong balance sheet with limited debt

Diversified business model across revenue, customers and geography

Solid financials with improving ROCE and margins

There is a pretty high degree of confidence the business will be larger in 5 years time. Looks good to me. Part 2 to come on AWS.

What makes you think that Amazon will decide to let its retail operating margins rise over the next few years? Over the past 20 years they found many opportunities to reinvest in the business to boost growth and expand into new markets. They still have many countries where they could decide to ramp up spending to gain share or position themselves better for the long-term. They also have a number of large market segments where they could decide to invest more (in opex or capex) for the long-term: healthcare products and services, cars, AI…. Why would ebit margins rise so fast from current levels in the next 3 or even 5 years? What would cause this change in long-term strategy?

One key reinvestment growth engine that it's disregarded often is healthcare in US. Massive growth opportunity in an industry with bad reputation and it seems everyone wants to disrupt it.