7 Powers - Why the truly best companies continue to outperform

8 part Series on Hamilton Helmer's book about enduring Power

Companies that persistently outperform are few and far between. Only a few create enduring value. Why?

Things change. Industries evolve, business models become obsolete and new challengers emerge with better, faster and/or cheaper ways of doing things. A lot of dominant firms of the past have seen previous high profits erode to normal levels with some even going extinct.

A clear illustration lies in the top 20 companies within the S&P 500 back in 1995. Only a few of those names are leaders today.

In fact, all but one name has dropped off the top 20 - Walmart being the sole survivor. Some have achieved okay returns but nothing like the preceding 30 years.

A few names have fallen off completely where both the economics and competitive advantages have eroded. Think Sears, once a giant retailer had filed for bankruptcy in 2018 due to impacts from competition and online players.

We are seeing the same now for Intel, number 7 on the list. Once the leading chip manufacturer, profits have actually turned negative due to broader competition and the rise of custom chips.

All too often great businesses fall prey to new, savvy competition. Think IBM, Kodak, Nokia, Sears, Blockbuster, Yahoo and more. These are the blow ups we want to avoid.

Strong financial metrics such as ROIC, margins and growth tell one part of the story - and it’s clearly better to have good financials than not. But they are backward looking and less telling when measuring impending change and durability. It is also often too late when it shows up in the financials.

So what does it take to identify those truly exceptional businesses?

There is no magic formula. Unfortunately.

Common attributes include reinvestment, culture, leadership, industry dynamics, balance sheet and more.

I think the most important factor is Power.

This concept is broken down by Hamilton Helmer in one of my favourite books, 7 Powers. He explores the concepts behind special businesses with enduring power.

Helmer formulated these insights from a career in management consulting at Bain & Company and then founding his strategy and investment firm now known as Strategy Capital.

Helmer has been an advisor to numerous successful names that have gone from newcomer to dominant market leader - Netflix being the notable example where he was also an early investor. Other leaders include Spotify and Stripe who have taken his learnings to drive leadership.

Helmer’s book is a strategy book, but it actually aligns very well with investing and my philosophy which seeks:

Market leaders in attractive industries with sustainable competitive advantages

Those with long runways to reinvest capital at high returns

Capital light businesses that have strong balance sheets

Companies led by managers with an owner’s mindset and long-term focus

This will be the first of an 8 part series diving deeper into all 7 Powers - breaking down the benefit, barrier and providing practical examples of those with and without Power. Helmer’s concepts are a must read for any investor, especially those with an eye for quality.

How do we define value?

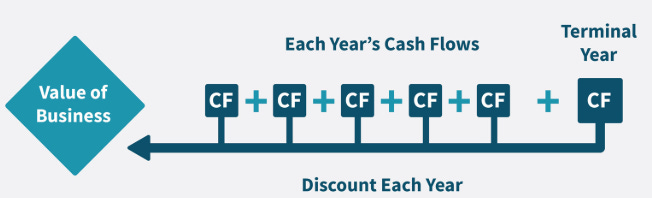

Before diving into Power, let’s start building the foundation and explore basic valuation. The value of a business today is derived from the present value of future cash flows also referred to as net present value (NPV).

A higher value today corresponds with higher future cash flows, with most value coming from the outer years - around 85% is derived after year 3. While in some cases, the terminal value can represent 70-80% of value.

How does Power align with Value?

As discussed, the terminal value will often represent the bulk of business value. So what drives a higher terminal value?

It’s the terminal growth rate - see above. When g is higher, the denominator is reduced. To explain, if you divide 100 by 3% vs 4%, the difference is a whopping $833.

Therefore those who can achieve persistent, high growth are the most valuable.

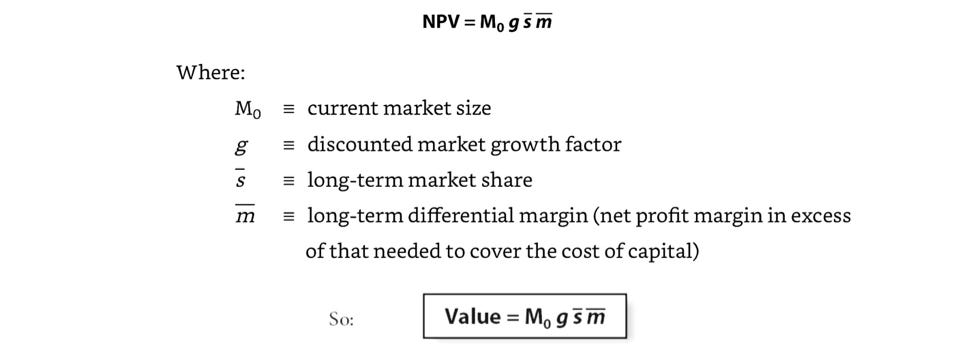

Helmer breaks this down further into his formula below.

He implies the same concept - that value is derived from those in large, attractive markets and have high market share with differential margins.

Breaking down the equation further:

Value (NPV) = [market scale] * [Power]

The former known as ‘market scale’ reflects market size and growth. This is common across all players in an industry.

Rather, Power is the differentiator. The ability to drive persistent returns above market. And it’s the key to business value. Helmer notes that:

Power is the set of conditions creating the potential for persistent differential returns

More Power > More Value. He further highlights:

Power is the core concept of Strategy and of this book, too. It is the Holy Grail of business - notoriously difficult to reach.

‘Strategy’ (not to be confused with lowercase s for 'strategy') is the study of Power and durable differential returns. Very difficult to achieve. As discussed, so many leading companies have seen high returns fade. Strategy focuses on building something durable with high barriers that competitors are just not able to copy.

Meanwhile, 'strategy' are the tactical actions that ensures Power continues to endure. No Power is everlasting. It needs consistent supervision i.e. Netflix releasing ad-based subscription tier in response to competition.

If there is poor strategy, this can reduce barriers and allow competitors to profitably gain share. Intel is again the classic example, actually described by Helmer as having Power, but at the end of the day management and strategy could not protect the business from inevitable change and competition.

What are the Powers?

Helmer identifies 7 Powers with defensible competitive advantages. These Powers allow a business to continue to generate cash flows (benefit) and defend itself from competition (barrier).

The thing to note is that Power needs to have both a benefit and barrier. The benefit is easier to attain. The barrier is much rarer. It is also a relative concept to that of a specific competitor. Those with Power are thus most prevalent in industries where there are few potential or existing competitors. I explain the benefit/ barrier below.

Benefit: must be reflected in the cash flows through any combination of higher prices, reduced costs or lower investment needs.

Barrier: the benefit needs to persist - something that prevents rivals from copying or undercutting a company’s success. Without it, profits attract competition, leading to value-destroying arbitrage.

Helmer’s advice is to ‘always look at the barrier first’.

Real-life example

Let's apply the concepts to a typical lemonade stand in your neighbourhood.

Through the 7 Powers lens and the formula above Value (NPV) = [market scale] * [Power]:

Market scale - limited as you're bound by your neighbourhood

Power - anyone can set up a competing stand tomorrow

As a result, your Value is low and cash flows are not durable.

The business has no 'Strategy' because it lacks Power. Your 'strategy' might be to set up the stand, choose where to operate or set competitive prices but those are just moves and not durable or defensive sources of competitive advantage.

How would a lemonade stand owner create Power?

Let's take that lemonade stand and try to build 'Power'. Imagine now we evolved this business into an app that is able to order lemonade for delivery from anyone selling it across multiple neighbourhoods and you are able to take a cut from every transaction.

As the app attracts more users, more buyers will be incentivised to join and that in turn allow users to have more options. What we are creating is a network effect - the more people use it (buyers & sellers), the better it gets. That is a Power.

The 'Strategy' we have taken is to create durable value. Or in other words, we created Power by generating a network effect. Relative to our lemonade stand, this Power will allow us to generate more durable future cash flows.

NPV (higher) = market scale (bigger as you are now not limited to just your neighbourhood) * Power (network effect)

While it might not be the best business in the world, you can see how already it is much superior to the original neighbourhood lemonade stand.

The key point is that many businesses have competitive advantages. But not many have Power. Power protects businesses from competitors eroding your returns and creates persistently differential returns - the key to value.

In the next articles, I will explore the different Powers and provide practical examples of those I think do and those misunderstood to have Power.

In the next article, I will answer the question of whether Starbucks, a global coffee powerhouse has the Power of Scale Economies.

Disclaimer: All posts on “cosmiccapital” are for informational purposes only. This is NOT a recommendation to buy or sell securities discussed. Please do your own work before investing your money.